The World Teleport Association (WTA) today released High Performance: Safety & Securitya new research report that shares insights about the most common under-appreciated safety and security issues at teleports and how their management can best address them.

Asia-Pacific - Market Trends

The Over-the-Top (OTT) video market will surpass US$200 billion by 2024, with 90% of that value fueled by subscription and advertising revenue, according to a new report by global tech market advisory firm, ABI Research.

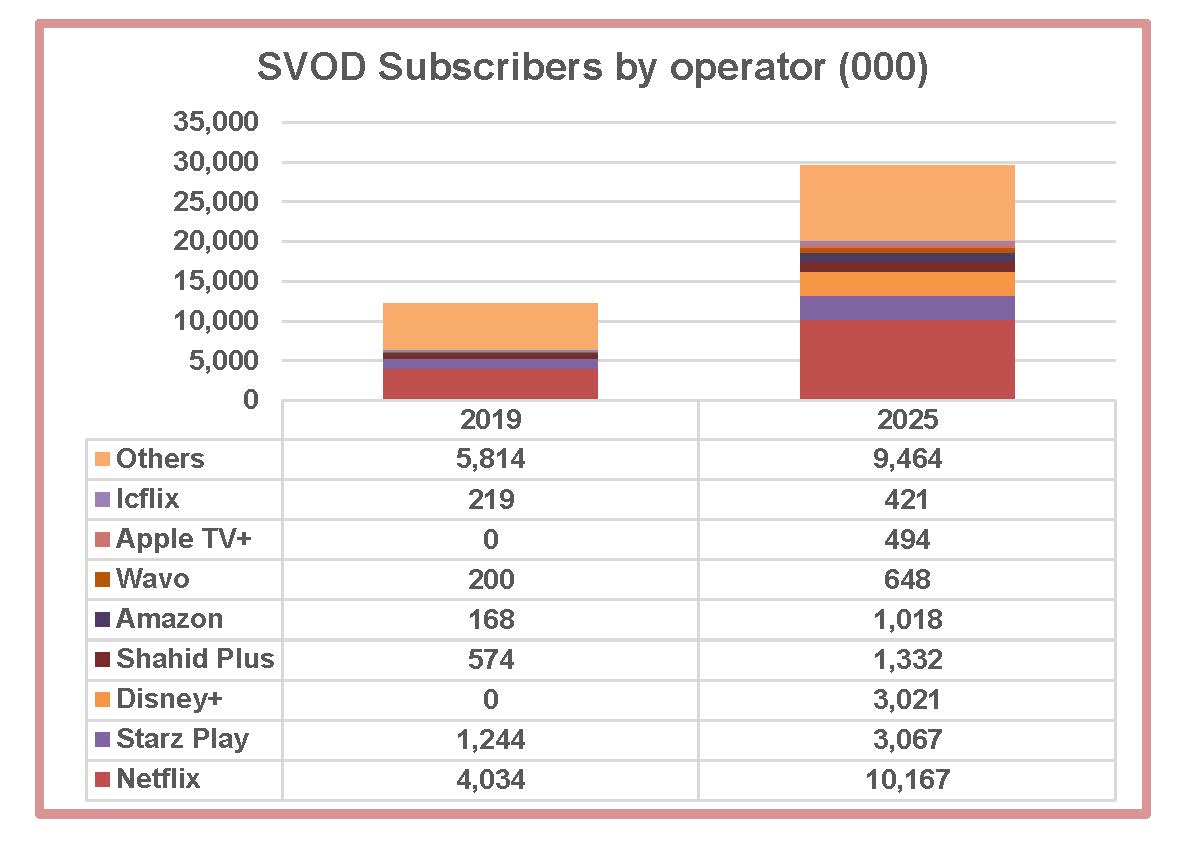

MENA Subscription Video on Demand (SVOD) revenues will reach US$2.97 billion by 2025; or US$ 2.1 billion more than the 2019 total according to new research from Digital TV Research. SVOD revenues will triple between 2019 and 2025. Turkey will total to US$ 908 million by 2025, with Saudi Arabia adding US$ 563 million and Israel US$ 470 million.

MENA Subscription Video on Demand (SVOD) revenues will reach US$2.97 billion by 2025; or US$ 2.1 billion more than the 2019 total according to new research from Digital TV Research. SVOD revenues will triple between 2019 and 2025. Turkey will total to US$ 908 million by 2025, with Saudi Arabia adding US$ 563 million and Israel US$ 470 million.

Pay TV revenues for the 20 countries in the Middle East and North Africa region fell by 12% between 2016 and 2019 to just under US$ 3 billion according to new resarch from Digital TV Research. Given the hangover from the beIN ban and generally falling ARPUs, revenues in 2025 (US$ 2.81 billion) will still be lower than in 2019.

Total Pay-TV industry revenue, comprised of subscription fees and local & regional advertising sales, grew 6% in Asia Pacific in 2019 reaching US$ 57 billion in 2019, according to Asia Pacific Pay-TV Distribution 2020, a new report published by leading industry analysts Media Partners Asia (MPA). Projections from MPA indicate that total pay-TV industry revenues will grow at a CAGR of 3% between 2019-24 to top US$66 billion by 2024.

The World Teleport Association (WTA) today published its annual rankings for the Top Teleport Operators of 2019. The annual rankings of companies by revenue and revenue growth are compiled by surveying teleport operators around the world as well as referencing the published results of publicly-held companies.

In its latest analysis of satellite manufacturing and launch services, Satellites to be Built and Launched by 2028, Euroconsult projects that the satellite market will experience a radical transformation in the quantity, value and mass of the satellites to be built and launched with a four-fold increase in the number of satellites at a yearly average of 990 satellites to be launched, compared to a yearly average of 230 satellites in the previous decade. The market will reach US$ 292 billion over the next decade.

A boom in virtualization of fixed broadband access infrastructure is developing and will sweep through almost all connections over the next decade, passing the 500 billion mark in 2025. That will be 40% of the total 1.26 billion global broadband subscriber base by then, compared with just 0.48% at the end of 2018 and 2.58% now at the start of 2020. These findings have just been reported by Rethink TV, the research arm of Rethink Technologies Research, in its latest report, Broadband Virtualization Accelerates to 500 million connections By 2025.

The World Teleport Asscociation (WTA) released a new research report on LEO/MEO Constellations and the Teleport The next eighteen months are critical ones for the first attempt since Iridium to loft a large-scale constellation of low-earth-orbit satellites that promise to transform global communications.

The World Teleport Asscociation (WTA) released a new research report on LEO/MEO Constellations and the Teleport The next eighteen months are critical ones for the first attempt since Iridium to loft a large-scale constellation of low-earth-orbit satellites that promise to transform global communications.

Historically the Mobile Satellite Services (MSS) providers Inmarsat, Iridium and Globalstar were the only satellite operators that were providing services for the maritime market. During the last ten years the market changed and now all the major satellite operators both MSS and Fixed Satellite Services (FSS) providers are now offering maritime solutions with a range of frequencies from L-Band ( Inmarsat, Globalstar, Irdium) and C-, Ku-, Ka- and X-Bands ( All major satellite operators e.g. Intelsat, SES, Eutelsat, Telesat).