The CABSAT 2019 conference, held in Dubai in March, brought together a wide variety of players from the satellite communications industry, namely satellite operators, service providers, broadcasters, and others. As one of the world’s premier satellite broadcast conferences, CABSAT has historically been just that — a predominantly satellite broadcast conference. However, in a sign of the times, recent years — and this year most notably — have seen a transition at CABSAT, from a primarily satellite broadcast conference to a satellite conference that has much emphasis on broadcast, but also perhaps equal emphasis on a surprisingly wide variety of other verticals.

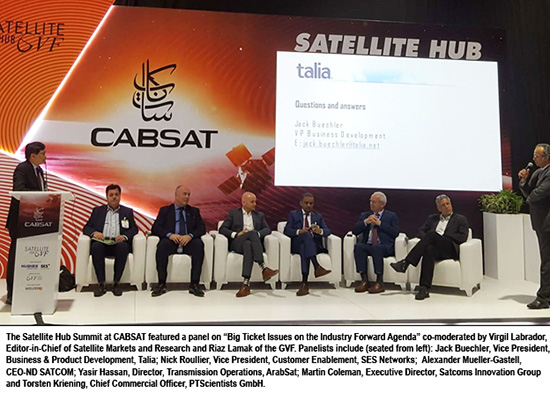

This tangential focus on broadcast was most apparently during the Global VSAT Forum (GVF) Satellite Hub Summit, which touched on a number of important satellite topics indirectly related to video. Likewise, this perpetually broadening of CABSAT’s scope is an indication of the broadening potential of satcom, but also the slow but steady erosion of the video golden goose.

Setting the Table—The Changing Landscape of the Satcom Industry

One significant takeaway from the whole of CABSAT, and more specifically the GVF Summit, was that the satcom industry landscape continues to change significantly. An industry that used to be dominated by satellite operators selling megahertz for video broadcast is becoming one that is beholden to our world where everything — our food, TV content, love lives, etc. — can be accessed via the universal language of zeroes and ones, via megabytes. In our increasingly-connected world, things like linear video broadcast will cease to be competitive in most instances, meaning that satellite operators must find a way to sell more megabits—a lot more megabits—to spearhead growth.

One significant takeaway from the whole of CABSAT, and more specifically the GVF Summit, was that the satcom industry landscape continues to change significantly. An industry that used to be dominated by satellite operators selling megahertz for video broadcast is becoming one that is beholden to our world where everything — our food, TV content, love lives, etc. — can be accessed via the universal language of zeroes and ones, via megabytes. In our increasingly-connected world, things like linear video broadcast will cease to be competitive in most instances, meaning that satellite operators must find a way to sell more megabits—a lot more megabits—to spearhead growth.

One such way that many analysts propose is through increasing satellite penetration for cellular backhaul networks. During the event, Andrew Faiola (Head of Mobility, Newtec) gave a glance at the 5G technology and its potential to reduce OPEX along with a data transfer of 88.39 Gbps in less than ten years as compared to 7.89 Gbps in 2016. This transition of the satcom industry into 5G technology will be a solid move to offer reliable connectivity solutions, but the ground segment capabilities are something that will watch the back of satcom industry in the coming years. With an increasing emphasis on Mbps, the satellite value chain will need to continuously develop more spectrally efficient equipment, allowing end users to get more Mbps, more cheaply, and more conveniently.

The innovation in the ground segment with low-cost investment will be one of the essential and decisive factors for the satcom industry, one which will enable the growth of satcom services in aviation, maritime, etc. Isotropic Systems, a startup developing high-throughput terminals, is bringing new hope for the satcom industry. The company has already signed contracts with SES, OneWeb and Inmarsat to offer ground terminal capabilities with a minimum cost between US$300-400. Isotropic notes that its ground terminals will be released at the latest by 2022, with this and other advancements expected to open many new markets for satcom. With that being said, while new ground equipment will be a major enabler of market expansion, another omnipresent theme—that of lower capacity prices—was also present at CABSAT, and also presents interesting questions for the industry’s future.

Declining Satellite Capacity Prices: Challenge or Opportunity?

The transformation in the satellite industry is being driven above all by declining prices, and significant increases in total amounts of capacity. This continued to be a topic throughout the week of CABSAT, and indeed, was highlighted by an industry report released the week of the conference outlining double-digit price declines. For satellite operators, major questions include how to move much more capacity without incurring significant cost, and how to maintain margin and value-add when selling wholesale. Ultimately, As connectivity everywhere becomes an expectation, and as the minimum viable bandwidth continues to increase, satellite will find a plethora of opportunities in filling in the bandwidth cracks of an ever more universally connected world. This will require new technologies such as steerable flat-panel antennas, satellite-friendly backhaul towers, and more efficient modems and other ground equipment. Importantly, all of these are being developed now. At lower price points, these applications will see huge opportunities for demand increases.

Traditional linear video broadcast offers relatively limited apparent demand elasticity for satellite operators—video broadcast companies like Sky UK or MultiChoice are unlikely to decide to broadcast many, many more channels if the price of satellite capacity comes down significantly. But, satellite vide in the form of OTT or related applications can present far greater opportunities for demand elasticity. During CABSAT week, Eutelsat launched Cirrus, a hybrid platform providing satellite and Over-The-Top (OTT) content distribution, with the company having secured its first customer, Mondo Globo, a Canadian video distributor to offer services via Eutelsat Cirrus. Through lower capacity pricing (brought on by Eutelsat’s significant investment into HTS in EMEA to launch in the coming years), Eutelsat hopes to drive elastic demand growth, and subsequently grow the market.

The declining satellite capacity prices in-general can be viewed as a challenge for the operators but an opportunity for the service providers, and likewise an opportunity to generally expand the market for satellite services. Simultaneously, a close eye on the technology transformation and a hunt for integrating satellite capabilities in different verticals will surely create ample opportunities for the satellite operators.

Aligning Policy and Technology

A major issue that remains not sufficiently discussed is the issue of spectrum allocation, coordination, and more generally, regulatory alignment. During her speech at CABSAT, Ms. Xiuqi “Ellie” Wang from the International Telecommunications Union (ITU), discussed the legal aspects of the satellite spectrum and the need for utilizing spectrum effectively. With the oncoming NGSO constellations expected to utilize unprecedented amount of spectrum, there will be a hugely increased need for coordination of spectrum, not to mention the physical satellites themselves.

As clear as any of an indicator of the value of spectrum, the industry has recently observed the tug of war situation for C-band, although Ku- and Ka-bands have been recently more popular among the satcom players targeting LEO and MEO satellite business. Moving forward, it is clear that more exotic frequency bands such as Q-band will likely need to be utilized in order to accommodate even a fraction of the proposed constellations.

The utilization of the spectrum depends partly on supply (i.e. how many constellations are fighting over finite spectrum) and also demand (i.e. on the customer demand for a specific sets of applications). The World Radiocommunication Conference (WRC) in October 2019, in Egypt, will provide a broader picture on the radio spectrum usage for satellite services, with this being a hot topic to follow over the coming 6-12 months and beyond.

Key Takeaways from the GVF Satellite Hub Summit in CABSAT 2019

The key takeaway from CABSAT, and from the GVF Satellite Summit 2019, is that the satellite operator value chain is evolving more quickly than ever, and that verticals such as linear video broadcast, while still relevant today, are not going to be the key to future growth. A changing value chain and changing consumer preferences, lower pricing, and policy issues will combine to redefine the satcom industry moving forward. This will require a lot more downstream activity, more resources devoted to helping satellite bridge the gaps in the global communications network, and more enabling non-industry professionals to help spread the benefit of satellite.

During the concluding part of the GVF Satellite Hub Summit, Riaz Lamak from the GVF announced Indo-Pacific Endeavour 2019 program, where GVF will be offering satcom training to 20+ military units from around the world. The Indo-Pacific Endeavour program is proof of international cooperation in defense satcom. It is also a valuable program to educate and exchange defense satcom capabilities among different nations, and is one such initiative.

Moving forward, satellite operators should explore, create and implement their satcom capabilities in this multi-disciplinary ecosystem. While the attitude of adapting to customer needs will help satcom industry progress in the coming years and the change in policy implications with the evolving technology will pave the more flexible path for the satellite businesses.

------------------------------------

Omkar Nikam is correspondent of the Satellite Executive Briefing magazine based in Strasbourg, France. He also works as a Research Analyst with Orbital Gateway Consulting (OGC) while completing his postgraduate studies at the International Space University. At OGC, he is focused on New Space. Apart from his academic and professional engagements in space activities, he also participates in voluntary science outreach programs. He can be reached at: omkar.nikam@community.isunet.edu.

Omkar Nikam is correspondent of the Satellite Executive Briefing magazine based in Strasbourg, France. He also works as a Research Analyst with Orbital Gateway Consulting (OGC) while completing his postgraduate studies at the International Space University. At OGC, he is focused on New Space. Apart from his academic and professional engagements in space activities, he also participates in voluntary science outreach programs. He can be reached at: omkar.nikam@community.isunet.edu.