The teleport industry got its start in the days when monopoly telephone companies ruled and, in the US, COMSAT was the sole gatekeeper for access to domestic and international satellites. Then the Reagan Administration’s Open Skies policy ended COMSAT’s lock on satellite access, and entrepreneurs jumped on the new opportunity.

In the 19 years since then, the industry has changed in remarkable ways. The industries where early entrepreneurs pioneered are still important to the teleport industry, but its current generation of leaders is preparing for a much broader range of opportunities. Teleports originate and distribute online video and connect with ships, oil rigs, trucks, trains and aircraft. They help deliver consumer broadband and push the Internet of Things beyond the edges of the terrestrial network. They are integrating cloud services into their solutions and providing gateway services for the growing number of high-throughput GEO, MEO and LEO satellite networks.

Pulse of an Industry

The World Teleport Association recently published a market-sizing study of the global teleport industry. It updated research published last year provide estimates of the number of commercial teleports in operation, their revenues, satellite capacity usage, capital expenditures and headcount. Using this data, decision-makers can estimate the global and regional market share for a teleport operating company, conduct due diligence for mergers and acquisitions, and identify potentially underserved regions for investment and market development.

The World Teleport Association recently published a market-sizing study of the global teleport industry. It updated research published last year provide estimates of the number of commercial teleports in operation, their revenues, satellite capacity usage, capital expenditures and headcount. Using this data, decision-makers can estimate the global and regional market share for a teleport operating company, conduct due diligence for mergers and acquisitions, and identify potentially underserved regions for investment and market development.

The teleport sector has seen consolidation as companies build scale to gain cost efficiencies and improve their competitive position. This has produced an industry that is smaller in the number of facilities it operates but larger in total revenues. The number of commercial teleports worldwide has decreased by 3% from 2016 to 2018, for an annual average of 1%. In 2010, WTA reported a worldwide commercial total of 996, representing an average 4% annual decline in facilities from 2010 to 2016. In that context, the 2016-2018 period saw a slower pace of consolidation in physical facilities

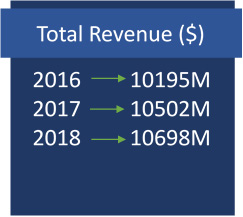

Over the same period, however, estimated total revenues of the teleport sector grew 5% from US$10.2 billion in 2016 to $10.7 billion in 2018. On that basis, average revenue per teleport rose 8% from $14.4 million in 2016 to $15.7 million in 2018. For the sector as a whole, consolidation did its job of creating fewer, more productive assets.

Consolidation has not been the whole story. In a mature technology market, midsize companies become larger and the largest seek further increases in scale. At the same time, however, new players enter the market to exploit new demand created by technology and market change. The teleport itself undergoes radical change: packing far more services into fewer antennas, virtualizing operations into software that once required massive hardware investments, and substituting terrestrial networks for satellite distribution where they can.

Regional Overview

Europe and North America are home to the largest number of commercial teleports, with the geographically larger Asia-Pacific region coming in third. The number of teleports in the top three regional markets declined from 2016 to 2018, however, while Latin America and the Middle East/Africa logged corresponding increases.

Changes in regional revenues were also in single digits. North American teleport revenues grew 6.6% over the period, while Asia-Pacific revenues grew 4.5% and European revenues grew 3.9%. Latin America grew 3.0% while Middle East/Africa achieved a nominal 0.8% growth even as the number of facilities increased.

Changes in regional revenues were also in single digits. North American teleport revenues grew 6.6% over the period, while Asia-Pacific revenues grew 4.5% and European revenues grew 3.9%. Latin America grew 3.0% while Middle East/Africa achieved a nominal 0.8% growth even as the number of facilities increased.

CAPEX and Capacity Spending

Capital expenditures varied among the regions in proportion to the number of facilities. Europe and North America are the two biggest markets for capital equipment purchases, with Asia-Pacific a distant third.

On a global basis in 2017, the teleport industry purchased 222,400 MHz of satellite capacity, with the spending in proportion to teleport counts in the regions. Capacity usage rose an average of 7% from 2016 to 2018, as detailed below.

The global teleport industry spent $4.9 billion on capacity in 2016, rising to an estimate $5.3bn in 2018. Spending on capacity increased during the period across all regions as teleport operators continued to make satellite a vital part of their network operations. Average spending on capacity grew 6.90% from 2016 to 2018.

Download the Report

For the complete report including global and regional breakdowns of teleports, revenues, capex, headcounts and antenna counts, go to https://www.worldteleport.org/store/ViewProduct.aspx?id=13793334.

-------------------------------

Robert Bell is the executive director of the World Teleport Association (www.worldteleport.org), which conducts research into the teleport and satellite industry and offers a Teleport Certification program to service providers.

Robert Bell is the executive director of the World Teleport Association (www.worldteleport.org), which conducts research into the teleport and satellite industry and offers a Teleport Certification program to service providers.