NSR forecasts THE inflight connectivity (IFC) will be a US$ 36 Billion market over the next decade, as more airlines outfit fleets with high throughput satellite (HTS) services. However, the IFC market endured a challenging 2018 due to delays in installing equipment, indecisions by airlines, and uncertainty on business models, on top of technical and regulatory hurdles according to NSR . Overall, the market lost a bit of its shine as aeronautical connectivity grew in 2018 by US$400 million 40% less than expected. On the bright side, passenger aircraft retail revenues reached more than US$1 Billion for the first time. NSR expects 2019 revenue growth to be the same with a faster pace of inflight connectivity hardware installs to catch up on backlog.

Euroconsult forecast that 23,000 commercial aircraft will offer connectivity to their passengers by 2027, up from 7,400 aircraft in 2017. In January 2018, around 90 airlines had either installed or committed to install IFC solutions. Offering connectivity was first seen as a differentiating factor, however as more and more airlines provide connectivity, offering in-flight Wi-Fi starts to become a must-have in order to keep a competitive positioning in the extremely challenging airline market

To shed light on the latest innovations in IFC, we asked the leading providers to participate in a virtual roundtable discussion. Participating in the roundtable are: Jags Burhm, Senior Vice President, Aero-Global Mobility, Eutelsat; Dominic Walters, Vice President, Inmarsat Aviation; Mike Hooper Director & General Manager, Aviation Line of Business, Iridium; Lisa Kuo, Director, Connectivity, Panasonic Avionics; Aditya Chatterjee, Senior Vice President, Aero Market Segment Solutions, SES; Gustavo Nader, VP of Strategy, Thales InFlyt Experience; Jon Cobin, EVP of Strategy, Gogo; and Meherwan Polad, Vice president, Global Sales and Business Development, Viasat Commercial Aviation.

To shed light on the latest innovations in IFC, we asked the leading providers to participate in a virtual roundtable discussion. Participating in the roundtable are: Jags Burhm, Senior Vice President, Aero-Global Mobility, Eutelsat; Dominic Walters, Vice President, Inmarsat Aviation; Mike Hooper Director & General Manager, Aviation Line of Business, Iridium; Lisa Kuo, Director, Connectivity, Panasonic Avionics; Aditya Chatterjee, Senior Vice President, Aero Market Segment Solutions, SES; Gustavo Nader, VP of Strategy, Thales InFlyt Experience; Jon Cobin, EVP of Strategy, Gogo; and Meherwan Polad, Vice president, Global Sales and Business Development, Viasat Commercial Aviation.

Satellite Markets (SM): Give us an overview of what your company does in the satcom aviation market?

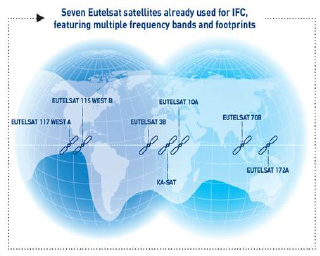

EUTELSAT— Eutelsat currently provides in-flight connectivity and live-TV services across Europe, the Middle East, Africa, Asia-Pacific and the Americas through seven satellites located between 117° West and 172°: EUTELSAT 117 West A, EUTELSAT 115 West B, EUTELSAT 3B, KA-SAT, EUTELSAT 10A, EUTELSAT 70B and EUTELSAT 172B.

INMARSAT— We’re transforming the aviation industry by bringing high-speed inflight Wi-Fi to every flight path in the world. We own and operate a network of high-throughput satellites covering the globe, allowing us to direct capacity exactly where it is needed most by our customers.

We can deliver both high-speed passenger connectivity and operational connectivity to the aircraft, estimated by the London School of Economics (LSE) to be worth $30 billion and $15 billion annually to airlines by 2035 (respectively).

Many airlines are already flying with or are in the process of installing our award-winning passenger connectivity solutions, including Lufthansa, Air New Zealand, Qatar Airways, Singapore Airlines, Norwegian, Avianca, Air Asia and Citilink to name a few. More than 1,750 aircraft are currently under signed contracts for our passenger Wi-Fi services, in addition to a strong new business pipeline.

Within safety and operational services, we are helping airlines tap into the power of real time operational insight to enable digital transformation. We are already on more than 90% of the world’s oceanic fleet with our Classic Aero service, the global standard for flight operations and safety satcoms. Our next-generation service, SB-S, is the first and only global aviation broadband solution for operations and safety communications, and is currently in flight with Hawaiian Airlines, Shenzhen Airlines and United Airlines.

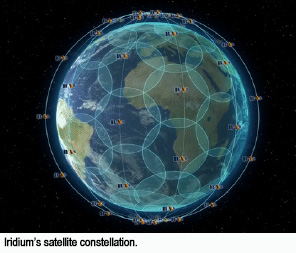

IRIDIUM—Iridium has been widely adopted across all aviation segments given our small antenna form factor and also our unique network that can support communication on fast moving aircraft, and also under the rotor blades of aircraft. In addition, Iridium is approved for offering AMS(R)S cockpit safety voice and FANs data services for oceanic, remote and polar operations for commercial and business aircraft. In short, Iridium is the global leader in supporting 10s of thousands of aircraft globally.

Panasonic Avionics—Panasonic Avionics Corporation (Panasonic) is a supplier of inflight entertainment and connectivity (IFEC) services and solutions. We design, engineer, manufacture, and install customized IFEC solutions including NEXT Online, our global, high-speed satellite connectivity network made available through partnerships and collaborations with satellite operators designed to optimize payloads for aero connectivity.

SES—SES is the world’s leading satellite operator and provider of multi-band, Ku and Ka capacity and network services supporting markets ranging from media and entertainment to inflight connectivity with more than 70 satellites in GEO and MEO (50+ GEO and 20 MEO) orbits combined with strategic ground infrastructure across the globe. SES is building the leading global multi-band, multi-orbit satellite network, delivering smart, seamless worldwide coverage to enable a new era of inflight connectivity. We have designed our global network to meet the ever-changing demands of inflight connectivity and entertainment with a future-proof intelligent connectivity that can dynamically and intelligently enable the bandwidth that passenger needs to enjoy the app they are using aboard the plane or to support the connected aircraft of the future.

THALES—Thales is a worldwide leader in aerospace, satellite networks, connected skies and cybersecurity. The company is also known for its market leadership in air traffic management, training and simulation, inflight entertainment technologies and nose-to-tail aircraft connectivity. Thales is a full-service integrated connectivity provider offering a wide range of technical solutions for seamless global coverage and a best in class onboard experience. Working with industry leading partners, we use satellite technology to ensure that a Wi-Fi connection can follow a passenger from the terminal, through take-off, at cruising altitude and landing. We’re also working on the operations side by helping airlines look at all the data coming from their aircraft. Harnessing that data can help airlines improve efficiency, get information on passenger behavior to increase brand loyalty and accelerate revenue generation.

VIASAT—Viasat is a global communications provider and a world leader in satellite broadband communications, networking and related technologies. As an innovator in broadband technologies and services, the Company offers an end-to-end platform of high-capacity Ka-band satellites, ground infrastructure and user terminals, enabling Viasat to provide cost-effective, high-speed, high-quality broadband solutions to enterprises, consumers, airlines and government users around the globe, whether on the ground, in the air or at sea.

Specific to aviation, the company’s vertical integration strategy, proprietary technology platform and high-volume of Ka-band capacity—more owned Ka-band capacity than any other IFC provider helps differentiate Viasat from the IFC pack, as the Company delivers the fastest satellite connectivity in the air several times faster than traditional IFC services and enables full streaming capabilities at-scale. Our belief is have a lot of capacity at the right cost to enable airlines to offer better services.

We also go beyond passenger experience, and offer complete operational connectivity from cockpit to cabin to ground to give airlines real-time data and analytics of their fleet, travelers, and crew which generate additional revenue opportunities and operational efficiencies.

Gogo-Gogo is the inflight internet company. We bring the highest performance to airlines and passengers alike across every device, every flight, everywhere—all powered by our global inflight network. Gogo partners with leading airlines across the globe who rely on our industry-leading 2Ku high-speed satellite Wi-Fi solution flying to over 80 countries.

SM: describe what solutions you now provide and in the future for In-Flight Connectivity for passengers and for aircraft operations?

EUTELSAT— Our global in-flight connectivity offer relies on different solutions depending on the market.Across the globe, we leverage the multiple frequency bands and diverse footprints our fleet offers to respond to growing the demand.

In Europe, leveraging the high transmission speeds and bandwidth of Eutelsat’s KA-SAT high throughput satellite, our inflight service allows aeronautical service providers to offer airlines and their passengers top-quality Internet access, video streaming and GSM services via tablets, smartphones and laptops.

With the launch of EUTELSAT 172B in 2017, we have significantly strengthened our offer across the Asia-Pacific region, one of the fastest-growing markets for this vertical. Through its innovative High Throughput Ku-band payload, this satellite can provide in-flight broadband with multiple user spots optimized to serve busy Asian and trans-Pacific flight paths. The strengths of this satellite have led to its selection by Panasonic Avionics Corporation and UnicomAirNet. Direct feedback from the airlines that are operating on EUTELSAT 172B has been very positive as they have experienced an increase in the user experience.

INMARSAT—Our aviation connectivity solutions and infrastructure have been designed specifically for this purpose. The Global Xpress network powers GX Aviation, our global passenger Wi-Fi solution offering the most extensive coverage of flight routes around the world, and JetConneX, our high-speed solution for business aviation users. We also founded the European Aviation Network, Europe’s fastest inflight connectivity service designed to meet the unique challenges of the region’s busy airspace.

The adoption of Inmarsat’s passenger Wi-Fi services has been fast-paced; in April this year, we announced that 1,000 aircraft have been installed with our next-generation inflight broadband solutions.

We also offer real-time operational connectivity to airlines with SB-S. Combining cutting-edge satellite technology with secure IP connectivity, SB-S is the world’s first and only global broadband solution for aircraft operational and safety communications, driving digital transformation in the airline industry. Inmarsat is the only aviation satcom provider authorized to provide aviation safety and operational services globally, including in China and India.

Iridium—Today, Iridium offers narrowband services but our next generation of Iridium Certus broadband services will enable a more diverse product offering. Iridium does not see this as a commercial aircraft service offering but it is very viable for a small number of passengers on a business jet. Our primary focus is on the cockpit/flight deck of aircraft, with ability for cabin service for business jets and aircraft with smaller numbers of passengers.

Iridium—Today, Iridium offers narrowband services but our next generation of Iridium Certus broadband services will enable a more diverse product offering. Iridium does not see this as a commercial aircraft service offering but it is very viable for a small number of passengers on a business jet. Our primary focus is on the cockpit/flight deck of aircraft, with ability for cabin service for business jets and aircraft with smaller numbers of passengers.

Panasonic Avionics—Panasonic has developed a suite of services around NEXT - our inflight entertainment and connectivity platform, including Theatre, Marketplace and Wellness solutions.

As part of NEXT Online, Panasonic offers a range of connectivity services for airlines and their passengers including fast internet, live television, and inflight mobile use, along with ZeroTouch™ which enables airlines to remotely deliver content to and from the aircraft via satellite, cellular or Wi-Fi connectivity.

All of Panasonic’s connectivity services are managed from its Customer Performance Center (CPC) which proactively monitors and manages each aircraft equipped with NEXT Online to provide airlines with peace-of-mind and confidence in their investment.

SES—SES Networks works closely with all leading inflight connectivity (IFC) service providers, including Gogo, Global Eagle, Panasonic Avionics, and Thales, to help develop and deliver tailored and intelligent connectivity services that airlines need to meet their passengers’ evolving and escalating demand for connectivity in the skies.

SES’s global aero network is enabled by conventional and the most up-to-date, state of the art high throughput (HTS) GEO satellites that are providing inflight connectivity to nearly half of the connected commercial aircraft flying today.

As part of our innovation roadmap, SES will bring the game-changing combination of MEO and GEO capacity to the aero market. SES Networks has already transformed connectivity at sea with its growing O3b Medium Earth Orbit (MEO) constellation – which features 20 Ka-band satellites in orbit today -- and aero is next up.

SES is developing a next-gen MEO system called O3b mPOWER, which will open the door to a whole new level of inflight connectivity services for airlines and their passengers and crew. Increasingly sophisticated IFC solutions will rely on the faster connectivity speeds and lower latencies that O3b mPOWER is set to deliver – giving airline passengers the same broadband experience in the sky that they’ve become accustomed to on the ground.

Airlines will increasingly look to various levels of satellite capacity – delivered over a mix of conventional and HTS satellites in GEO and MEO – to not only deliver connected passenger services such as email, gaming, social media, web browsing and streaming, but to drive operational efficiencies across their enterprise. Pilots, for example, are utilizing connectivity in the cockpit to track real-time weather conditions along their flight path to reduce flight delays and avoid turbulence, which in turn saves money and improves passenger satisfaction. Airlines are utilizing connectivity and fill further utilize this connectivity to monitor fuel consumption, engine wear, even food and beverage inventories to cut waste in real time. SES and our IFC service provider partners are working with airlines to help them fully capitalize on our intelligent connectivity across their operations.

THALES—Thales is providing the next generation aviation connectivity solution over the Americas. FlytLIVE includes full internet services with the capability to stream to the entire cabin with high speeds, increased capacity, and unmatched redundancy. This solution ensures a consistent experience to crew and passengers at peak times and in high traffic routes while optimizing bandwidth.

FlytLIVE today offers a full end-to-end solution where passengers receive full internet connectivity with the capability to stream video content interact through social media and play games. In 2021, FlytLIVE will operate with the SES-17 satellite manufactured by Thales Alenia Space. Its spot beams will provide full coverage for the Americas region including South America, Caribbean Islands and North America. The solution will be equipped with close to 200 spot beams of mixed sizes for flexible allocation of capacity over high-traffic airline routes, digital transparent processors that adapt where aircrafts fly, and field of view beams overlaying the spot beams to enable multicast and the most efficient delivery of content and IPTV channels.

Leveraging broadband services over the Iridium NEXT constellation of 66 operational satellites and 9 spare satellites that cover 100% of the globe, FlytLINK by Thales provides dedicated satellite-based communications capabilities primarily aimed at connecting aircraft cockpit and crew operations. This includes real-time weather, flight tracking, secure flight safety data and voice, electronic flight bag pairing, enhanced operations through crew scheduling, in-air reporting, service logging, aircraft monitoring and more.

Gogo-Gogo Inflight Systems incorporate a high-capacity, fully redundant and scalable network dedicated to aviation. It uses proprietary technology to access our open ecosystem of Ku-band satellite network for global flights, which means the best performance for aviation for now and in the future. Gogo has more than 1300 aircraft flying on its global satellite network, both with our Gogo Ku and Gogo 2Ku products.

Gogo Ku is our first-generation broadband satellite solution, which is currently used by Delta and Japan Airlines. Gogo 2Ku is the leading high-speed satellite Wi-Fi solution providing a ground-like experience for passengers. It’s now flying on more than 1,000 aircraft globally with more than 18 airlines committed to the service.

The innovative Gogo 2Ku antenna and proprietary modem deliver significantly higher bandwidth to aircraft, minimize service disruptions associated with beam switches, and drive faster satellite handoffs. 2Ku relies on two low profile, high efficiency, mechanically steered phased-array satellite antennas manufactured by ThinKom. The antenna is only 4.5” in height and 6.5” in height including radome. This results in lower drag compared to other SATCOM solutions. The radome is 17” off the top of the aircraft.

Today, the technology is delivering industry leading performance including the ability to stream video. 2Ku can deliver 100+ Mbps to an aircraft today. Today, 2Ku is delivering more than 15 Mbps to each passenger device at 98 percent system availability.

We’ve designed our system-level platform to support both passenger and operational applications. That involves an architecture that can support separate in cabin networks, that is designed to feed a variety of aircraft and ground data sources securely and contemplates the ability to host and change software in compliance with strict aviation standards. Gogo provides a suite of connected aircraft services such as eEnablement, which is pilot and crew connectivity, data management (aircraft data access and wireless quick access recorder) and operational solutions that include automated turbulence reporting and flight optimization.

SM: Currently IFC solutions are using either Ku or Ka-Band. What proportion among the two bands are you using and do you have any plans to move between the two bands or implement hybrid solutions?

EUTELSAT—Eutelsat currently uses both Ku and Ka-band capacity across several markets and we’ve found that airlines focus is on providing an affordable service rather on a debate on Ku vs Ka-band. Our fleet is compatible with both bands and we plan on continuing to work with both for the time being as this meets the markets requirements and provides us with maximum flexibility to address mobility markets.

INMARSAT-We’re continuing to invest in Ka-band to deliver a truly global passenger connectivity solution with GX Aviation. The global network uses three core satellites that provide global coverage, and a fourth operational satellite that adds further capacity where needed. We are continuing to expand the network with flexible high-capacity Ka-band satellites that will dynamically add and move capacity wherever needed.

To meet future demand, we have a fully-funded development roadmap that includes new satellite launches in 2019, 2020 and 2021. Later this year, we will launch GX-5 to provide additional capacity over Middle East, Europe and the Indian sub-continent, and in the consequent years we will launch two extra I-6 satellites. These developments bring unprecedented flexibility, scalability and cost efficiency to the network, assuring customers their requirements will continue to be met in the next decade and beyond.

EAN is comprised of an S-band satellite complemented by more than 300 ground stations. This network design was conceived from scratch, specifically for the needs of European aviation. We offer the most consistent service in Europe due to this fully integrated system, working in unison across land and sea.

Iridium — Iridium does not offer Ku or Ka band for services but we have partnered with many such companies to offer a combined solution for Iridium as the cockpit solution and the Ku or Ka as the cabin solution. The services however are separate and do not cross over.

Panasonic Avionics — Panasonic currently provides connectivity solutions over both the Ku and Ka bands. To us, it’s not about the frequency spectrum – it’s all about the network that provides the best user experience. We seek to implement economically viable options that will enhance the connected experience for our airline customers and their passengers in flight.

SES—SES continues to build a global multi-orbit, multi-band network of conventional and high throughput satellites and ground infrastructure designed to deliver on current and future inflight connectivity demands. We currently have both Ku-band and Ka-band capacity in GEO, and with our MEO Ka-band we are on the verge of furthering the transformation of connected air travel, much as we have already aboard cruise ships at sea.

By providing global coverage in both Ku-band and Ka-band across two orbits, SES is enabling IFC service providers and ultimately the airlines now to create new IFC offerings that help differentiate them in a fiercely competitive marketplace. Having powerful connectivity in multiple bands and orbits also helps airlines to future proof their IFC strategies and deployments. And as we work with technology partners, antenna producers for example, we can develop hybrid solutions that enable airlines to leverage both Ka-band and Ku-band capacity, allowing them to use the best connection to meet their requirements at any given time.

THALES—Thales has used Ka-band satellite technology from the beginning of our connectivity program. Ka High-throughput satellites (HTS) will remain the dominant technology with increasing awareness of new global Ka HTS solutions, which have the ability to provide unprecedented amounts of capacity in high traffic zones. The performance and capacity of Ka HTS solutions specifically designed for mobility enable global, seamless satellite-based connectivity, making it the best choice for the broader commercial aviation market.

VIASAT—Viasat is a Ka-band IFC provider, and to date, almost all of our airline install base use our Ka-band system. However, we also have dual Ku-/Ka-band shipset, and where necessary, we will leverage Ku-band satellites as gap-fillers. This idea is not new to Viasat—the Company has years of expertise in delivering dual-band antenna systems to the global market. The Company’s first-generation Ku-/Ka-band shipset served airframes ranging from commercial narrow-body planes to larger senior leader government aircraft.

Then in April 2019, Viasat introduced its second-generation Ku-/Ka-band shipset, inclusive of an advanced hybrid antenna and complementary radome. This dual-band system, aimed at the commercial wide-body aircraft market, will keep passengers and crew connected across commercial Ku- and Ka-band Geosynchronous and Non-Geosynchronous satellite networks, virtually anywhere they fly around the globe.

The shipset sets into motion an accelerated migration path for commercial airlines to operate on Viasat’s global High Capacity Ka-band network including our Viasat-3 constellation. It immediately enables worldwide roaming connectivity for new or retrofit aircraft – serving a large and growing portion of their routes on the fastest Ka-band networks, and the balance on global widebeam or spotbeam Ku satellites. Airlines can steadily migrate a greater proportion of their routes to the faster, more economical Ka-band service enabled by a growing array of partner satellites as well as the global ViaSat-3 constellation planned for launch in 2021 and 2022.

Gogo--Gogo’s global satellite network offers both global coverage and scalable capacity in the Ku band. This allows airlines to benefit from abundant capacity from many satellite operators and satellites on a global basis. As more aircraft come online, Gogo can easily lease extra capacity. We leverage the open ecosystem of the leading satellite providers in the world, with the largest including Intelsat and SES.

Our strategy is and has always been “customer-focused and technology-agnostic.” Our satellite network is GEO and Ku in commercial aviation because to date that’s been the only source of supply that meets our needs in terms of performance, economics, scalability, redundancy and certainty of supply. Passenger and airline expectations for satellite Wi-Fi means continual growth for capacity needs – not just every several years or some day in the future, but right now and on an ongoing basis. It means handling the global and local requirements of aviation including managing the 20% of the earth’s geography that sees 80% of the traffic and, serving hub cities like Atlanta, London or Tokyo, with outstrip the capacity of any one beam or satellite at their peaks. We’ve been clear that we deployed 2Ku in the Ku-band for these reasons – not any attachment to a certain frequency or orbit. We’ve said we would consider adding Ka-band based services if-and-when it met our needs for serving customers, but we were early entrants via partnership in Ka and saw its issues and we don’t yet see those being overcome. Nor is there any need to diversify today because Ku has the coverage, capacity, ability to layer, redundancy and economics we need.

SM: What are your plans for the next few years using satellite communications for the Aviation market considering the wave of new satellite constellations both GEO High Throughput Satellites (HTS) and the new wave of LEO and MEO constellations?

EUTELSAT—We believe that GEO will remain the best fit for in-flight connectivity for both technical and financial reasons. We expect the availability of Very High Throughput Satellite (VHTS)capacity to be more impactful on the industry than the one from the launch of constellations. The scale of VHTS and the associated lower Capex/Gbps will further drive service adoption. With regards to this evolution, Eutelsat will benefit from the launch of the KONNECT VHTS satellite due to enter into service in 2022.

INMARSAT—There is still a lot of talk and investment in low and medium earth orbit satellite constellations such as OneWeb, Telesat and StarLink (SpaceX). But there continue to be business challenges with LEO, particularly with the spread of capacity over low density regions, which can lead to inefficiencies and low yield.

There’s a clear funding gap in the LEO strategy, so although we’re staying close to the market and continuing to investigate opportunities, our strategy focuses on self-owned and operated geosynchronous satellites (GEO). We believe that GEO satellites are the most efficient way to deliver capacity to our customers, offering the best service with the best economics.

Iridium—Not much for Iridium here as we are not going to be an IFC main supplier as these other systems are planning. As mentioned before, our focus is on the cockpit. If anything, these new entrants have the potential to be new partners of ours.

Panasonic Avionics—We are already utilizing HTS across our worldwide network, and will shortly augment this with our XTS system (Extreme Throughput Satellite - an enhanced version of HTS). We are also actively talking to NGSO operators to see where and when the collaboration can take place. Our technology is agnostic, which makes Panasonic the best value solution provider for the connected in-flight experience.

SES—SES Networks is keenly focused on a new age of inflight connectivity, with an IFC roadmap set to bring unrivaled multi-band, multi-orbit satellite capacity to aviation.

Today, our GEO HTS satellites – SES-12, SES-14, and SES-15 – are providing powerful capacity across air travel routes around the world, already taking inflight connectivity to a new level.

2021 promises to be a pivotal year in the aero market, as SES launches SES-17 – an advanced Ka-band HTS satellite – into GEO orbit to serve as the foundation of Thales’ FlytLIVE IFC service over North, Central and South America as well as the Caribbean and Atlantic Ocean Region. 2021 will also see the launch of SES’ next generation O3b MEO constellation called O3b mPOWER. With the GEO and MEO pieces firmly in place, SES plans to introduce to the aero market in 2022 the leading global multi-band, multi-orbit network of smart, seamless worldwide coverage capable of meeting each passenger’s connectivity requirements virtually anywhere in flight.

THALES—With continuous innovation of our products and solutions, Thales is at the forefront of new technology development and is focused on the new wave of satellite constellations. We are working closely with our partners to develop and test next-generation solutions that are capable of multi-orbit operations to ensure we maintain relevancy and leadership in the market.

VIASAT—Viasat’s proprietary Ka-band satellites are at the core of our technology platform. The ViaSat-1 satellite, the company’s first-generation high-capacity Ka-band spot-beam satellite, was placed into service in January 2012. On June 1, 2017, the Company’s second-generation, ViaSat-2 satellite, was successfully launched into orbit. In addition, Viasat owns and operates two additional satellites over North America: WildBlue-1 and Anik F2, and the company jointly owns KA-SAT over Europe through its joint venture agreement. The company also has leasing agreements with Ku-band satellite operators to ‘fill in the coverage gaps’ until Viasat’s third-generation, global, 3+ Terabit per second (Tbps) constellation, ViaSat-3, is in orbit.

With respect to the ViaSat-3 constellation, the Company currently has two ViaSat-3 class satellites under construction—the first satellite is for the Americas, the second is for the Europe, Middle East and African (EMEA) market, and Viasat recently announced it has begun design on a third ViaSat-3 class satellite to serve the Asia Pacific market. With all three ViaSat-3 class satellites on orbit, the Company will have global coverage and more capacity in space than any other IFC provider.

Gogo—As a company, we were early adopters of LEO in the L-band and it’s been an important part of our business aviation services for many years. Gogo has satellite partnerships in place that include high-throughput satellite capacity and future low earth orbit (LEO) satellite capacity when it comes online. We’re very supportive of the efforts to add broadband LEO and hope it will be an augmentation to our network moving forward. There’s still quite a ways to go but we have the only LEO-ready antenna on the market today.

-------------------------------------------

Bernardo Schneiderman is the Principal of Telematics Business Consultants. He can be reached at: info@tbc-telematics.com

Bernardo Schneiderman is the Principal of Telematics Business Consultants. He can be reached at: info@tbc-telematics.com