A number of highly visible new space initiatives, backed by some of the worlds internet billionaires, are challenging the existing satellite industry. Their marketing is great, American style, but is it really a game changer for the satellite industry? For rocket and satellite manufacturers maybe, but the business cases for the satellite operators are not very convincing yet.

When looking for a transition in the satellite industry there is no better place as in the satellite Internet of Things (IoT) market. Where satellite voice, broadband IP connectivity and broadcasting are suffering from heavy competition, lower prices and dwindling margins, the satellite IoT market shows healthy profits and the prospect of strongly growing revenues in the coming five years.

When looking for a transition in the satellite industry there is no better place as in the satellite Internet of Things (IoT) market. Where satellite voice, broadband IP connectivity and broadcasting are suffering from heavy competition, lower prices and dwindling margins, the satellite IoT market shows healthy profits and the prospect of strongly growing revenues in the coming five years.

A recent update on the satellite-IoT market shows that the hype on IoT and the satellite based IoT connectivity market has not faded and that its forecasts are still looking strong:

The global market for IoT-focused satellite services, focused on end-device connectivity hardware and the annual connectivity fees charged, is forecasted to grow to US$ 5.9 Bil. in 2025, after taking off in the 2021-2022 period.

This implies a massive tripling or quadrupling of satellite IoT/M2M devices and applications in the next 5 years. By 2025, some 30.3mn Satellite IoT devices are expected to be deployed globally, growing at a CAGR of just under 40%. It is clear that satellite IoT will bring a massive change over the coming years to the world in general, the IOT industry and to the satellite industry in particular.

Truly global IoT connectivity, something that only satellite can offer, will change environmental monitoring, agriculture, public infrastructure management and anything related to wide area remote sensing. The availability of low cost, low power global connectivity will increase the total number of connected sensors and with that data-points in a variety of global environmental, societal , industrial, agricultural and logistical applications increasing the accuracy of data-based forecasts and trends.

This will cause the satellite industry to change as well. Incumbent satellite providers will be pressured by a new wave of startups that are leveraging the recent advances in smaller satellite technologies providing low cost, low power connectivity. Incumbent satellite providers are in a good position though to meet that challenge, with their networks up and running, and IoT-focused customers could be a nice way to improve their margins, especially when compared to the increasingly cut-throat broadband and broadcast satellite market. For that they might even absorb one of the new Leo players.

In this article we will look both at new and old space satellite players, the services they offer and how they are preparing for the satellite IoT boom.

Satellite IoT Playing field: Old vs New Sat-IoT Players

Let’s start with a look both at the ‘old’ players in the satellite IoT arena and look how they are doing. Incumbent satellite providers have their satellites already up in space and their investments in the space and ground segments are already made. Traditional Mobile Sat Systems (MSS) like Inmarsat, Thuraya, Iridium, Globalstar have been dominant in the M2M/IoT market, using their L-band spectrum with a focus on mobile and maritime applications. In the last 10 years they realised 3.5 - 4 million satellite IoT terminals in the field.

Fixed Sat Systems (FSS) like Eutelsat, Intelsat or Asiasat have developed M2M and IoT services over using Ku or Ka band over the past years as well. Examples are the Ka-sat based Telemetry service from TooWay/Eutelsat, and the recent development of the ASAT-8200 unit by Spacebridge. With their higher bandwidths they are very well suited for Satellite IoT and in particular for backhaul services connecting terrestrial local area IoT networks (eg. NB-IoT, Lora, Wifi, BT) from high density sensor networks to the internet.

For the NewSpace industry, and the dozen nano satellite IoT startups, the satellite IoT market is a hugely lucrative opportunity as they don’t have to take on anywhere near the level of capex burden that the incumbent satellite network operators have been saddled with. New satellite players take advantage of the new cubesat technology (using a range of UHF, VHF, S-band, and Ku-band services) to bring down their service costs, while the Low Earth Orbit allows the use of low power modems to connect the ground sensors.

NewSpace companies active in this market include Astrocast, Myrioata, Lacuna, Kineis, Kepler Communications, Swarm technologies and Hiber. Their service features, low cost, low power, low latency, makes them well suited for Direct-To-Satellite services for terminals that are spread widely over geographic areas.

Satellite IoT Service Typology

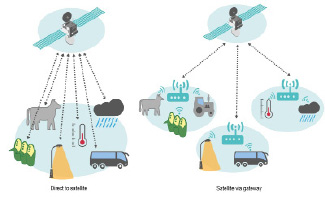

Combined the satellite industry is responding to the IoT market demand with two types of satellite IoT connectivity service.

Combined the satellite industry is responding to the IoT market demand with two types of satellite IoT connectivity service.

Sat-IoT Backhaul Service

Comparable to the GSM or Wifi Backhaul service, the IoT Gateway Backhaul over satellite emerges as a new SATCOM application segment. The IoT market is currently experiencing the advent of ultra-low cost terrestrial radio transmission standards for IoT such as LoRa™, Sigfox™, LTE-M or NB-IoT targeting less than US$ 5 per radio transmitter. These networks com with low cost localized gateways to concentrate larger numbers of IoT devices in their vicinity, even thousands. For the satellite industry connecting these gateways is leading to a new satellite application segment.

Direct to Satellite services

This type of service, especially the low cost and low power variety as promised by the NewSpace Sat-IoT players, is ideal for wide area sensor network with sensors dispersed over wide geographical territory.

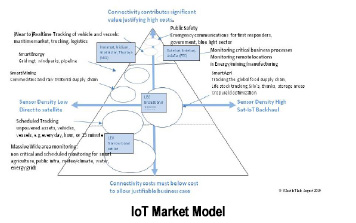

The low power feature is important as they are mostly deploying in remote areas, and the low cost will enable massive networks with new data-points around the world to feed the data-analytics servers in a wide range of industries. On the vertical axis costs are the main driver, combined with latency and reliability. The horizontal axis looks at sensor density per square meter.

In the top of the pyramid we see a lot of high value IoT services like tracking, tracing, logistics, insurance, and performance monitoring for remote assets. This market is already covered by existing Sat-Iot providers. Below there we see the Industry 4.0 applications like in process monitoring but also grid management in the energy sector or asset management in the mining sector. On the bottom of the pyramid a range of wide area monitoring applications like public infra structure monitoring, smart agriculture and every application that monitors the impacts on food, water, environment and security. This will benefit from the low costs, low power Sat-IoT connectivity the new cubesat based Sat-IoT networks are working on. In particular the governmental and public sector will benefit from this type of satellite IoT connectivity. (More on this in a follow up article.)

Challenges for the Satellite Industry

The growing variety of sat-iot connectivity will trigger the global proliferation of the IoT industry into the 90% of our globe without terrestrial networks. This will lead to the same effect like how ubiquitous broadband internet and mobile cellular brought along the “Connected Society”, the shift now going from Internet-of-People to Internet-of-Things.

We see the satellite industry responding to the IoT connectivity demand both with low cost/low power Direct To Satellite connectivity as well as with various combinations of terrestrial (cellular and LPWAN) IoT access networks and satellite backhaul.

Will this be a game changer for the satellite industry? We like to think so. In the next 5 years IoT will lead to the equivalent of a new industrial revolution and with that a new Satellite Communications revolution.

During that revolution a number of challenges have to be met however. To benefit from the growing opportunities sat-iot connectivity is offering customers, satellite operators and their IoT value chain partners will need a thorough understanding of the various components of IoT applications. This goes much further then the connectivity part (modems, antenna’s, satellites, teleports), and also includes the data-analytics and data-visualization part and how to integrate the use of IoT dashboards in corporate IT infrastructure and organization. Satellite operators and their partner eco-structure will have to evolve from capacity (connectivity) providers to service providers, offering full end-to-end solutions.

Due to this complexity, it looks as the classic customer - vendor relationship (satellite service providers and system integrators together with satellite operators ) is changing into a partnership where opportunities of Sat IoT solutions are explored together and in an iterative way.

It looks as the sat-IoT industry is going through a paradigm change indeed.

--------------------------------------------------

Hub Urlings was one of the pioneers of Satellite M2M as Product Manager Inmarsat-C at the famous KPN Station 12. The success of this “small data” satellite service, its global coverage and reliability made that the service was used for a myriad of applications: from sending messages, to truck fleet management, to pipeline monitoring and bringing back data from all types of sensors. At that time satellite was the only type of network that was able to offer global coverage for what we would now call IoT services. Now, 25 years later he is again involved in the development of a new generation of Sat-IoT services. He can be reached at: urlings@m2sat.com

Hub Urlings was one of the pioneers of Satellite M2M as Product Manager Inmarsat-C at the famous KPN Station 12. The success of this “small data” satellite service, its global coverage and reliability made that the service was used for a myriad of applications: from sending messages, to truck fleet management, to pipeline monitoring and bringing back data from all types of sensors. At that time satellite was the only type of network that was able to offer global coverage for what we would now call IoT services. Now, 25 years later he is again involved in the development of a new generation of Sat-IoT services. He can be reached at: urlings@m2sat.com