Following a record year for commercial space funding in China, and with 2021 showing further significant year on year growth, leading international consulting and market intelligence firm Euroconsult have announced a new quarterly market intelligence report dedicated to providing the latest news, expert analysis and insights into the lucrative Chinese space market.

The firm’s China Space Industry report is evolving from an annual document to a series of in-depth quarterly reports in order to provide more current and actionable information about the Chinese space sector, including satellite industry, technological developments, funding updates and relevant M&A. The streamlined reports will enable a more responsive approach to providing unique insights into a market currently experiencing dynamic growth, drawing out a series of key themes to allow for better understanding of the strategic direction of the Chinese space sector, along with a timeline of recent government space activities and analysis of the country’s tech sector in the space industry.

Authored by Euroconsult Senior Affiliate Consultant and China specialist Blaine Curcio, the report is essential reading for space industry decision makers and investors looking to stay informed on the increasing commercialisation of the Chinese space sector. The Q1 2021 Special Edition is full of up-to-date analysis and data, including coverage of the Chinese Space Ecosystem structure and the latest Chinese 5-year plan around government policy and related analysis, including a bonus update on major events of H2 2020 as part of this edition.

Authored by Euroconsult Senior Affiliate Consultant and China specialist Blaine Curcio, the report is essential reading for space industry decision makers and investors looking to stay informed on the increasing commercialisation of the Chinese space sector. The Q1 2021 Special Edition is full of up-to-date analysis and data, including coverage of the Chinese Space Ecosystem structure and the latest Chinese 5-year plan around government policy and related analysis, including a bonus update on major events of H2 2020 as part of this edition.

Report author Blaine Curcio stated, “In recent years, not a week goes by without significant updates in the Chinese space sector. The industry is developing incredibly quickly, with new companies emerging on a regular basis. The new report format is ideally suited to the fast-paced Chinese space ecosystem. As well as key market updates, the report includes enhanced coverage of the investment conditions, such as regulatory environment, and the roles of provincial and national government and the big tech industry.”

“Critically, we look closely at the impact of market developments on the space industry in the West, including satellite manufacturing value chain opportunities and the latest market trends, Indeed, while the most advanced commercial space companies clearly remain Western companies, China is now leading the world in terms of number of commercial space companies being established,” Curcio added.

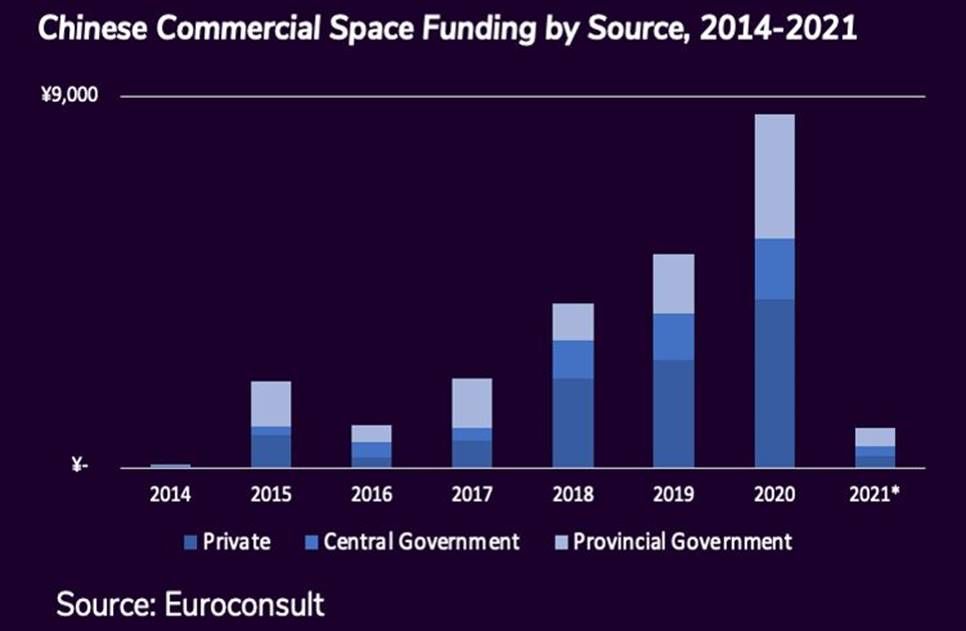

China’s plans to place a space station into low earth orbit may be well known, but the pace at which the nation’s commercial sector is developing and the detail around government space strategy is far less understood due to a variety of reasons, including accessibility and language barriers. Euroconsult’s report pinpoints key developments in a country that is now home to more than 15 commercial launch companies, accounting for around half of funding received in the last 7 years. During the same time period, earth observation activity and satellite manufacturing have each benefitted from nearly 20% of total funding. The latter has been boosted this decade with China’s National Development and Reform Commission (NDRC) adding satellite internet to its “New Infrastructures” list, providing increased support.

Euroconsult’s Chinese market quarterly reports will continue to demonstrate that the country’s commercial space industry is driven by a complex mix of incentives and stakeholders, and whilst standalone technologies have proven relatively easy for Chinese commercial companies to advance, explore how integrated systems - such as LEO mega constellations - will present more of a challenge. Chinese space industry rapid growth over the coming years is a certainty and equally likely to develop in a different and distinctive way to Western equivalent markets.

Subscribers to the Premium Edition of the China Report will also benefit from personal consultation with the report author, in order to provide additional context, clarity, and analysis of the report’s findings and their impact on subscriber organizations.

To coincide with this month’s first quarter report release, Euroconsult is set to deliver a webinar on latest trends within the Chinese satellite manufacturing supply chain, with participation from key sector players, on the 27th of May. The event will provide additional opportunities to learn more about this exciting area of commercial space and further demonstrates the firm’s expertise and knowledge of the Chinese space market.