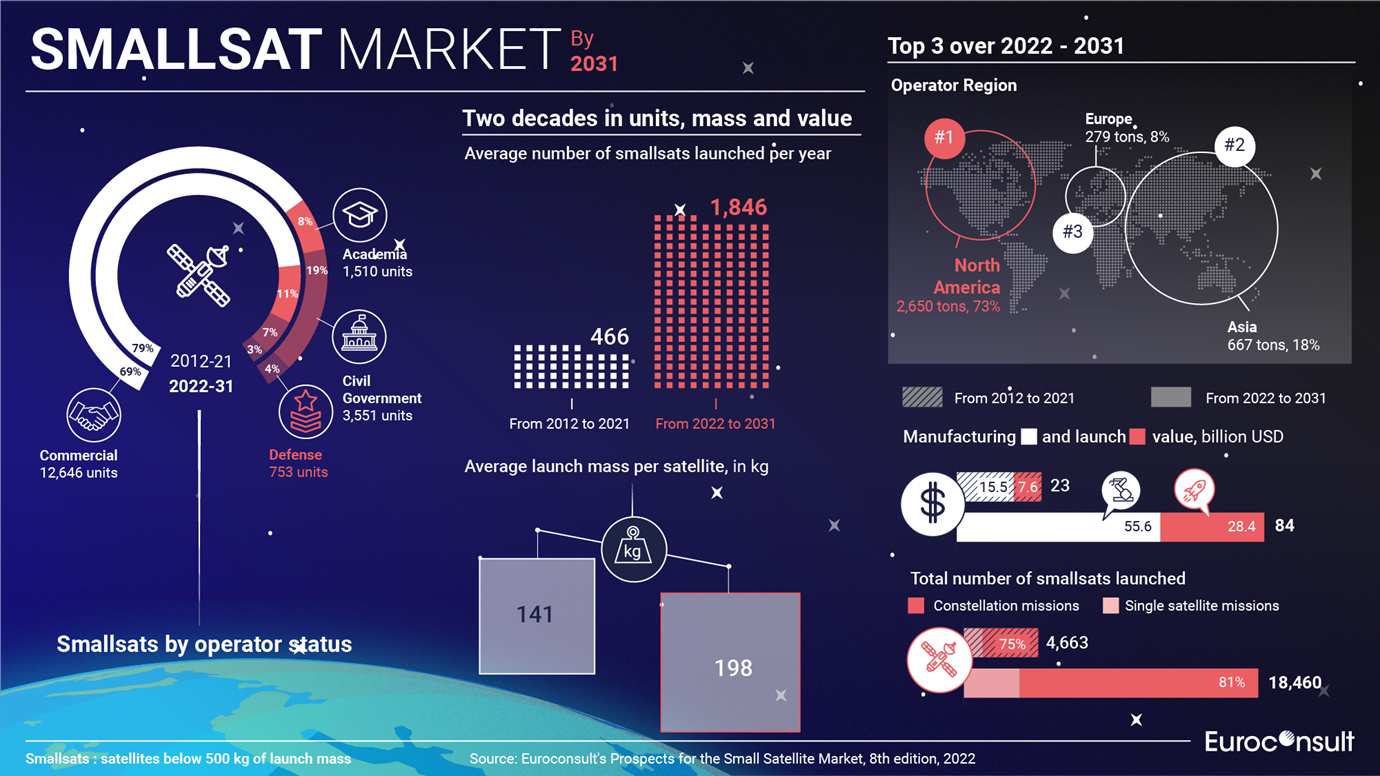

The latest update of “Prospects for the Small Satellite Market” was released this week by Euroconsult, forecasting further growth in the global supply and demand of government, commercial and academic satellites weighing up to 500 kg. The market intelligence report, now in its 8th edition, anticipates that about 18,500 smallsats will be launched over 2022-2031, representing about 365 tons per year, i.e., one ton per day to be launched on average over the next ten years. However, the smallsat market presents a growing number of challenges such as high inflation, limited market addressability, difficult profitability, oversupply risk and concentration of the market by a handful of established players.

The main driver for continued growth at times of macro-economic uncertainty due to the war in Ukraine, the COVID pandemic, disrupted supply chains, high inflation and central bank monetary policy changes remains NGSO constellations, driven by LEO broadband and Earth observation and the continuous necessity for replenishment launches. Of all smallsats to be launched over 2022-2031, 81% are expected to be part of constellations.

Alexandre Najjar, Senior Consultant at Euroconsult stated, “While the war has had severe consequences on players that have part of their supply chains in Russia or Ukraine, it has demonstrated the value of smallsat applications, enabling commercial operators to showcase their capabilities and the merits of their constellations. Consequently, a growing number of government agencies are considering investing in their own smallsat systems or dedicating a budget to the procurement of commercial third-party smallsat-based services, supporting growth of the sector.”

The smallsat manufacturing and launch market value will quadruple over the next decade, to $56 billion and $29 billion respectively, driven by the multiplication of constellation projects from both commercial and government stakeholders. Euroconsult has released its updated findings at a time of smallsat mega-factory multiplication in various nations across the world, initiated in the U.S. and China.

The smallsat manufacturing and launch market value will quadruple over the next decade, to $56 billion and $29 billion respectively, driven by the multiplication of constellation projects from both commercial and government stakeholders. Euroconsult has released its updated findings at a time of smallsat mega-factory multiplication in various nations across the world, initiated in the U.S. and China.

Flagship examples of low earth orbit (LEO) broadband constellations, such as SpaceX’s Starlink and China’s GuoWang, account for over half (53%) of the projected demand over 2022-2031 in units. Readers are therefore advised to go beyond raw numbers as vertical integration keeps growing with numerous players seeking to manufacture, operate and launch their own smallsats. Significant future market shares are now captive of a region, country or of an integrator and/or launch provider, challenging both commercial satellite integrators and launch providers which see more of their target customers not only leaving their addressable market, but also competing with their own services.

The updated report comes with an option to access premium features, including Euroconsult’s Smallsat Constellation Database and its new Launcher Database – exclusive access to Euroconsult’s databases for the first time in its history.

Najjar added, “However, growth in numbers, mass and value will not prevent high inflation and supply chain disruptions from impacting constellation materialization probability by inflating the capex and lead times of smallsat projects. We anticipate that stakeholders that have yet to raise significant amounts of capital will likely face a difficult situation, leading to smaller constellations, cancelled projects and scope reductions, as well as consolidation between players. Nonetheless, smallsats still represent a significant capability building opportunity for new entrants in the space sector, and the war in Ukraine has put the spotlight on the value proposition enabled by commercial satcom and Earth observation smallsat constellations, showcasing their merits around the world. A growing number of governments and commercial ventures alike ramp up their investments in small satellite systems and services, as well as manufacturing and launch capacities.”

Other valuable updates to Prospects for the Small Satellite Market include a reviewed and refined pricing model for manufacturing and launch prices, most notably with regards to inflation-driven cost and price increases already witnessed in the manufacturing and launch industries and anticipated in coming years. The Euroconsult report incorporates new content to help give decision makers key knowledge in this area, as well as a reviewed and up-to-date forecast accounting for the economic situation and the ongoing impact of COVID-19.

You can discover more about the report and the table of contents by downloading the free extract of the report.