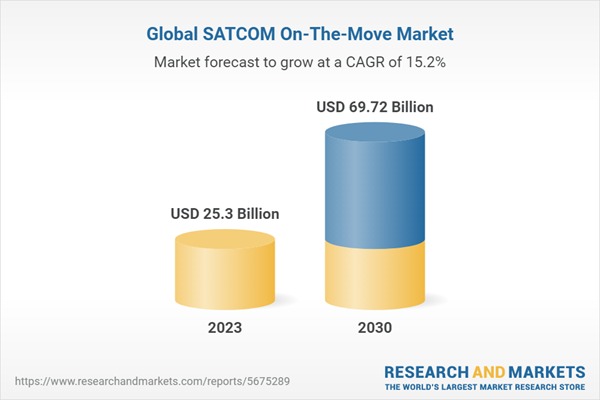

The SATCOM On-The-Move Market size was estimated at USD 22.43 billion in 2022, USD 25.30 billion in 2023, and is expected to grow at a CAGR of 15.22% to reach USD 69.72 billion by 2030.

The SATCOM On-The-Move (SOTM) market is experiencing growth owing to the increasing demand for high-speed connectivity in remote locations across various sectors, such as defense, maritime, aviation, and land-based transportation. SOTM systems enable reliable and secure communication for individuals, vehicles, ships, and aircraft while in motion. Major application areas include defense & homeland security, emergency response, maritime communications, aeronautical communications, commercial vehicle fleet management, and media broadcasting. Advancements in technology have led to the development of more efficient satellite tracking systems capable of maintaining stable connections during rapid movement. In addition, the growing emphasis on network-centric warfare and intelligence gathering by defense forces worldwide necessitates real-time data sharing and communication without geographical constraints. Low earth orbit (LEO) satellite constellations present potential opportunities for market growth by offering faster data transfer rates with lower latency than traditional geostationary earth orbit (GEO) satellites. LEO networks have smaller coverage footprints, enabling higher capacity utilization through frequency reuse. However, several limitations and challenges are affecting the SOTM market. High initial investment and ongoing maintenance expenses may deter potential customers from adopting these solutions. Regulatory challenges such as obtaining spectrum licenses and adhering to national and international communication standards may impede market penetration. Innovations in antenna technology, integration with next-generation satellite networks, and advancements in AI applications are the key factors shaping the future of this market.

Regional Insights

The global SATCOM On-The-Move market encompasses significant growth due to consumer needs and purchasing behavior varying across key countries in the Americas, Europe, and Asia-Pacific. The growth of the market is influenced by factors such as rising demand for advanced satellite communication systems by military forces and enhancements in border security and surveillance capabilities. In North America, increased adoption of satellite communication systems has led to a rise in significant investment in the private sector. Europe shows promising growth potential owing to its focus on improving national defense through advanced communication technology investments. Countries including Saudi Arabia, UAE, South Africa, Israel, and Nigeria drive demand for robust satellite communication systems in the EMEA region. The need for connected military applications has spurred governments to invest in infrastructure upgrades. Asia-Pacific, China, Japan, India, and Australia heavily invest in satellite communications technology to support various sectors. Companies worldwide invest in R&D to develop innovative technologies for SATCOM On-The-Move systems. Both public and private sectors contribute to increased global investments in the SATCOM On-The-Move market.

FPNV Positioning Matrix

The FPNV Positioning Matrix is pivotal in evaluating the SATCOM On-The-Move Market. It offers a comprehensive assessment of vendors, examining key metrics related to Business Strategy and Product Satisfaction. This in-depth analysis empowers users to make well-informed decisions aligned with their requirements. Based on the evaluation, the vendors are then categorized into four distinct quadrants representing varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital (V).

Market Share Analysis

The Market Share Analysis is a comprehensive tool that provides an insightful and in-depth examination of the current state of vendors in the SATCOM On-The-Move Market. By meticulously comparing and analyzing vendor contributions in terms of overall revenue, customer base, and other key metrics, we can offer companies a greater understanding of their performance and the challenges they face when competing for market share. Additionally, this analysis provides valuable insights into the competitive nature of the sector, including factors such as accumulation, fragmentation dominance, and amalgamation traits observed over the base year period studied. With this expanded level of detail, vendors can make more informed decisions and devise effective strategies to gain a competitive edge in the market.

Key Company Profiles

The report delves into recent significant developments in the SATCOM On-The-Move Market, highlighting leading vendors and their innovative profiles. These include Airbus SE, Alico Systems Inc., ASELSAN Elektronik Sanayi ve Ticaret Anonim Sirketi, Ball Corporation, Celera Motion by Novanta Company, Cobham Ltd., Comtech Telecommunications Corp., EchoStar Corporation, EM Solutions Pty Ltd., General Dynamics Corporation, Gilat Satellite Networks Ltd., Honeywell International Inc., Inmarsat Global Ltd. by Viasat Inc, Intelsat US LLC, Iridium Communications Inc., KVH Industries, Inc., L3Harris Technologies, Inc., Raytheon Technologies Corporation, Satcube, SES S.A., SpaceX, Synertone Communication Corporation, Thales Group, The Boeing Company, Thuraya Telecommunications Company by Al Yah Satellite Communications Company PJSC, and VectorNav Technologies, LLC.

Market Segmentation & Coverage

This research report categorizes the SATCOM On-The-Move Market to forecast the revenues and analyze trends in each of the following sub-markets:

- Component

- Antennas

- MIMO

- Phased Arrays

- Inertial Measurement Unit

- Inertial Navigation Units

- Modems & Routers

- Power Amplifiers

- Radio

- Receivers

- Transmitters

- Antennas

- Platform

- Airborne

- Commercial Aircraft

- Military Aircraft

- Unmanned Aerial Vehicles

- Land

- Commercial Vehicles

- Manpacks

- Military Vehicles

- Trains

- Unmanned Ground Vehicles

- Naval

- Commercial Ships

- Military Ships

- Unmanned Maritime Vehicles

- Airborne

- Frequency

- EHF/SHF-Band

- Ka-Band

- Ku-Band

- L & S-Band

- Multi-Band

- Q-Band

- VHF/UHF-Band

- X-Band

- Vertical

- Commercial

- Aviation

- Business & Enterprise

- Marine

- Media & Entertainment

- Telecommunication & Cellular Backhaul

- Transportation & Logistics

- Government & Defense

- Homeland Security & Emergency Management

- Military

- Commercial

- Application

- Airliners Live Connectivity

- Command & Control Centers

- Virtual Private Network (VPN) Connectivity

- VOIP or Video Conferencing

- Region

- Americas

- Argentina

- Brazil

- Canada

- Mexico

- United States

- California

- Illinois

- Indiana

- New York

- Ohio

- Pennsylvania

- Texas

- Asia-Pacific

- Australia

- China

- India

- Indonesia

- Japan

- Malaysia

- Philippines

- Singapore

- South Korea

- Taiwan

- Thailand

- Vietnam

- Europe, Middle East & Africa

- Denmark

- Egypt

- Finland

- France

- Germany

- Israel

- Italy

- Netherlands

- Nigeria

- Norway

- Poland

- Qatar

- Russia

- Saudi Arabia

- South Africa

- Spain

- Sweden

- Switzerland

- Turkey

- United Arab Emirates

- United Kingdom

- Americas

The report offers valuable insights on the following aspects

- Market Penetration: It presents comprehensive information on the market provided by key players.

- Market Development: It delves deep into lucrative emerging markets and analyzes the penetration across mature market segments.

- Market Diversification: It provides detailed information on new product launches, untapped geographic regions, recent developments, and investments.

- Competitive Assessment & Intelligence: It conducts an exhaustive assessment of market shares, strategies, products, certifications, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players.

- Product Development & Innovation: It offers intelligent insights on future technologies, R&D activities, and breakthrough product developments.

The report addresses key questions such as

- What is the market size and forecast of the SATCOM On-The-Move Market?

- Which products, segments, applications, and areas should one consider investing in over the forecast period in the SATCOM On-The-Move Market?

- What are the technology trends and regulatory frameworks in the SATCOM On-The-Move Market?

- What is the market share of the leading vendors in the SATCOM On-The-Move Market?

- Which modes and strategic moves are suitable for entering the SATCOM On-The-Move Market?

Please note: For this report, the purchase of an Enterprise license allows up to ten worldwide users of an organization access to the report

Please note: This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Frequently Asked Questions about the Global SATCOM On-The-Move Market

What is the estimated value of the Global SATCOM On-The-Move Market?

The Global SATCOM On-The-Move Market was estimated to be valued at $25.3 Billion in 2023.

What is the growth rate of the Global SATCOM On-The-Move Market?

The growth rate of the Global SATCOM On-The-Move Market is 15.2%, with an estimated value of $69.72 Billion by 2030.

What is the forecasted size of the Global SATCOM On-The-Move Market?

The Global SATCOM On-The-Move Market is estimated to be worth $69.72 Billion by 2030.

Who are the key companies in the Global SATCOM On-The-Move Market?

Key companies in the Global SATCOM On-The-Move Market include Airbus SE, Alico Systems Inc., ASELSAN Elektronik Sanayi ve Ticaret Anonim Sirketi, Ball Corporation, Celera Motion by Novanta Company, Cobham Ltd., Comtech Telecommunications Corp., EchoStar Corporation, EM Solutions Pty Ltd. and General Dynamics Corporation.

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | October 2023 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD ) in 2023 | $ 25.3 Billion |

| Forecasted Market Value ( USD ) by 2030 | $ 69.72 Billion |

| Compound Annual Growth Rate | 15.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |

Table of Contents

1. Preface

1.1. Objectives of the Study

1.2. Market Segmentation & Coverage

1.3. Years Considered for the Study

1.4. Currency & Pricing

1.5. Language

1.6. Limitations

1.7. Assumptions

1.8. Stakeholders

2. Research Methodology

2.1. Define: Research Objective

2.2. Determine: Research Design

2.3. Prepare: Research Instrument

2.4. Collect: Data Source

2.5. Analyze: Data Interpretation

2.6. Formulate: Data Verification

2.7. Publish: Research Report

2.8. Repeat: Report Update

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. SATCOM On-The-Move Market, by Region

5. Market Insights

5.1. Market Dynamics

5.1.1. Drivers

5.1.1.1. Rising utilization of ultra-compact SATCOM terminals in defense and advanced ground combat vehicles

5.1.1.2. Increasing application across telecommunication and telemetry sector

5.1.1.3. Penetration of SOTM electronically steered and phased array antennas

5.1.2. Restraints

5.1.2.1. High cost of design, development, and maintenance of SATCOM On-The-Move

5.1.3. Opportunities

5.1.3.1. Technological advancements in SATCOM On-The-Move technology

5.1.3.2. Strategic collaborations and investments in SATCOM On-The-Move technology

5.1.4. Challenges

5.1.4.1. Technical and operational issues associated with SATCOM On-The-Move technology

5.2. Market Segmentation Analysis

5.2.1. Component: Portable and versatile introduction of innovative electronic devices for SATCOM On-The-Move

5.2.2. Platform: Evolving needs for defense requirements on air, naval, and land platforms

5.2.3. Frequency: Availability of the appropriate frequency band for SATCOM On-The-Move systems

5.2.4. Vertical: Enhanced communication capabilities for commercial and, government & defense

5.2.5. Application: Essential role of SOTM technology for several applications in enabling seamless connections

5.3. Market Trend Analysis

5.3.1. Established partnerships between market players and governments to foster Satcom-on-the-Move systems in the Americas

5.3.2. Government initiatives and massive investment to attract global industry giants to expand their services in the APAC region

5.3.3. Robust government initiatives and presence of key players enhancing SATCOM On-The-Move technology development in Europe

5.4. Cumulative Impact of COVID-19

5.5. Cumulative Impact of Russia-Ukraine Conflict

5.6. Cumulative Impact of High Inflation

5.7. Porter’s Five Forces Analysis

5.7.1. Threat of New Entrants

5.7.2. Threat of Substitutes

5.7.3. Bargaining Power of Customers

5.7.4. Bargaining Power of Suppliers

5.7.5. Industry Rivalry

5.8. Value Chain & Critical Path Analysis

5.9. Regulatory Framework

6. SATCOM On-The-Move Market, by Component

6.1. Introduction

6.2. Antennas

6.3.1. MIMO

6.3.2. Phased Arrays

6.3. Inertial Measurement Unit

6.4. Inertial Navigation Units

6.5. Modems & Routers

6.6. Power Amplifiers

6.7. Radio

6.8. Receivers

6.9. Transmitters

7. SATCOM On-The-Move Market, by Platform

7.1. Introduction

7.2. Airborne

7.3.1. Commercial Aircraft

7.3.2. Military Aircraft

7.3.3. Unmanned Aerial Vehicles

7.3. Land

7.4.1. Commercial Vehicles

7.4.2. Manpacks

7.4.3. Military Vehicles

7.4.4. Trains

7.4.5. Unmanned Ground Vehicles

7.4. Naval

7.5.1. Commercial Ships

7.5.2. Military Ships

7.5.3. Unmanned Maritime Vehicles

8. SATCOM On-The-Move Market, by Frequency

8.1. Introduction

8.2. EHF/SHF-Band

8.3. Ka-Band

8.4. Ku-Band

8.5. L & S-Band

8.6. Multi-Band

8.7. Q-Band

8.8. VHF/UHF-Band

8.9. X-Band

9. SATCOM On-The-Move Market, by Vertical

9.1. Introduction

9.2. Commercial

9.3.1. Aviation

9.3.2. Business & Enterprise

9.3.3. Marine

9.3.4. Media & Entertainment

9.3.5. Telecommunication & Cellular Backhaul

9.3.6. Transportation & Logistics

9.3. Government & Defense

9.4.1. Homeland Security & Emergency Management

9.4.2. Military

10. SATCOM On-The-Move Market, by Application

10.1. Introduction

10.2. Airliners Live Connectivity

10.3. Command & Control Centers

10.4. Virtual Private Network (VPN) Connectivity

10.5. VOIP or Video Conferencing

11. Americas SATCOM On-The-Move Market

11.1. Introduction

11.2. Argentina

11.3. Brazil

11.4. Canada

11.5. Mexico

11.6. United States

12. Asia-Pacific SATCOM On-The-Move Market

12.1. Introduction

12.2. Australia

12.3. China

12.4. India

12.5. Indonesia

12.6. Japan

12.7. Malaysia

12.8. Philippines

12.9. Singapore

12.10. South Korea

12.11. Taiwan

12.12. Thailand

12.13. Vietnam

13. Europe, Middle East & Africa SATCOM On-The-Move Market

13.1. Introduction

13.2. Denmark

13.3. Egypt

13.4. Finland

13.5. France

13.6. Germany

13.7. Israel

13.8. Italy

13.9. Netherlands

13.10. Nigeria

13.11. Norway

13.12. Poland

13.13. Qatar

13.14. Russia

13.15. Saudi Arabia

13.16. South Africa

13.17. Spain

13.18. Sweden

13.19. Switzerland

13.20. Turkey

13.21. United Arab Emirates

13.22. United Kingdom

14. Competitive Landscape

14.1. FPNV Positioning Matrix

14.2. Market Share Analysis, By Key Player

14.3. Competitive Scenario Analysis, By Key Player

14.3.1. Merger & Acquisition

14.3.1.1. DISH Network Corporation and EchoStar Corporation to Combine

14.3.1.2. Viasat Completes USD 6.3 Billion Inmarsat Acquisition In A Major Satcom Merger

14.3.1.3. Gilat Signs Definitive Agreement to Acquire DataPath, Inc. a Company in Trusted Communications for the US DoD, Military and Government Sectors

14.3.2. Agreement, Collaboration, & Partnership

14.3.2.1. Viasat and Oxford Space Systems Collaborating on Low Size, Weight, and Power SATCOM Capability

14.3.2.2. Cobham Satcom Signs with Leading U.S. Prime Contractor for Advanced Maritime Antenna Solutions

14.3.2.3. Boeing’s New Military Satellite Integrates Anti-Jam Payload for Enhanced Battlefield Communication

14.3.2.4. Airbus to Provide Satellite Communications for Belgian Armed Forces

14.3.3. New Product Launch & Enhancement

14.3.3.1. L3Harris Breaks Barriers in Secure SATCOM with HAAM-R Modem at Northern Edge

14.3.3.2. SpaceX Launches 13 Satellites for U.S. Space Development Agency

14.3.3.3. Honeywell Introduces New Small Satcom System, Versawave With 5G, For Advanced Air Mobility Market

14.3.3.4. Keysight Introduces 2 GHz Real-Time Spectrum Analysis Solution for Satellite Communications Operators

14.3.3.5. Iridium Communications Unveils The New Iridium GO! exec, Redefining Personal Off-the-Grid Connectivity

14.3.4. Investment & Funding

14.3.4.1. Italy's Leaf Space Raises Euro 20 Million For Expansion Of Satellite Communications Network

14.3.5. Award, Recognition, & Expansion

14.3.5.1. Satcom Direct and Gilat Sign Strategic Agreement for Joint ESA Project to Expand Plane Simple Portfolio

14.3.5.2. Cobham Satcom Receives Japanese Approval for SAILOR XTR VSAT Antennas

14.3.5.3. Gilat Awarded Multimillion-Dollar Contract for SATCOM Expansion on Trains in Asia-Pacific

15. Competitive Portfolio

15.1. Key Company Profiles

15.1.1. Airbus SE

15.1.2. Alico Systems Inc.

15.1.3. ASELSAN Elektronik Sanayi ve Ticaret Anonim Sirketi

15.1.4. Ball Corporation

15.1.5. Celera Motion by Novanta Company

15.1.6. Cobham Ltd.

15.1.7. Comtech Telecommunications Corp.

15.1.8. EchoStar Corporation

15.1.9. EM Solutions Pty Ltd.

15.1.10. General Dynamics Corporation

15.1.11. Gilat Satellite Networks Ltd.

15.1.12. Honeywell International Inc.

15.1.13. Inmarsat Global Ltd. by Viasat Inc

15.1.14. Intelsat US LLC

15.1.15. Iridium Communications Inc.

15.1.16. KVH Industries, Inc.

15.1.17. L3Harris Technologies, Inc.

15.1.18. Raytheon Technologies Corporation

15.1.19. Satcube

15.1.20. SES S.A.

15.1.21. SpaceX

15.1.22. Synertone Communication Corporation

15.1.23. Thales Group

15.1.24. The Boeing Company

15.1.25. Thuraya Telecommunications Company by Al Yah Satellite Communications Company PJSC

15.1.26. VectorNav Technologies, LLC

15.2. Key Product Portfolio

16. Appendix

16.1. Discussion Guide

16.2. License & Pricing

List of Figures

FIGURE 1. SATCOM ON-THE-MOVE MARKET RESEARCH PROCESS

FIGURE 2. SATCOM ON-THE-MOVE MARKET SIZE, 2022 VS 2030

FIGURE 3. SATCOM ON-THE-MOVE MARKET SIZE, 2018-2030 (USD MILLION)

FIGURE 4. SATCOM ON-THE-MOVE MARKET SIZE, BY REGION, 2022 VS 2030 (%)

FIGURE 5. SATCOM ON-THE-MOVE MARKET SIZE, BY REGION, 2022 VS 2023 VS 2030 (USD MILLION)

FIGURE 6. SATCOM ON-THE-MOVE MARKET DYNAMICS

FIGURE 7. SATCOM ON-THE-MOVE MARKET SIZE, BY COMPONENT, 2022 VS 2030 (%)

FIGURE 8. SATCOM ON-THE-MOVE MARKET SIZE, BY COMPONENT, 2022 VS 2023 VS 2030 (USD MILLION)

FIGURE 9. SATCOM ON-THE-MOVE MARKET SIZE, BY PLATFORM, 2022 VS 2030 (%)

FIGURE 10. SATCOM ON-THE-MOVE MARKET SIZE, BY PLATFORM, 2022 VS 2023 VS 2030 (USD MILLION)

FIGURE 11. SATCOM ON-THE-MOVE MARKET SIZE, BY FREQUENCY, 2022 VS 2030 (%)

FIGURE 12. SATCOM ON-THE-MOVE MARKET SIZE, BY FREQUENCY, 2022 VS 2023 VS 2030 (USD MILLION)

FIGURE 13. SATCOM ON-THE-MOVE MARKET SIZE, BY VERTICAL, 2022 VS 2030 (%)

FIGURE 14. SATCOM ON-THE-MOVE MARKET SIZE, BY VERTICAL, 2022 VS 2023 VS 2030 (USD MILLION)

FIGURE 15. SATCOM ON-THE-MOVE MARKET SIZE, BY APPLICATION, 2022 VS 2030 (%)

FIGURE 16. SATCOM ON-THE-MOVE MARKET SIZE, BY APPLICATION, 2022 VS 2023 VS 2030 (USD MILLION)

FIGURE 17. AMERICAS SATCOM ON-THE-MOVE MARKET SIZE, BY COUNTRY, 2022 VS 2030 (%)

FIGURE 18. AMERICAS SATCOM ON-THE-MOVE MARKET SIZE, BY COUNTRY, 2022 VS 2023 VS 2030 (USD MILLION)

FIGURE 19. UNITED STATES SATCOM ON-THE-MOVE MARKET SIZE, BY STATE, 2022 VS 2030 (%)

FIGURE 20. UNITED STATES SATCOM ON-THE-MOVE MARKET SIZE, BY STATE, 2022 VS 2023 VS 2030 (USD MILLION)

FIGURE 21. ASIA-PACIFIC SATCOM ON-THE-MOVE MARKET SIZE, BY COUNTRY, 2022 VS 2030 (%)

FIGURE 22. ASIA-PACIFIC SATCOM ON-THE-MOVE MARKET SIZE, BY COUNTRY, 2022 VS 2023 VS 2030 (USD MILLION)

FIGURE 23. EUROPE, MIDDLE EAST & AFRICA SATCOM ON-THE-MOVE MARKET SIZE, BY COUNTRY, 2022 VS 2030 (%)

FIGURE 24. EUROPE, MIDDLE EAST & AFRICA SATCOM ON-THE-MOVE MARKET SIZE, BY COUNTRY, 2022 VS 2023 VS 2030 (USD MILLION)

FIGURE 25. SATCOM ON-THE-MOVE MARKET, FPNV POSITIONING MATRIX, 2022

FIGURE 26. SATCOM ON-THE-MOVE MARKET SHARE, BY KEY PLAYER, 2022

Companies Mentioned

- Airbus SE

- Alico Systems Inc.

- ASELSAN Elektronik Sanayi ve Ticaret Anonim Şirketi

- Ball Corporation

- Celera Motion by Novanta Company

- Cobham Ltd.

- Comtech Telecommunications Corp.

- EchoStar Corporation

- EM Solutions Pty Ltd.

- General Dynamics Corporation

- Gilat Satellite Networks Ltd.

- Honeywell International Inc.

- Inmarsat Global Ltd. by Viasat Inc

- Intelsat US LLC

- Iridium Communications Inc.

- KVH Industries, Inc.

- L3Harris Technologies, Inc.

- Raytheon Technologies Corporation

- Satcube

- SES S.A.

- SpaceX

- Synertone Communication Corporation

- Thales Group

- The Boeing Company

- Thuraya Telecommunications Company by Al Yah Satellite Communications Company PJSC

- VectorNav Technologies, LLC