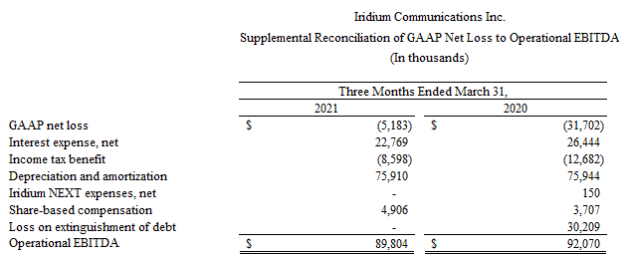

Iridium Communications Inc. (Nasdaq: IRDM) today reported financial results for the first quarter of 2021 and reiterated its full-year 2021 outlook. Net loss was US$ US 5.2 million, or $0.04 per diluted share, for the first quarter of 2021, as compared to net loss of US$ 31.7 million, or $0.24 per diluted share, for the first quarter of 2020. This decrease in net loss was primarily the result of the absence of debt extinguishment costs, which were incurred in the year ago period with Iridium’s refinancing of its senior unsecured notes.

Operational EBITDA (“OEBITDA”) for the first quarter was US$ 89.8 million, as compared to $92.1 million for the prior-year period, representing a year-over-year decrease of 2% and an OEBITDA margin(1) of 61%. The change in OEBITDA primarily resulted from service revenue in the prior-year’s quarter being relatively unaffected by the COVID-19 pandemic.

Iridium reported first-quarter total revenue of US$ 146.5 million, which consisted of $116.2 million of service revenue and $30.3 million of revenue related to equipment sales and engineering and support projects. Total revenue increased 1% from the comparable period of 2020, while service revenue was essentially flat to the year-ago period. Service revenue, which represents primarily recurring revenue from Iridium’s growing subscriber base, was 79% of total revenue for the first quarter of 2021.

The company ended the quarter with 1,518,000 total billable subscribers, which compares to 1,332,000 for the year-ago period and is up from 1,476,000 for the quarter ended December 31, 2020. Total billable subscribers grew 14% year-over-year, driven by growth in commercial and government IoT customers.

“Iridium delivered first quarter results in line with our forecast. While total revenue increased, it’s hard to compare this quarter’s performance to the pre-pandemic period a year earlier. Subscribers grew at a double-digit pace, led by ongoing demand for consumer-oriented IoT devices, and Iridium’s commercial IoT subscribers eclipsed one million users on our network this quarter,” said Matt Desch, CEO, Iridium. Desch added, “We feel very good about Iridium’s ability to accelerate service revenue growth over the balance of the year based upon the positive feedback and activity we are seeing with our business partners.”

Commenting on the company’s share repurchase program, Desch said, “Iridium retired 1.6 million shares of common stock during the quarter under its recently authorized share repurchase program. The open-market activity reflects our confidence in Iridium’s business prospects and our outlook for strong revenue growth into the future.”

Iridium Business Highlights

Service – Commercial

Commercial service remained the largest part of Iridium’s business, representing 62% of the company’s total revenue during the first quarter. The company’s commercial customer base is diverse and includes markets such as maritime, aviation, oil and gas, mining, recreation, forestry, construction, transportation and emergency services. These customers rely on Iridium’s products and services as critical to their daily operations and integral to their communications and business infrastructure.

- Commercial service revenue was US$ 90.4 million, down 1% from the year-ago period, due to the prior period being largely unaffected by the global pandemic, as well as lower hosted payload revenue.

- Commercial voice and data subscribers were essentially flat from the year-ago period at 350,000 customers. Commercial voice and data average revenue per user (“ARPU”) was US$ 39 during the first quarter, compared to US$ 40 in last year’s comparable period. Commercial IoT data subscribers grew 21% from the year-ago period to 1,003,000 customers, driven by continued strength in consumer personal communications devices. Commercial IoT data ARPU was $8.39 in the first quarter, compared to $9.71 in last year’s comparable period.

- Commercial broadband revenue was US$ 9.4 million, up from $8.7 million in the year-ago period. This rise was primarily attributable to ongoing adoption of Iridium Certus broadband service. Commercial broadband average revenue per user (“ARPU”) was $265 during the first quarter, compared to $267 in last year’s comparable period.

- Iridium’s commercial business ended the quarter with 1,365,000 billable subscribers, which compares to 1,192,000 for the year-ago period and is up from 1,324,000 for the quarter ended December 31, 2020. IoT data subscribers represented 73% of billable commercial subscribers at the end of the quarter, an increase from 70% at the end of the prior-year period.

- Hosted payload and other data service revenue was US$ 14.8 million in the first quarter compared to $16.3 million in the prior-year period. This change was due primarily to the recognition of a data billing settlement in the prior year quarter.

Service – Government

Iridium’s voice and data solutions improve situational awareness for military personnel and track critical assets in tough environments around the globe, providing a unique value proposition that is not easily duplicated.

Under the Enhanced Mobile Satellite Services contract (the “EMSS Contract”), a seven-year, US$ 738.5 million fixed-price airtime contract with the U.S. Air Force Space Command signed in September 2019, Iridium provides specified satellite airtime services, including unlimited global standard and secure voice, paging, fax, Short Burst Data®, Iridium Burst®, RUDICS and Distributed Tactical Communications System services for an unlimited number of Department of Defense and other federal government subscribers. Iridium also provides maintenance and support work for the U.S. government’s dedicated Iridium gateway under two other contracts with the U.S. Air Force Space Command. Iridium Certus airtime services are not included under these contracts and may be procured separately for an additional fee.

- Iridium’s government business ended the quarter with 153,000 subscribers, which compares to 140,000 for the year-ago period and is up from 152,000 for the quarter ended December 31, 2020. Government voice and data subscribers rose 7% from the year-ago period to 63,000 as of March 31, 2021. IoT data subscribers increased 11% year-over-year and represented 59% of government subscribers, an increase from 58% at the end of the prior-year period.

Equipment

- Equipment revenue was US$ 24.0 million during the first quarter, up 8% from the prior-year period.

- In 2021, the company continues to expect equipment sales in line with 2020 levels.

Engineering & Support

- Engineering and support revenue was US$ 6.4 million during the first quarter, compared to $7.0 million in the prior year’s quarter, primarily due to the episodic nature of contract work on U.S. government and commercial projects.

Capital expenditures were $9.4 million for the first quarter, which includes US$ 0.6 million of capitalized interest. The Company ended the first quarter with gross debt of US$ 1.63 billion and a cash, cash equivalents and marketable securities balance of $222.3 million, for a net debt balance of $1.41 billion.

During the period ended March 31, 2021, the Company repurchased 1.6 million shares of its common stock under its previously announced $300 million share repurchase program at a total purchase price of $59.3 million. As of March 31, 2021, $240.7 million remained available and authorized for repurchase under this program.

2021 Outlook

The company reiterated its full-year 2021 outlook and other elements of long-term guidance:

- Total service revenue growth of approximately 3% for full-year 2021. Total service revenue for 2020 was $463.1 million.

- Full-year 2021 OEBITDA between US$ 365 million and $375 million. OEBITDA for 2020 was US$ 355.6 million.

- Net leverage of below 3.5 times OEBITDA at the end of 2022, assuming $300.0 million in share repurchases. Net leverage was 3.9 times OEBITDA at December 31, 2020.