The Asia Pacific online video industry will generate US$27 billion in advertising and subscription revenue this year, up 24% Y/Y from 2018, according to a new report, Asia Pacific Online Video & Broadband Distribution 2020, published today by Media Partners Asia (MPA). This pie is forecast to expand at a robust 13% CAGR to US$50 billion by 2024, propelled by rising investment and competition, widening broadband access and ongoing development of local content, payment infrastructure and IP protection.

China, the world’s second-largest online video after the US, remains a major part of this growth, representing 59% of online video advertising and subscription revenue in Asia Pacific this year, according to MPA, although this share will contract slightly to 55% by 2024. At the same time, online video revenues in China are forecast to reach US$27 billion in 2024, up from US$16 billion in 2019, a 11% CAGR. MPA analysts have reduced earlier China forecasts as a result of economic deceleration as well as increased market maturity and regulatory oversight.

Nonetheless, China’s online video ecosystem remains highly developed, benefiting from sizable investments from digital majors Alibaba, Baidu and Tencent. These three players are absorbing sustained losses in video thanks to profitability in other parts of the business. This allows them to buy and create local premium content in volume, as well as exclusive sports rights, while developing innovative technologies and large talent pools.

In recent years, a fourth player, ByteDance, has emerged as another formidable force in China’s online video market. Between them, Alibaba, Baidu, ByteDance and Tencent will represent 69% of online video revenue in China this year, MPA forecasts. Chinese players have also started rolling out online video services in Asia, notably ByteDance in India, Japan and Southeast Asia as well as iQiyi and Tencent in Southeast Asia and Taiwan.

Ex-China, APAC’s largest online video geographies by revenue are: (1) Japan; (2) Australia & New Zealand; (3) India; (4) Korea; (5) Taiwan; and (6) Thailand, with Indonesia set to overtake Thailand by 2024. Online video revenues in APAC ex-China will grow from US$11 billion in 2019 to US$23 billion by 2024, a 16% CAGR, according to MPA projections.

Commenting on the findings of the report, MPA executive director Vivek Couto said “The online video industry is evolving and growing rapidly across Asia Pacific. This is especially true in countries with a significant addressable broadband market, developed payment infrastructure and a dynamic local content ecosystem, as entertainment and, in some cases, sports rights move online. Government-enforced IP protection has also been relatively effective in some markets, helping drive the market forward.

At the same time, deep investments in content and technology have helped a handful of homegrown and global players to scale and dominate market share. Some of these players have access to abundant capital, with content and video distribution forming part of larger ecosystems in some cases, subsidizing costs and investment. Standalone OTT video remains loss-making in Asia Pacific on the whole, although some operators should start to see profits over the next three to five years, either in large domestic markets or as part of an expanding global and regional footprint.

Deft regulation will be key to fulfilling online video’s potential. In many instances, regulators are attempting to bring OTT regulations in line with broadcasting and pay-TV, although restrictions on foreign investment could inhibit best-of-breed competition, while imposing TV content standards on niche online services may be counter-productive. Rules on foreign content titles allowed within libraries also potentially limit consumer choice.”

MPA’s Asia Pacific Online Video & Broadband Distribution 2020 report foresees advertising models staying dominant across most of APAC over the next five years, with the exception of China, Australia & New Zealand, although subscription services are expected to gain scale in key markets. A critical mass of customers is already paying for premium entertainment online in Australia & New Zealand, China and Japan, with India and Korea not far behind.

In Japan and Korea, SVOD (subscription-based video-on-demand) will contribute a significant chunk of sector revenues by 2024. Advertising will remain dominant however, reflecting the slow-burn nature of SVOD in these markets as well as the growth of online video advertising, benefiting YouTube in particular.

In India, SVOD will account for about one third of sector revenues by 2024, although local players are also making inroads into online video advertising alongside YouTube. Disney-owned Hotstar is a strong and fast-growing number two platform across both advertising and subscription, lifted by access to IPL cricket in particular. Hotstar has also benefited from demand for catch-up content from Star India, its direct owner, as well as access to premium Hollywood entertainment. MPA estimates that Hotstar will account for more than 20% of online video advertising in India this year, while its low-ARPU subscription model has also attracted a critical mass of customers.

In Southeast Asia, advertising will remain the cornerstone of industry revenue, maintaining a 74% share of online video revenues by 2024, according to MPA. YouTube will dominate, although some local and regional platforms should gain incremental share. Southeast Asia SVOD revenues have largely been driven by Netflix so far.

Overall, the Asia Pacific pie will remain fairly evenly split between advertising and subscription according to MPA, with advertising’s share decreasing slightly from 56% in 2019 to 54% in 2024, as subscription increases its share from 44% in 2019 to 46% in 2024.

Market Leaders

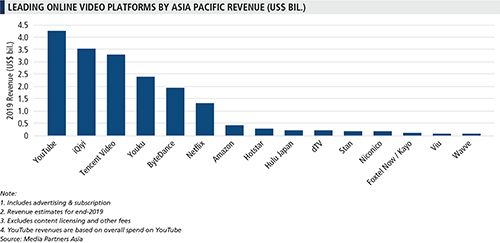

According to MPA analysis, 15 operators will account for almost 70% of Asia Pacific online video revenues in 2019. This list comprises four operators in China, three in Japan, two in Australia, and one each in India and Korea, alongside three global platforms and one regional service.

Global players

Outside China, global platforms have established strong positions in the online video landscape at this early stage of industry development. Between them, Amazon, Netflix and YouTube are on track to represent 54% of online video advertising and subscription revenues in Asia Pacific ex-China this year. YouTube continues to grow consumption and advertising, benefiting from a formidable blend of data and tech, although competition is increasing in key markets such as Australia and India. Netflix is an effective proxy for SVOD in much of Asia Pacific outside China with an estimated 13.2 mil. paying subs as of year-end 2019, according to MPA. At the same time, Amazon has made significant progress in India and Japan where it has invested in local content for its Prime Video service, complementing the growth of other Amazon services.

Outside China, global platforms have established strong positions in the online video landscape at this early stage of industry development. Between them, Amazon, Netflix and YouTube are on track to represent 54% of online video advertising and subscription revenues in Asia Pacific ex-China this year. YouTube continues to grow consumption and advertising, benefiting from a formidable blend of data and tech, although competition is increasing in key markets such as Australia and India. Netflix is an effective proxy for SVOD in much of Asia Pacific outside China with an estimated 13.2 mil. paying subs as of year-end 2019, according to MPA. At the same time, Amazon has made significant progress in India and Japan where it has invested in local content for its Prime Video service, complementing the growth of other Amazon services.

More global players are about to join the fray. Disney+ will make its APAC debut in Australia and New Zealand in November 2019 at a competitive price point of US$6.7 per month, likely followed in 2020 by Japan, where a similar service, Disney Deluxe, already exists today. India, Korea, Southeast Asia and Taiwan should come on stream in 2021. Meanwhile, Apple TV+ will launch globally in November 2019, with prices in Asia Pacific ranging from US$1.4 per month in India to US$6.1 per month in New Zealand.

Asia Pacific Online Video & Broadband Distribution 2020

This comprehensive report reviews the drivers and dynamics shaping the fast-moving online video and telecoms industries across 14 Asia Pacific markets with analysis of online video subscribers and ARPUs; advertising & subscription revenues; content costs; mobile & home broadband subscribers, ARPUs and revenues; online video distribution, pricing & packaging, telco partnerships & integrations across more than 100 operators; and key regulatory, commercial and infrastructural developments.