NSR’s Flat Panel Satellite Antenna Analysis, 6th Edition report, released today, sees over 6M cumulative FPA shipments generating nearly $17B in equipment revenues over the next decade. The growing Non-GEO HTS Consumer Broadband market will yield nearly 5 million in shipments alone, driven by the growing number of HTS constellations expected over the next ten years.

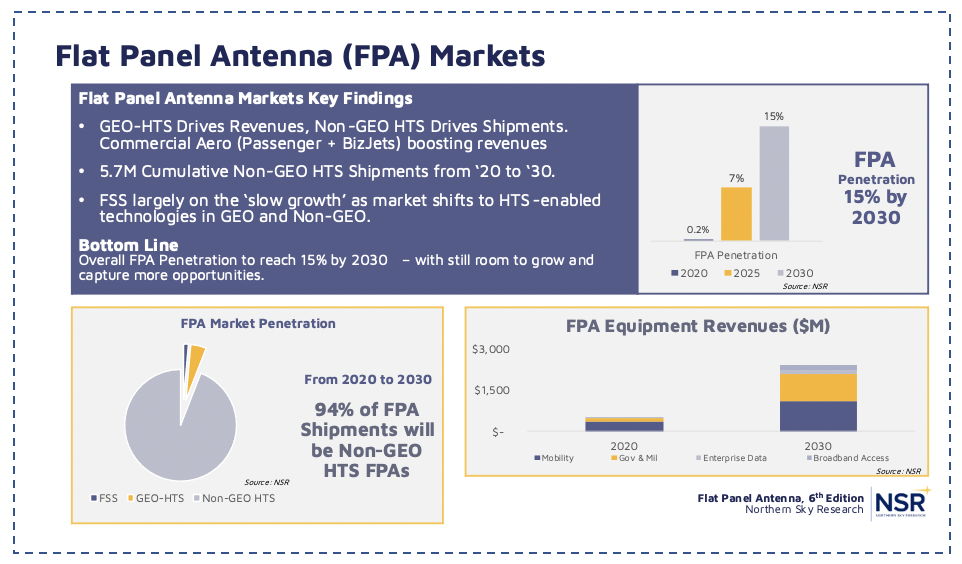

“Near-term, COVID-19 continues to present supply-chain challenges across the equipment supplier landscape,” states Principal Analyst and Report Co-Author Brad Grady. “However, customer demand remains robust, with FPAs reaching upwards of 15% Satellite Terminal penetration by 2030 – up from basically 0% today.”

“Near-term, COVID-19 continues to present supply-chain challenges across the equipment supplier landscape,” states Principal Analyst and Report Co-Author Brad Grady. “However, customer demand remains robust, with FPAs reaching upwards of 15% Satellite Terminal penetration by 2030 – up from basically 0% today.”

“There is a lot of activity in the FPA market,” adds Charlotte Van Camp, NSR Analyst and report Co-Author. “Prices are being pushed down, and we’ve seen good improvements on antenna performance, but in the end, it will be one or the other.” She adds, “Several players are still looking for a spot in the FPA market. The biggest winners of the market will be the “can do it all multi-orbit, multi-frequency, multi-beam antenna.”

Grady continues, “Total Cost of Ownership is driving SATCOM markets. Increasingly, that means all the way down to the ground segment – and FPAs provide a highly flexible capability to leverage an increasingly complex space segment.”

Bottom Line, Commercial Mobility end-users will generate 60% of cumulative revenues. Consumer Broadband applications will unlock US$1 Billion in revenues for FPA manufacturers. HTS architectures in GEO and Non-GEO account for nearly 99% of In-Service Units by 2030 (up from 30% in 2020), and GEO-HTS remains as the largest cumulative equipment revenue source – more than US$10 Billion by 2030.