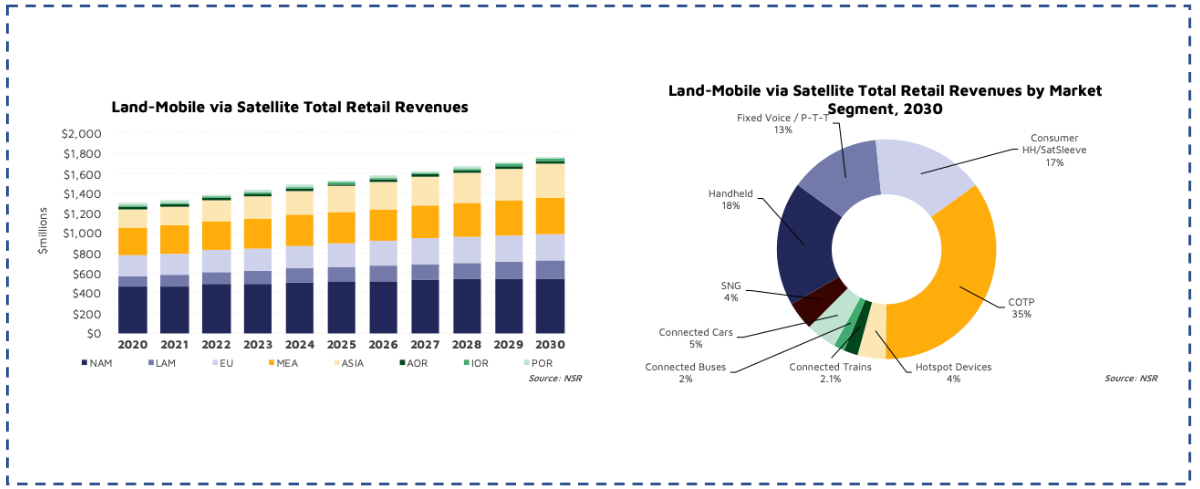

NSR’s Land Mobile via Satellite, 9th Edition (LMvS9) report, released today, forecasts despite some challenges with enterprise segments over the past 16 months, consumer handheld demand soared throughout 2020, after challenges at the start of the year. LMvS9 finds this solid base propelling the market to add over 500,000 new land mobile subscribers over the coming decade, reaching 1.2 million active subscribers in 2030.

COVID-19 caused decreased usage across some form factors analysed over the past year. “Traditional satellite telephone form factors, push-to-talk, fixed voice, and hotspot devices all experienced either a flattening of retail revenues, or a slight decline, as economic activity dropped,” states Alan Crisp, NSR Senior Analyst and lead report author.

COVID-19 caused decreased usage across some form factors analysed over the past year. “Traditional satellite telephone form factors, push-to-talk, fixed voice, and hotspot devices all experienced either a flattening of retail revenues, or a slight decline, as economic activity dropped,” states Alan Crisp, NSR Senior Analyst and lead report author.

However, social distancing has encouraged more consumers to travel outdoors and participate in eco-tourism, especially within North America. Garmin and Iridium were the biggest winners in this space given their already dominant presence in the market; however, relatively newer devices such as the ZOLEO Satellite Communicator, the Bivystick, and others are also seeing boosts, but revenue ultimately returns to Iridium as the operator.

These devices, along with Globalstar SPOT, are not without their challenges. Churn is much higher compared to other MSS narrowband services, and ARPU remains extremely low compared to all other form factors. However, carefully crafted pricing strategies and global expansion of distribution channels all point to overall strong growth.

While consumer devices have had a “head start” from the second half of 2020, nearly all other land mobile verticals are expected to get back on track to growth from later this year, from GEO-HTS COTP to MSS services. Connected vehicles are also inching their way forward with new integrated services with electronically steered FPAs.