Cambridge, Mass., March 3, 2020

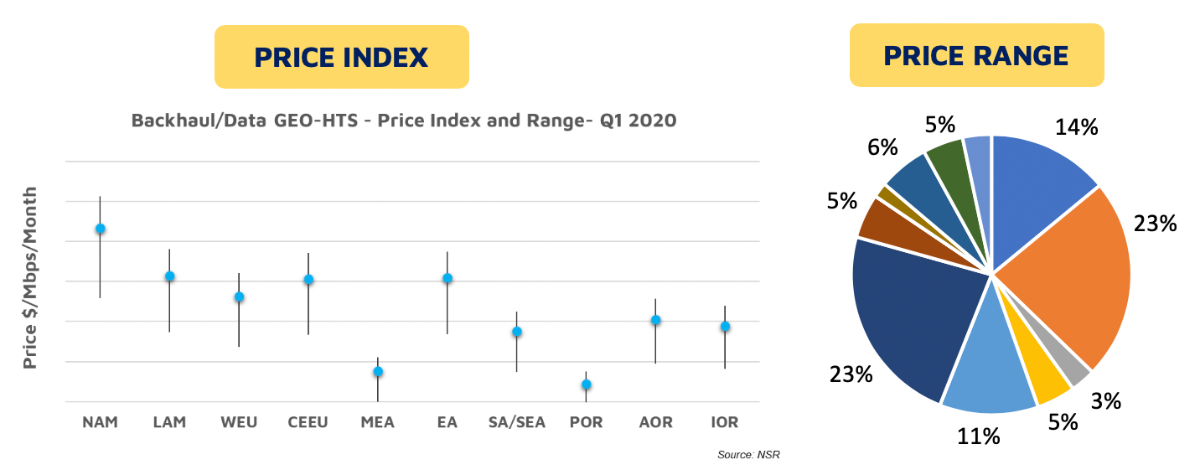

NSR’s latest report, Satellite Capacity Pricing Index, 6th Edition (2020) finds capacity pricing declines decelerating in 2020, with the global mean price index declining by ~13% in Q1 2020, in contrast to ~17% in Q1 2019. This decline slows further in 2020, with signs of stabilization across some regions, bands, and applications to come by 2021 in advance of large waves of both GEO and Non-GEO capacity entering the market.

“Competition to grab market share has slowed considerably compared to 2017-18, as operators look to touch base with P&L fundamentals by tiering capacity. Maritime is witnessing a boost in demand, while Aero looks to post the highest growth in the segment, bringing much-needed pricing stability, and a return to double-digit growth for network wholesale revenues,” states Gagan Agrawal, NSR Senior Analyst and report author. NSR forecasts Consumer Broadband and Backhaul to exhibit declines of ~15-20% due to highly CAPEX efficient capacity coming online in 2021. Mobility and Gov-Mil segments will provide much more stability.

Operators are accepting the trend of price declines, offsetting losses via increasing contract volumes and choosing specific regions to grow. Duration of contracts has consistently decreased, and with it, the bargaining power of operators. Though, increasing ground efficiencies and ARPUs in the service segment has prompted several operators to pursue managed services to arrest wild swings in pricing and revenue.

|

NSR’s Satellite Capacity Pricing Index, 6th Edition (2020) (SCPI6) is unparalleled in its depth of insight provided through index prices, ranges, and forecasts. Both the SCPI6 proprietary pricing tool and analysis are definitive resources to predict the near to medium term scenarios for the industry; answering strategic questions on evolving business models in the satcom industry.

|

|