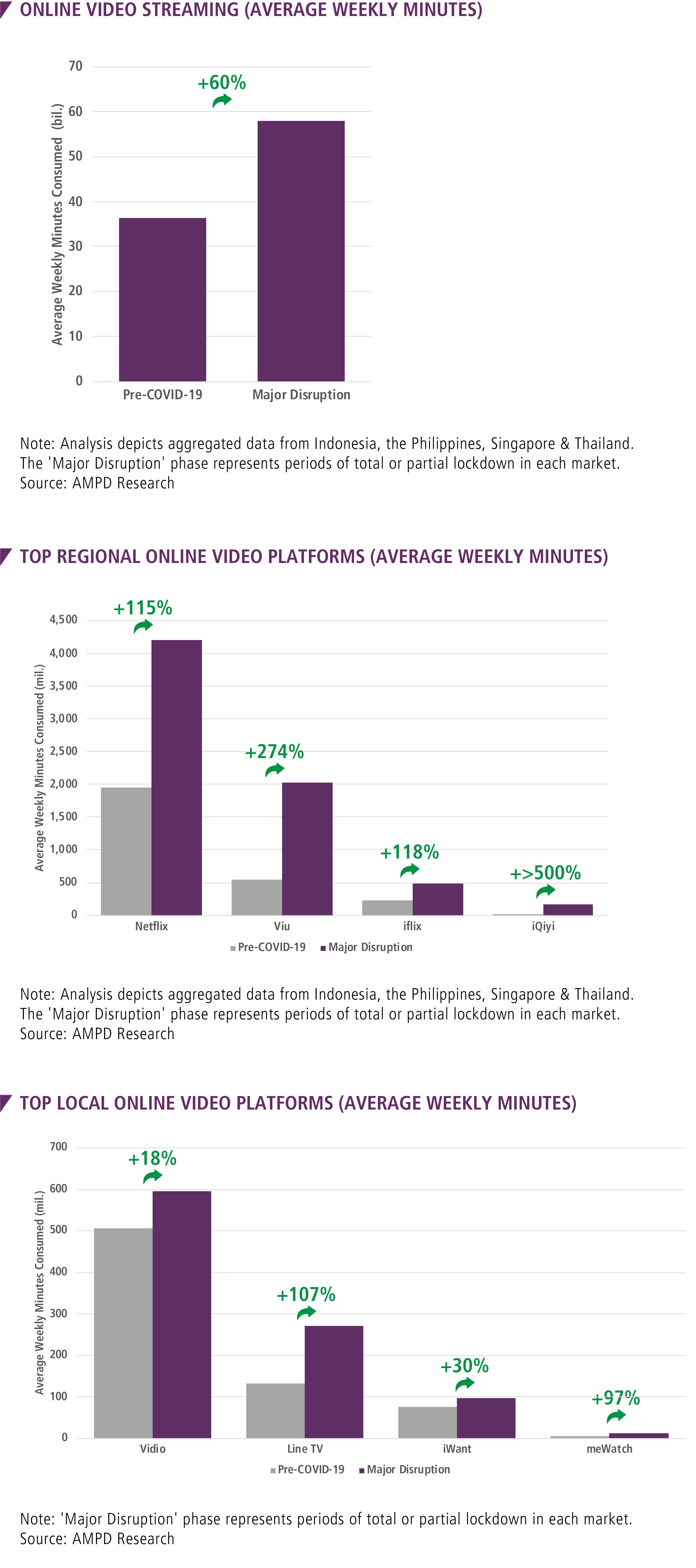

Total online video weekly streaming minutes on mobile grew 60% in aggregate across Indonesia, Malaysia, the Philippines and Singapore between January 20 – April 11, 2020, according to a new report published today by Media Partners Asia (MPA). With the disruption and subsequent lockdown measures enforced during the COVID-19 pandemic, total online video streaming weekly consumption reached 58 billion minutes on mobile by April 11, 2020 versus 36.4 billion on January 20, 2020.

The report, entitled Southeast Asia Online Video Consumer Insights & Analytics: A Definitive Study, leverages MPA’s proprietary AMPD Research platform, which evaluates consumer behaviour and usage patterns across the digital economy, including online video & gaming. Using a unique solution that fuses passively observed digital behaviour and empirical survey data, the study is the result of research carried out between January - April 2020 in the four SEA markets with insights collected from a sample of 32,425 individuals. The report also includes detailed analysis and profiles of 43 unique OTT platforms. The report will be updated again in Q3 and Q4 2020. MPA will also release studies using the AMPD Research solution, targeting Australia, Taiwan, Japan, Korea & India markets through Q2 & Q3 2020.

Key findings of the study include:

- YouTube, already dominant, has grown incrementally from its high base during the surveyed period.

- Netflix has benefited from robust pay subs demand across its mobile plans with heavy consumption of its Korean, Anime, and Western Original content (i.e. US & Europe).

- Viu streaming minutes & viewers continue to grow, driven largely by Korean content while its pay subs have spiked up significantly in Thailand and grown steadily in other SEA markets.

- iQiyi, still in soft launch phase in SEA, has grown steadily in Indonesia, the Philippines & Thailand.

- Amazon Prime Video grew most significantly in Singapore through the surveyed period.

- Global & regional players performing well but placed outside of the top five video apps by streaming minutes include HBO Go, Tubi, Viki and iflix. Apple TV’s penetration across the key surveyed markets is low.

- Amongst local players, the study notes significant growth across: (1) SCMA-owned Vidio in Indonesia; (2) ABS-CBN owned iWant; (3) MediaCorp.-owned meWatch in Singapore; and (4) LineTV in Thailand.

- Mobile video platforms continue to grow consumption with the most significant being AISPlay and TrueID in Thailand.

Commenting on the key findings of the report include, MPA executive director Vivek Couto said: “The penetration of streaming video has increased dramatically during this pandemic as millions have been forced to operate from home. The focus now is on how successfully SVOD platforms will be able to retain newly acquired customers in 2H 2020 and to what extent AVOD platforms can capitalise on the expanded reach. Through the study, MPA analysis indicates that the four markets had a combined 7 million paying online video or OTT customers at end-March 2020, accounting for US$350 million in annual consumer spend. Netflix is a clear leader in most markets, followed by Viu with its freemium service while other players such as HBO, iQiyi and Tencent are well placed to grow in the future along with new entrants such as Disney+. Key local players should be encouraged by increasing consumption and in certain cases, monetisation, in the surveyed markets as they look to invest in scaling their offerings and managing the transition from broadcast to digital video. The onus is now on more robust aggregator offerings from traditional pay-TV platforms and new mobile & virtual operators. As consumer spend between online video & pay-TV re-calibrates, the delivery & distribution of live and on-demand streaming video will be critical in Southeast Asia. Today, consumer spending on online video is ~25% in aggregate of what customers spend on linear pay-TV services in the four markets.”

This report is produced by Media Partners Asia (MPA) using its proprietary AMPD Research platform. This report is the result of research carried out in Jan – April 2020 across four Southeast Asia (SEA) markets: (1) Indonesia; (2) the Philippines; (3) Singapore; and (4) Thailand. The report is focused on consumption, monetisation and usage across the digital economy with a focus on Online or OTT Video and detailed profiles of 43 unique OTT platforms. The report leverages insights and behaviour patterns from a sample size of 32,245 individuals, the largest ever sample size used to measure online video in these four SEA markets. The report will be updated again in August & December 2020.

This report also uses AMPD Vision® platform data. AMPD Vision® passively measures “real” consumption on all mobile devices. It uses a permission-based panel of consumers who consent to the collection of their session-based activity. The data reported is anonymised and conforms to data privacy legislation in markets where the service operates including European Union’s General Data Protection Regulation (GDPR) and the Republic of Singapore’s Personal Data Protection Act (PDPA) which delivers parallel compliance in Asia-Pacific Economic Cooperation (APEC) member states. For the purposes of this report, AMPD Vision® was used by MPA to provide a consolidated view of streaming media consumption across global and regional VOD services on mobile devices. MPA also used the results of an Establishment Survey, which serves as a VOD Profiling Study conducted continuously across the four markets. Under this survey, data is collected through an interactive online survey among intern et users aged 15 years and above.