We live in a mobile world. More and more, inhabitants of the developed world expect to be able to access data and video wherever they are, and at same connectivity speed that is available in their home or office. High-speed internet access, has become a necessity. In the developing world it paves the way to local commerce, education and economic growth. In those parts of the world, mobile networks are frequently the only means of connectivity available. We have now reached the point where globally most internet access is via mobile devices. 52% in January 2020. In Africa and Asia at 60% and 62% respectively the figure is even higher. In developed economies as well, it has becoming a very popular access method accounting for 48% of internet access in North America.

Even in the midst of the Covid-19 crisis when most of the world’s population is confined to their homes, mobile usage continues to increase in many countries. China, for example saw a 30% increase in the number of hours per device spent on mobile data usage. In Italy the figure was 11%. It’s not just internet access that has seen these increases. The use of voice services has also increased considerably, as people strive to keep in touch with loved ones and friends during the periods of lockdown that have been enforced around the world. Verizon in the US for example reports that the average number of daily voice calls, is currently more than double the number of calls made on Mothers’ Day, normally one of the busiest days of the year.

According to the Ericsson Mobility Report, at the end of 2019 there were 7.9 billion mobile subscriptions, projected to grow to 8.9 billion by 2025. In spite of these large numbers, in 2020 over three billion people in the world, still have no access to any kind of fixed or mobile service. Usually mobile networks are the first step in providing connectivity to unserved areas. Unserved means no fiber or terrestrial backbone. Satellite is the ideal way to connect these regions.

According to the Ericsson Mobility Report, at the end of 2019 there were 7.9 billion mobile subscriptions, projected to grow to 8.9 billion by 2025. In spite of these large numbers, in 2020 over three billion people in the world, still have no access to any kind of fixed or mobile service. Usually mobile networks are the first step in providing connectivity to unserved areas. Unserved means no fiber or terrestrial backbone. Satellite is the ideal way to connect these regions.

Absolute numbers of subscriptions may be experiencing only single digit growth, but data usage is accelerating at a far greater pace: growing 49% between 2018 and 2019. Going forwards Ericsson is predicting mobile traffic to experience an annual growth of 27% to 2025, from 38 to 160 exabytes per month. A lot of this increase is due to the increasing amount of video being viewed on mobile devices. Video is forecast to account for 78% of overall traffic in 2025.

We hear a lot about 5G, and that is definitely the future. However, for some Mobile Network Operators (MNOs) so is 4G. In the next few years, many networks around the world will be upgraded to this technology. According to the latest statistics from the GSMA of the 7.9 billion subscriptions, 48% are still on 2 and 3G networks. This figure is projected to drop to 23% by 2025, at which point 20% will be on 5G networks and 56% on 4G. According to Cisco’s Global Mobile Data Traffic Forecast, 4G users typically use three times more data than 3G users and ten times as much as 2G users. Preliminary figures from South Korea, indicate that 5G subscribers are using 2.6 times as much data as 4G subscribers. This means that effectively almost every MNO will be dealing with increased traffic volume in the next few years. An increase, that in some areas can more cost effectively be handled by satellite backhaul.

Upgrading a network to the next generation technology isn’t as simple as flipping a switch, and suddenly everyone is using it. Users upgrade at their own pace; therefore, the MNO has to be able to handle all generations of mobile technology and mix of traffic types at the base station. Similarly, the backhaul solution has to be versatile and flexible enough to handle the different traffic mix of voice, data and video, as well as the increased volume of data.

Satellite Backhaul

For many years now, MNOs have relied on satellite for backhaul in more remote and less developed regions of the globe. In fact, without satellite it would have been both a logistical nightmare and prohibitively expensive to connect these networks to the backbone. Compared to laying fiber or installing microwave links, satellite is quick and easy to deploy, being indifferent to both inhospitable terrain and line of sight restrictions.

Early installations were expensive and offered only low bandwidths. They were often undertaken to meet Universal Service Obligations (USO) and subsidized by governments. Unfortunately, because of this, satellite came to be viewed as the technology of last resort. Fortunately, some forward looking MNOs have recognized that things have changed and taken advantage of satellite’s capabilities.

For example, in 2015 Avanti Communications, using an ST Engineering iDirect modem, worked with TTCL (now known as TTC), a mobile operator in Tanzania to extend its network reach, so as to give rural customers the same opportunities as those living in urban and suburban areas. Customers can now access the internet at speeds of up to 15Mb. Similarly, in 2017, Teledata de Mozambique chose Newtec’s (now ST Engineering iDirect) Dialog hub for its mobile backhaul and banking services.

Satellite backhaul however, is not confined to developing economies and rural areas, satellite equipped base stations are also found in urban areas. This is particularly true for first responder networks. As Stuart Burson, Associate Director, Satellite Solutions Group, Verizon Response Team, in the US said: “The industry needs to get the word out that in a crisis, satellite will still be the main technology that can be counted on to provide consistent communications. In addition, satellite service providers must be integrated into the software defined network…We will continue to add satellite capabilities to our wireless response fleet so they can respond much faster. We are using more high-throughput satellite product offerings, like those from ST Engineering iDirect, to augment the bandwidth required for LTE communications. Bandwidth needs are always growing and satcom will be critical.”

Several factors have now combined to make satellite backhaul an attractive proposition for MNOs. On the supply side, the advent of High Throughput Satellites (HTS) caused bandwidth prices to fall dramatically, changing the economics entirely. In most parts of the world, bandwidth is now priced at US$ 200-300 per Mbps, about a third of what it was a few years ago. According to analysis by NSR, this means that when a base station throughput is more than 600GB per month, satellite becomes the cheapest solution for backhaul. To put this into perspective, data consumption in Sub-Sahara Africa is typically 0.6GB per month. So, if a base station supports 1,000 users, even in a low-revenue developing economy, satellite would be the most economical solution.

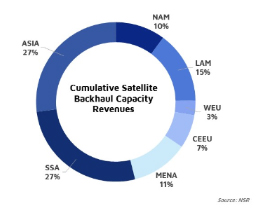

NSR’s Wireless Backhaul via Satellite, 14th Edition report, forecasts US$ 39 billion in 2019-2029 cumulative capacity revenues for Satellite Backhaul. With backhaul networks rapidly transitioning to 4G and the installed base continuously expanding, Mobile Backhaul via Satellite offers sizable opportunities in all regions. Small cells will play an increasingly important role in this growth, as lower costs expand the addressable market to areas previously uncovered due to industry cost metrics, according to NSR.

NSR’s Wireless Backhaul via Satellite, 14th Edition report, forecasts US$ 39 billion in 2019-2029 cumulative capacity revenues for Satellite Backhaul. With backhaul networks rapidly transitioning to 4G and the installed base continuously expanding, Mobile Backhaul via Satellite offers sizable opportunities in all regions. Small cells will play an increasingly important role in this growth, as lower costs expand the addressable market to areas previously uncovered due to industry cost metrics, according to NSR.

The NSR report further added that the multiple mergers and acquisitions in the VSAT platform space are particularly relevant for the satellite backhaul market. The combination of ST Engineering iDirect and Newtec created a strong force in the global ground segment market and Satellite Backhaul forms an integral part of the newly merged company’s strategy. Comtech/Gilat/UHP have followed this bold lead, but the acquisition is not expected to close until the later part of 2020. Additionally, as MNOs are increasingly willing to outsource network management, multiple entities are moving into offering end-to-end services.

As the nature of mobile communications has changed, so too has the supporting ground satellite technology. Terminal prices have fallen drastically, so adding to the financial attractiveness of a satellite solution. The current generation of platforms now accommodates data, video and internet access as well as voice. VSAT platforms are flexible and scalable so as to cope with the explosion in bandwidth and changing customer demands. Most give the MNO the opportunity to “start small,” yet offer economies of scale as networks expand and bandwidth needs increase. They’re able to compress video and handle large volumes of data. The mix of traffic demands more complex Service Level Agreements (SLAs) and sophisticated Quality of Service (QoS) bandwidth management. The current generation of platforms is future-proof to accommodate the demands of 5G.

On the demand side, the exponential growth of the mobile market, both in terms of numbers of devices and bandwidth consumption, mean that MNOs are looking to offload traffic in congested areas. This is particularly true in cases of sudden demand surge. A major sporting event or a disaster for example, when excessive spikes in traffic, overload the terrestrial network.

“We are seeing exponential demand for mobile connectivity which is covering every region. Demand is growing from the most urban to the most rural areas. Mobile networks are poised to become the primary way in which we connect, especially as 5G comes online with new use cases. Mobile network operators will need satellite and its inherent capabilities to help with this tremendous surge in demand, in both rural and urban areas,” said Semir Hassanaly, Head of Cellular Backhaul and Trunking, ST Engineering iDirect.

An additional factor is the increasing use by mobile operators of small cells. Operators around the world are deploying them to increase network capacity in congested areas and to extend coverage to extreme rural areas. Small cells are particularly relevant for 5G. In urban areas most 5G deployments will utilize millimeter waves, as these enable larger bandwidth allocations, facilitating the higher speeds integral to 5G. By definition, as they don’t travel as far, millimeter waves necessitate the use of small cells. In rural areas, 5G deployments will be a mixture of macro cells for wide area coverage, and small cells to provide the higher bandwidths to clusters of isolated customers. These rural customers are no different from their urban counterparts in terms of expectations. They want and expect to be able to access the same social networking, video sites and mobile money services as their urban counterparts, making a low data rate solution no longer viable, hence the need for small cells to accommodate this.

According to NSR a small cell base station can be set up for under US$20,000. Cheaper bandwidth and terminals, coupled with small cells and greatly enhanced hubs combine to make satellite a very attractive proposition for the MNO. Coupling 5G’s use of small cells with the existing use by MNOs led NSR to forecast that by 2029 there will be 800,00 satellite backhaul sites in operation, up from well under 100,000 today.

Key Players

In spite of a recent spate of mergers and acquisitions there are still several companies meeting the challenge to provide a flexible, scalable ground system. These include: ST Engineering iDirect,(including Newtec), Comtech (including Comtech EF Data, Gilat and UHP Networks), Hughes and Spacebridge (which split from Advantech Wireless), among others. All of these companies have been in the market for many years and to a greater and lesser degree have products that meet the current demands of the mobile backhaul.

One company which is making significant inroads in the satellite backhaul market is ST Engineering iDirect. The combination of two great innovators in the market, iDirect and Newtec creates a formidable player. The company is responsible for installing a satellite backhaul network of 1,500 cellular sites, the largest such network in the world; twelve of the top 25 telcos are ST Engineering iDirect customers. The company is also making a name for itself in 4G and now has a 50% share of new installs in this market. Dialog, the company’s flagship product for backhaul was awarded the prestigious “Teleport Technology of the Year” by the World Teleport Association in 2020.

Dialog is a flexible, scalable, efficient multi-service platform. Data, video, voice, and datacasting can all be offered from the one platform. It is flexible enough to grow as the MNO’s business grows. If there is no terrestrial infrastructure in a region, it can support individual end-users, once cellular is deployed in a region, it will handle the backhaul. It can provide IP trunking. When fiber is present it will be there for offloading capacity during demand surges, or for emergency needs. As 5G is rolled out, its multicasting capabilities make it ideal for delivering video to the edge. Total versatility and flexibility. Mx-DMA (Cross-Dimensional Multiple Access) return technology provides the flexibility to simultaneously support a symmetrical 2G network at the same time as a more asymmetrical 3 or 4G network. It can also enable doubling of transponder throughput. Mx-DMA and SCPC (Single Channel per Carrier) modems for Dialog enable beam switching on a single satellite or between multiple satellites for the aeronautical and maritime markets.

It is also important to note that Dialog works seamlessly with any orbit, and ST Engineering iDirect was responsible for the world’s first 5G backhaul and OTT delivery over a LEO satellite. Other demonstrations include Over-the-Air MEC-based (Multi-access Edge Computing) layered video streaming over a 5G multilink satellite and terrestrial network using a GEO satellite, and 5G video to planes.

Looking to the Future

5G is a step change for the mobile industry, it’s the broadband network on steroids. It is expected to deliver speeds of up to 10Gbps, 100 faster than today’s 4G/LTE networks and accommodate up to one million devices per square kilometer. Video already accounts for 60% of mobile network traffic, predicted to rise to 78% by 2025; 5G will facilitate this increase. However, 5G isn’t just a bigger, faster network, it will have exponentially higher efficiencies, massive scalability, lower latency and significantly lower costs. It is poised to be the driver for the Internet of Things (IoT), enabling machine to machine communication at an unprecedented level. It will be used as a fixed network providing broadband to the home.

Three basic use cases have been agreed upon:

• Enhanced Mobile Broadband (eMBB)

• Ultra-reliable low-latency communications (URLLC)

• Massive Machine Type Communications (mMTC)

The ability to support these three very different use cases, is made possible by the fact that 5G, will be a virtual rather than a physical network. The vast majority of the standards are software not hardware. The architecture will take advantage of Network Function Virtualization (NFV) and Software Defined Networking (SDN). Together these essentially move the core network functions to the cloud. They also enable network slicing, which is the key to being able to simultaneously run the very different applications.

5G is also a step change for the satellite industry. A common network architecture, which all access technologies, including satellite, will adhere to, has been defined. It is the first time that the industry has been actively involved in developing the standards for a mobile technology. ST Engineering iDirect has been a significant contributor to several of the 5G standards working groups, including SaT5G, SATis5 and OSMOSIS, and, as already mentioned has conducted several demonstrations of satellite integrated 5G.

Of course, just as 2G and 3G exist alongside 4G, 4G will continue to coexist with 5G. The standard is backwards compatible, so any 5G modem will work with 4G.

Obviously, satellite has a tremendous role to play in backhaul for 5G, both fixed and mobile, but it will also facilitate many of the use cases.

eMBB will provide faster data rates, enabling the increased use of video streaming services. This is an area where satellite can play a major role. MNOs will need to deliver video to the edge, to accommodate the increased demand. Not only can the multicast capabilities of satellite deliver it there more efficiently, satellite operators have been operating content delivery networks for many years, and already have the skill and experience to do this.

While satellite will never be used for URLLC required for vehicle to vehicle communication, satellite delivery of streamed video for passenger entertainment will significantly reduce the congestion that would otherwise occur at the base station. The multicast capabilities of satellite are ideally suited to deliver software updates to vehicles, once again relieving network congestion for the MNO.

Satellite also has a role to play offloading 5G networks. While the actual data rate involved in eM2C communication is small, aggregating all the data from millions of devices, will have a major impact on network loads. Network slicing enables non-latency sensitive data, to be offloaded onto satellite or to simply enhance efficiency by sending over satellite.

| To read or download a pdf of the full report on Satellite Cellular Backahul sponsored by ST Engineering iDirect click here. |

As already mentioned, NSR is forecasting that by 2029 there will be 800,000 satellite backhaul sites in operation. This is due to mobile users consuming ever greater amounts of bandwidth, usually in the form of video, forcing MNOs to install more base stations to accommodate this. Small cells are now widely deployed and this trend will increase with 5G, A typical 5G network will be a mixture of small cells for millimeter wave coverage and larger base stations for wide area coverage.

ST Engineering iDirect

Since the merger was announced a year ago iDirect/Newtec is now one unified company, ST Engineering iDirect; and is in the perfect position to lead the innovation and transformation of the satcom industry. The merger combined the complementary strengths of each: iDirect’s unparalleled networking and mobility features with Newtec’s exceptional performance and efficiency. This combination gives the new company the scale to accelerate its technology strategy, delivering products to market faster than was previously possible.

The newly combined portfolio of high-value product lines give customers one comprehensive solution, from one trusted source, across a complete array of markets. The portfolio has wide -ranging impact spanning a myriad of markets and applications, including telcos, mobile network operators, broadcast, high-speed mobility, military and enterprise.

The portfolio represents the industry’s defacto standard in performance, efficiency and reliability, and covers the gambit from small- to medium-range networks; dedicated TDMA or SCPC networks; massive scale broadcasting; to dynamic, multiservice, large-scale HTS platforms.

A key innovation in the portfolio is Mx-DMA waveform as part of the Dialog platform. Mx-DMA MRC (multi-resolution coding), unites SCPC (single channel per carrier) efficiency and TDMA (time-division multiple access) scalability in an innovative way, adding new dimensions of adaptability. Mx-DMA MRC applies the full scalability of a TDMA return link to the original Mx-DMA HRC (high resolution coding) return at the same efficiency levels. This means that service providers can now cover a variety of use cases in a single self-organizing return link, sharing satellite capacity more efficiently over a group of terminals and applications. This results in the lowest TCO (total cost of ownership) for the MNO or satellite operator.

At the ST Engineering iDirect launch of the technology Thomas Van den Driessche, President of the Executive Board and Chief Commercial Officer said “This is the most efficient, most advanced return technology that you can imagine…the efficiencies are incredible, the overhead is very low and it scales 10,000-100,000 sites, it’s the most advanced VSAT return technology ever built. With the added dimensions and scalability, we are unlocking tremendous flexibility and scale so our customers can deliver a broader range of service levels at a lower cost structure without compromise.”

The Future Vision from ST Engineering iDirect

ST Engineering iDirect’s technology vision is driving this re-definition of ground infrastructure capability. The goal is to create the world’s first cloud-based, multi-access, multi-orbit technology platform.

This Platform will ensure full interoperability with future 5G networks to drive broader adoption of satellite connectivity at massive scale and enable customers to offer unified, value-added services across any existing or future telecommunication network.

Through this vision, rather than being the technology of last resort, satellite will be the MNO’s keystone that facilitates network expansion and the rollout of 5G.

-----------------------------

Elisabeth Tweedie has over 20 years experience at the cutting edge of new commmunications entertainment technologies. She is the founder and President of Definitive Direction (www.definitivedirection.com), a consultancy that focuses on researching and evaluating the long-term potential for new ventures, initiating their development, and identifying and developing appropriate alliances. During her 10 years at Hughes Electronics, she worked on every acquisition and new business that the company considered during her time there. She can be reached at etweedie@definitivedirection.com

Elisabeth Tweedie has over 20 years experience at the cutting edge of new commmunications entertainment technologies. She is the founder and President of Definitive Direction (www.definitivedirection.com), a consultancy that focuses on researching and evaluating the long-term potential for new ventures, initiating their development, and identifying and developing appropriate alliances. During her 10 years at Hughes Electronics, she worked on every acquisition and new business that the company considered during her time there. She can be reached at etweedie@definitivedirection.com