Sports Rights Forecast 2023-2033, Top 15 sports leagues to hold $66.9 billion in global media rights by 2028, $88 billion by 2033

Bristol, UK, March 21, 2023

More so than any other content vertical, live sports seem to be the definitive means by which our industry values a video service. With live sports comes a captive fanbase that are willing to jump through hoops to watch the games, as well as one or two zeitgeist moments of the calendar year which will draw astonishing traffic to whichever service is playing host.

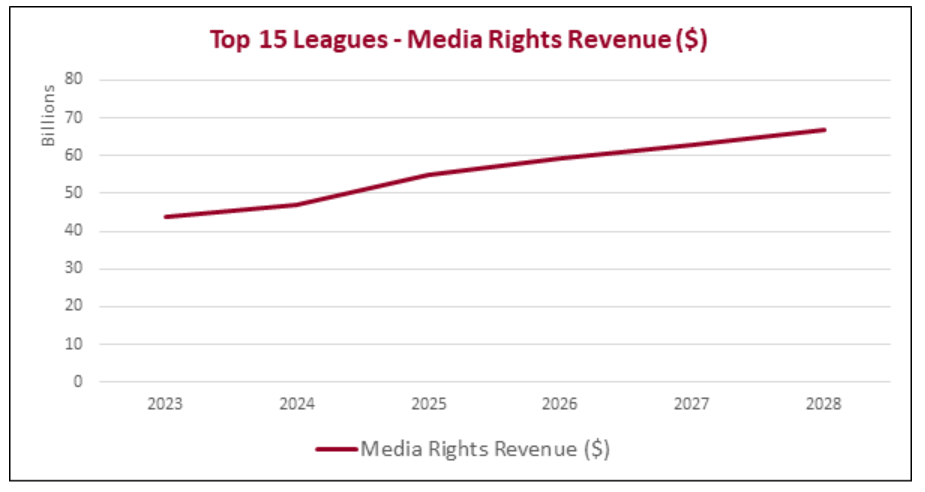

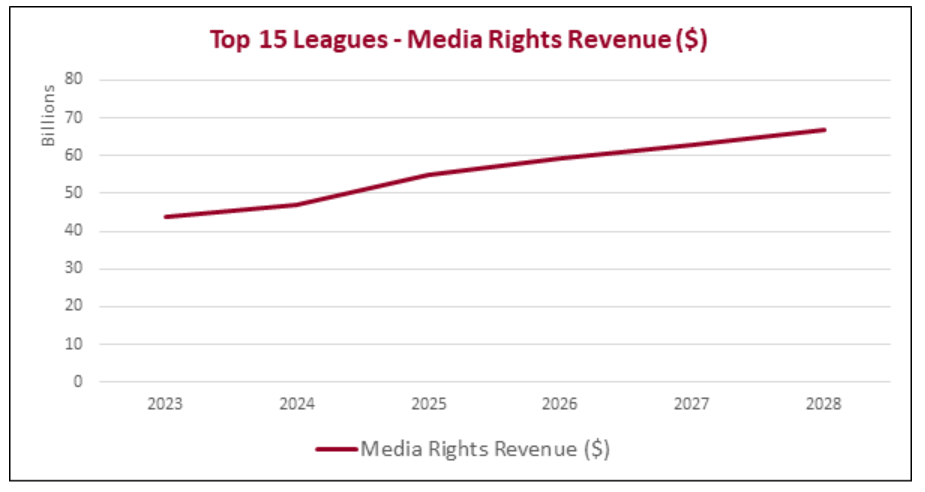

It is therefore no wonder that sports rights prove an ever-popular forecast topic, but equally one that is easily clouded by hysteria and hype. This is easily done in such a rapidly growing industry. Between 2014 and 2023, Media Rights Revenues (MRRs) for the Top 15 Leagues has more than doubled, growing to $43.8 billion this year.

In this report, we have assembled a confident picture of the global MRRs for each of the Top 15 Leagues over the past decade, and projected these numbers over the next ten years until 2033. Whittling down the global sports events to a finite number of annual leagues seemed to be the best way to get a consistent, reliable and considered measurement on the sports rights market.

We feel that the Top 15 Leagues (in terms of MRR) provide a healthy variety of revenue size, geography (of both the league and its audience) and sports played, while also collectively making up a significant enough portion of the total sports rights market to serve as a legitimate bellwether.

As such, we predict that the MRR of the Top 15 Leagues will grow from $43.8 billion in 2023 to reach $67 billion in 2028, at a CAGR of 8.87%. All 15 leagues will see growth in their MRRs over the next five years, although to widely varying extents. Major League Baseball (MLB) will see the slowest growth, at a CAGR of just 1.98% over the next five years, while the National Basketball Association (NBA) is set to grow at a CAGR of 26.30%, reaching $13.5 billion in 2028.

This report arrives amid a transitional phase where sports rights are consistently being repackaged into smaller and smaller portions in order to meet the demand of a growing pool of hungry rights holders. The premium reputation that precedes live sports content has driven up the demand, as all emerging video services vie to prove themselves as stalwart of the media and entertainment landscape. Combine this with the desperation of pay TV platforms, which see their legacy sports contracts as the final hurdle preventing their dubious customers from churning exclusively to the streamers, and we have a rapidly inflating rights market with no end in sight.

That is, until the rights owners (i.e., the sports leagues themselves) decide enough is enough, cut off all their licensing agreements in certain territories, and take their content direct to the consumer (D2C) via a proprietary streaming platform. Already, these platforms are on the market (e.g., the NBA League Pass), but no rights-owner has yet taken a decisive step towards self-sufficient and exclusive distribution, opting in the meantime to run their platforms around any traditional rights agreements they hold.

However, that change is certainly coming. The economic benefits of cutting out the middleman while charging similar to the end-user are too strong to not already be firmly in the long-term strategy of every major rights holder on the planet. It is simply a case of ‘when’, not ‘if’.

As a rough guideline, we believe that a likely tipping point into the next phase of transition will come at the next phase of rights renegotiations for some of the leading sports leagues, many of which appear to converge around 2033. We therefore see this report as a useful means of gauging exactly how much money stands to be swept from the rights holders’ content budgets, as live sports distribution becomes an entirely in-house job.

The Top 15 Leagues in terms of MRR, in alphabetical order, are: B.League (Japan), Bundesliga (Germany), Campeonato Brasilaeiro Serie A (Brazil), Chinese Super League, English Premier League, Formula 1 World Championship, La Liga (Spain), Ligue 1 (France), Major League Baseball (USA), Major League Soccer (USA), National Basketball Association (USA), National Football League (USA), National Hockey League (USA), Serie A (Italy), and the UEFA Champions League/Europa League (Europe-wide.)

This is the latest forecast in the Rethink TV Archive, which now includes:

- Subscription Video on Demand Market Forecast 2022-2027

- Investigating the Energy Use of Video Delivery and Consumption 2022-2027

- Video Distribution Market & Open Caching 2022-2028

- Open Internet Contribution Transport Protocol Forecast 2022-2027

- Content Recommendations Software Forecast 2022-2027

- Low Latency Distribution Protocol Forecast 2022-2027

- SVoD and AVoD Forecast 2022-2027

- Multicast-ABR Forecast 2022-2027

- WiFi Cloud Management, Multi-AP, WiFi 6, 6E, and 7 Forecast 2021-2026

- Decentralized CDN and Multi-CDN Forecast 2021-2026

- Cloud Production Technologies – Market Forecast 2021-2026

- Set Top Box, Smart TV, and Connected TV Device Operating System Forecast – 2020-2026

- Media & Entertainment Transcoding Workload and Device Royalty Forecast 2020-2030

- OTT Security market reaches $452 million, as live sports draw nearer to the direct-to-consumer cliff-edge

- Customer Journey Management Forecast 2020-2026

- Pure WebRTC emerges to take share from Private CDN, as total CDN market hits $33 billion by 2025

- Long Form, Social Media, and Gaming Online Video grow to $171.5 billion

Rethink Technology Research is an analyst firm that has established itself over its 21-year history as a thought leader in 5G, and all forms of wireless; the entertainment ecosystem and streaming media; the Internet of Things; and has now embarked on the energy marketplace. Rethink TV is our video research team, producing market forecasts, technology white papers and tracking operator-technology vendor relationships in OTT video.

|

Rethink TV forecasts core OTT video technologies and applications, explaining how changing business models will revolutionize video delivery. It also comprises profiles of the 100 largest operators in the world, and the technology stacks they use to deliver OTT video content. Available on an annual subscription basis, it’s designed as a tool to increase revenues from OTT video markets and survive the rethink of TV.

|

|

|

| Rethink Research has been publishing, forecasting, consulting and ‘telling it like it is’ in the technology world, for almost 20 years. What our clients most like about us is our independent, non-biased research; regularly picking the brains of industry executives to provide our readers with no-nonsense insights that are impossible to find anywhere else. And, unlike other analyst groups, we don’t sugar-coat how tough the future will be. |

|

|

Sports Rights Forecast 2023-2033

is available via our e-Commerce store |

|

|

|

|

|