Bristol, UK., October 26, 2023

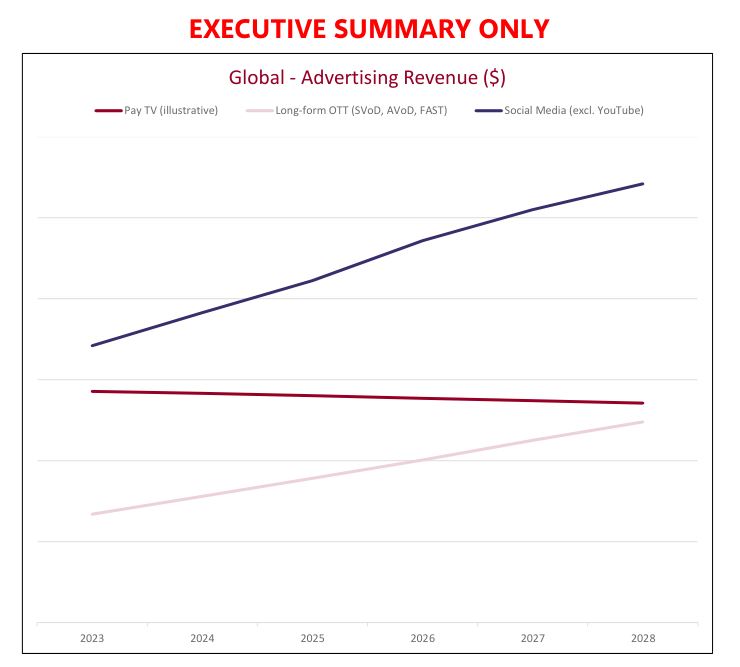

The past decade has seen Social Media platforms completely transform from communication tools, with sprinklings of entertainment, into fully-fledged entertainment hubs. Rethink TV believes this transition is still in its early days, meaning that Social Media is a key player in the power vacuum that is following the decline of Pay TV where, too often, the SVoD, AVoD and FAST branches of Long-form OTT are considered to be the only contenders.

|

| Social Media grows to $314 billion market in 2028, dwarfing Pay TV and Long-form OTT, with 280.4 billion hours watched per month. |

Even when excluding YouTube, Rethink TV finds that Social Media’s ad revenue grows 58.5% over the next five years to reach $270.9 billion in 2028. This dwarfs the $123.9 billion ad revenue that will be collected by Long-form OTT platforms, as well as the $135.5 billion collected by Pay TV.

The report also finds that video accounts for growing a portion of Social Media’s advertising revenue. Video watching balloons to 90.8% of total Monthly Active Hours (MAHs) on Social Media by 2028 – equivalent to 280.4 billion hours per month.

This huge contribution to total watch times means that Social Media is a keystone part of many debates that cut across our industry. Codec adoption, ‘fair contribution', and ad targeting capabilities are just a few examples of key issues that are massively impacted by the decisions of just a handful of Social Media companies.

The new report looks at the top six global Social Media video platforms – Facebook, Instagram, Snapchat, TikTok (including China’s Douyin), YouTube and X (formerly Twitter) – and provides regional KPIs on each platform’s Monthly Active Users, Monthly Active Hours, Monthly Hours Watched and Advertising Revenue.

Rethink TV finds that Social Media poses a legitimate threat to the distribution landscape for more traditional media and entertainment assets. User-generated content (UGC) has evolved to the point where it can genuinely compete with stalwart unscripted content studios and zeitgeist broadcast events. More traditional media still has scripted content firmly in its grasp, but this is not by any means guaranteed in the future, especially as technology continues to lower the cost of entry to high-quality production.

We are already seeing user-generated content slowly working its way up the ranks of long-form OTT platforms. Harvesting content from popular YouTube creators is now seen as a cheap and easy way to spin up a few more FAST channels with readymade content that will instantly attract a dedicated audience. Equally, Social Media platforms seem poised to make some landgrabs in the premium content space, with much of the necessary infrastructure ready to go.

This is the latest forecast in the Rethink TV Archive, which now includes:

- Social Media Video Market 2023-2028

- Impact of Strikes and Inflation on Content Spending 2023-2028

- Set Top & Smart TV and Connected TV Device Operating Systems 2023-2028

- Media & Entertainment Codecs Market 2023-2030

- AVoD, FAST, and SVoD Market 2023-2030

- Sports Rights Forecast 2023-2033

- Investigating the Energy Use of Video Delivery and Consumption 2022-2027

- Video Delivery Market 2022-2028

- Open Internet Contribution Protocols 2022-2027

- Content Recommendations Software 2022-2027

- Low Latency Distribution Protocols 2022-2027

- Multicast-ABR 2022-2027

- WiFi Cloud Management, Multi-AP, WiFi 6, 6E, and 7 2021-2026

- Decentralized CDN and Multi-CDN 2021-2026

Rethink Technology Research is an analyst firm that has established itself over its 22-year history as a thought leader in 5G, and all forms of wireless; the entertainment ecosystem and streaming media; and the energy transition. Rethink TV is our video research team, producing market forecasts, technology white papers and tracking operator-technology vendor relationships in OTT video.

About Rethink

| Rethink Research has been publishing, forecasting, consulting and ‘telling it like it is’ in the technology world, for more than 20 years. What our clients most like about us is our independent, non-biased research; regularly picking the brains of industry executives to provide our readers with no-nonsense insights that are impossible to find anywhere else. And, unlike other analyst groups, we don’t sugar-coat how tough the future will be. |

|