The latest forecast from Rethink TV charts the arrival of Open Caching technologies, and the impact they will have on the Video Delivery Market. This market shows no sign of slowing, but there is a fight brewing among its component parts. CDNs currently reign supreme, and while we have previously examined the potential impact of WebRTC and Decentralized-CDN (D-CDN), as part of our CDN studies, the new disruptor on the block is Open Caching.

Put very simply, the Open Caching specifications allow for ISPs to create a caching system within their networks that could significantly reduce their operational costs, while also netting them payments from the OTT content providers (CPs) that are trying to reach those fixed-line broadband customers.

The ISPs could do this independently, or they could use a vendor that has implemented Open Caching capabilities within their portfolio. The CDNs would thus be left in the lurch, as the CPs would pay the ISPs for delivering video, and in so doing, the CPs would reduce their spend with the CDNs.

Of course, the CDN providers themselves could pursue Open Caching too, and this is far from an all-or-nothing game. Compounding this has been the recent push towards ‘Telco CDN,’ a term that describes how CDNs have begun brokering deals to locate their caching servers within the ISP networks – a move that looks quite similar to Open Caching, on paper.

The CDN vendors are diversifying into services, and have been aware of the competitive threat of technologies like Open Caching for some time. There have been attempts at a similar approach before, and skepticism remains in the CDN camp.

The standards development organization behind the Open Caching family, the Streaming Video Technology Alliance (SVTA) has a lot on its plate, but with Open Caching, it wants to enable a global ecosystem. In very simple terms, it wants to create an API scheme that would allow a CP to set the terms of delivery, and then have Open Caching compliant systems carry and cache that traffic. However, this system is not finalized, nor is there a certification or compliance program, nor is work on the necessary billing APIs underway.

Not that this has stopped certain vendors pursuing early pre-standard Open Caching wins aggressively – acting as the middlemen between the CPs and the ISPs until that global API program is implemented. There is, of course, a risk that these early programs lead to incompatible islands, depending on how different the finalized Open Caching standards are to what is being currently installed, but given the prevalence of software, updates and reconfigurations are not exactly onerous these days.

To this end, there is still a lot of uncertainty on the commercial side of the Open Caching proposition. There is consensus that the underlying technologies are sound and achievable, but this is a story that the video industry has heard and told many times, and the business model is ultimately what makes or breaks a new approach.

In the broader story of the video delivery market, the beginnings of a push towards environmental performance being pivotal. Video is easily attacked for its carbon output, and Rethink TV is working on a report that will explore this issue more fully. However, OTT platforms will be challenged on this basis, by both investors and governments, which makes new technologies much more appealing.

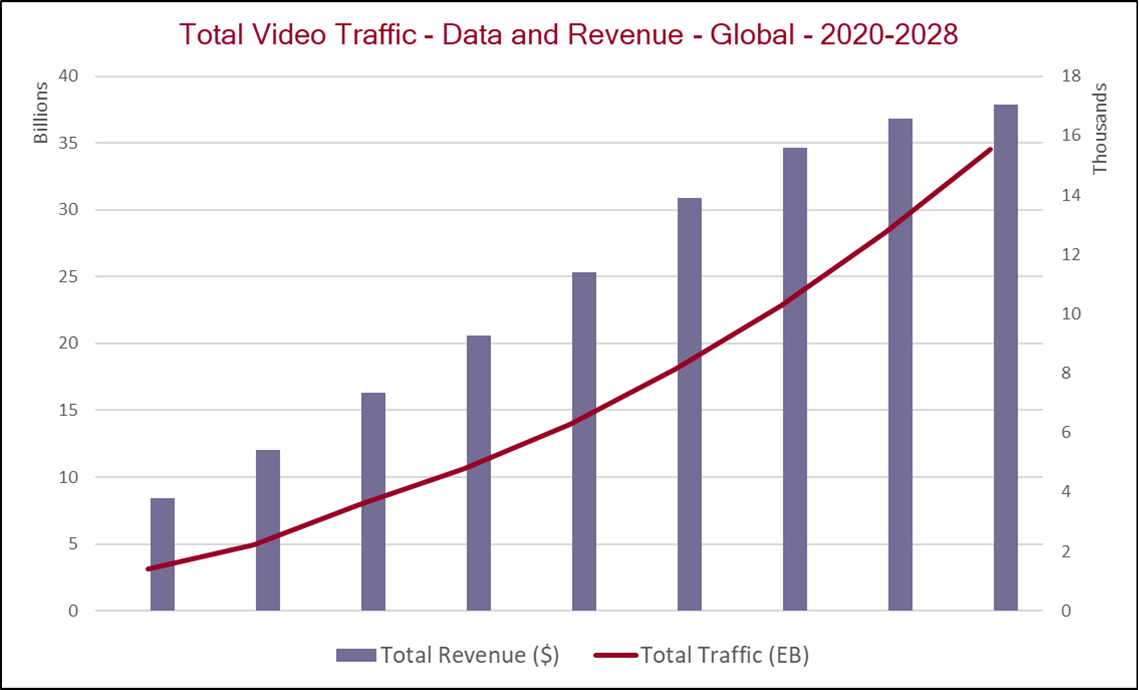

As a whole, the total video delivery market will tick on as expected, in terms of traffic. However, the arrival of both Open Caching and Telco CDN, as well as the impact of Multicast-ABR, WebRTC, and Decentralized-CDN, will mean that traffic growth will begin to slow. The revenue growth is expected to slow sooner, but this is no surprise to those in the delivery game. Customers expect a lower per-unit price, while also expecting those vendors and services to handle the growth in traffic volumes seamlessly. This is why new technologies are so interesting.

This is the latest forecast in the Rethink TV Archive, which now includes:

Rethink Technology Research is an analyst firm that has established itself over its 21-year history as a thought leader in 5G, and all forms of wireless; the entertainment ecosystem and streaming media; the Internet of Things; and has now embarked on the energy marketplace. Rethink TV is our video research team, producing market forecasts, technology white papers and tracking operator-technology vendor relationships in OTT video.

|

|||||

|

Companies mentioned in this report: Agile Content, AIOZ Network, Akamai, Alibaba, Altice, Amazon, Ateme, Axel, BitTorrent, BitTube, Blue Ridge Communications, Breaker, Broadpeak, BT, CDNnow, CDNvideo, CloudFlare, Concurrent, Conversant Solutions, CTA Wave, D.tube, DASH-IF, DAZN, Decent, Disney, Edge Networking, Edgemesh, Edgio, Eluv.io, Fastly, G-CoreLabs, Globecast, Google, Haivision, LBRY, Letmesee, Livepeer, Lumen, MediaKind, MEO, Microsoft, MovieBlock, Nanocosmos, NBCU, NCTC, Net Insight, Netflix, NETINC, NKN, Paramount, Peer5, Poseidon Network, Qumu, Qwilt, Red5 Pro, Ridge, Sia, Storj, Strivecast, SVTA, SWRM Labs, Synamedia, Syntropy, Tachyon, Telefonica Argentina, Telefonica, Theta Network, TIM, Vecima, Velocix, Verizon, Vevue, Viaplay, Viblast, VideoCoin, Vidgo, Wowza, Yahoo, Zixi.

This is the latest forecast in the Rethink TV Archive, which now includes:

- Open Internet Contribution Transport Protocol Forecast 2022-2027

- Content Recommendations Software Forecast 2022-2027

- Low Latency Distribution Protocol Forecast 2022-2027

- SVoD and AVoD Forecast 2022-2027

- Multicast-ABR Forecast 2022-2027

- WiFi Cloud Management, Multi-AP, WiFi 6, 6E, and 7 Forecast 2021-2026

- Decentralized CDN and Multi-CDN Forecast 2021-2026

- Cloud Production Technologies – Market Forecast 2021-2026

- Set Top Box, Smart TV, and Connected TV Device Operating System Forecast – 2020-2026

- Media & Entertainment Transcoding Workload and Device Royalty Forecast 2020-2030

- OTT Security market reaches $452 million, as live sports draw nearer to the direct-to-consumer cliff-edge

- Customer Journey Management Forecast 2020-2026

- Pure WebRTC emerges to take share from Private CDN, as total CDN market hits $33 billion by 2025

- Long Form, Social Media, and Gaming Online Video grow to $171.5 billion

|

Rethink TV forecasts core OTT video technologies and applications, explaining how changing business models will revolutionize video delivery. It also comprises profiles of the 100 largest operators in the world, and the technology stacks they use to deliver OTT video content. Available on an annual subscription basis, it’s designed as a tool to increase revenues from OTT video markets and survive the rethink of TV. |

Rethink Research has been publishing, forecasting, consulting and ‘telling it like it is’ in the technology world, for almost 20 years. What our clients most like about us is our independent, non-biased research; regularly picking the brains of industry executives to provide our readers with no-nonsense insights that are impossible to find anywhere else. And, unlike other analyst groups, we don’t sugar-coat how tough the future will be. |

|