In the last quarter of 2018 a real small sat express consisting of the Indian PSLV and the American SpaceX Falcon-9 launchers will bring a large number of small satellites into an sun synchronous orbit. After long delays more than 80 small satellites from more than 30 customers from around 20 countries, that are waiting anxiously to have their small satellites launched into orbit.

Introduction

In the last quarter of 2018 a real small sat express consisting of the Indian PSLV and the American SpaceX Falcon-9 launchers will bring a large number of small satellites into an sun synchronous orbit. After long delays more than 80 small satellites from more than 30 customers from around 20 countries, that are waiting anxiously to have their small satellites launched into orbit.

On board of the small sat express one can find a full range of microsats and cubesats that together give a good sample of the new small sat market: universities (even a high school) with their scientific payloads, research institutes with tech demo’s, earth observation companies just adding another eye to their constellation that is already orbiting. Most interesting however on the small sat express are half a dozen IoT satellites built by a new generation of space start ups.

The importance of the satellite express being succesful is high for this group of new space start up. The new IoT satellites operators are at the forefront of the strong growing commercial small satellite sector and they are showing the way for the new space business. The IoT small satellitess launched end of this year have the potential to become game-changers in the global IoT market and change the world. So let's have a closer look.

Can Small sat IoT bring a new era to the Global IoT market?

Much is said and written about the huge potential of the global IoT industry. Different IoT applications can be envisioned in a myriad of businesses and market segments connecting devices, processes, people and organizations worldwide. Critical for the development and growth of the IoT market are three things: low power devices, with low cost hardware and connectivity and last but not least global coverage. A match with these 3 requirements is exactly what the new generation small sat IoT networks are offering to the market.

Low power and cost efficient connectivity was already available in terrestrial networks like cellular, Lora or Sigfox, but they are all together not even covering 10% of the worlds surface. Global coverage is offered by satellite operators Iridium and Globalstar and (nearly global) by Inmarsat and Thuraya, but their solutions do not meet the extreme low cost / low power requirements to trigger a global boost for the IoT industry breaking out of the high end market segments.

It takes the innovations combined in the new generation small sat IoT networks (low cost satellite and communication nodes, improved and low power communication links between communication nodes on the ground and the satellite) to at last match the all power, costs and coverage requirements in the IoT market.

Exciting times ahead for the global IoT industry when the new space operators manage to get their small satellites launched. And the chances for that are good as a number of operators use two different launchers to minimize any launch risk. After a succesful launch on all three requirements for exponential growth of the global IoT will be met and world is entering a new IoT era.

Who is on board of the Smallsat express?

The manifest of the PSLV and SpaceX launchers end this year contains a wide range of small satellite types: university (even high school) research missions, technology demonstrators, government and defense missions and, at the break of the NewSpace era, commercial small satellites. Around 75% of the satellites on the smallsat express is from the commercial sector, marking the birth of the new space industry.

Below we will have a closer look at the commercial satellites on board the small sat express, in particular at the new small sat IoT operators. Nearly all of them launching their first satellites as a first step for much larger planned constellations.

So who are those new sat-iot players and what are they offering? Let's have a closer look at some of these player and what they are offering in terms of global IoT connectivity.

The company was only established in 2016 and is regarded as an insider tip. The Hiber system is designed to provide low cost connectivity for IoT (Internet of Things) sensors and devices that run on very limited power and are not latency-sensitive. Core markets are non critical applications in Smart Agriculture, Energy, Logistics/Asset Tracking/Transportation, Environmental Monitoring.

In the next stage the Hiber constellation will grow up to 24 cube satellites, later to expanded to 50. The service level will grow along from 1 message per day to 100 messages per day.

The company was only established in 2016 and is regarded as an insider tip. The Hiber system is designed to provide low cost connectivity for IoT (Internet of Things) sensors and devices that run on very limited power and are not latency-sensitive. Core markets are non critical applications in Smart Agriculture, Energy, Logistics/Asset Tracking/Transportation, Environmental Monitoring.

In the next stage the Hiber constellation will grow up to 24 cube satellites, later to expanded to 50. The service level will grow along from 1 message per day to 100 messages per day.

After integration of the NanoLink terminal, ground based assets can reliably and securely send any kind of sensor data to the constellation of nanosatellites that will acknowledge the reception. Astrocast enables transmission of 1KB/day from any region on the earth.

Astrocast estimates it can build, launch and operate a 64-cubesat constellation for less than $50 million to provide low-data-rate providing global L-band machine-to-machine (M2M) services. Target markets are mainly in the B2B area like monitoring and predictive maintenance. The next phase of the constellation will have 16 satellites in 2 planes and the final configuration consist of eight operational satellites per orbital plane, and eight different orbital planes in sun-synchronous polar orbits.

The Centauri's are the first of a constellation with more than 100 nano satellites that Fleet is planning to launch, creating a global, free connectivity network that will plug directly into the millions of digital sensors already beginning to transform industries like agriculture, logistics, and the extractive sector like mining and gas.

Myorita is established in 2015 and has a strong technology back ground and is a spin-off company from the University of South Australia. It has designed a novel communications protocol that uses advanced signal processing that allows very large numbers of low power signals from user terminals to be received on the same frequency channel. Myriota states its technology would be capable of supporting hundreds of millions of devices.

Myriota aims it's service a wide range of industries including agriculture, defense, utilities, environmental monitoring, asset tracking and logistics. Especially in areas like the less densely populated regions of Australia there’s many industries that have remote and mobile operations that are going to benefit from their services.

Other IoT smallsats to keep an eye on

What does it take to launch a Small satellite ?

Building a small sat is a challenge but launching one is maybe even a bigger one. The Satellite Launching sector until recently focused on traditional (big) satellites and saw the new space small satellites more as a nice fill up for the empty space they had in the rocket’s cargo bay anyway.

For a small sat operator to get his satellite launched this means that you have to find space alongside the primary payload in the launching rocket or to rideshare. Being a “secondary” payload however does not come easy. It means you have no control over the launch date what so ever (although some might argue this exercise in patience is good for the corporate soul), you have no control over the altitude or orbit where it will bring you (only limited launchers go to the right orbital plane), you have to pay for the launch costs way in advance without any guarantees on the actual launch (causing any small sat investor/financer to raise their eyebrows). Last but not least, the logistic process to get on board of a launcher is so complicated dedicated brokers are making a business out if it.

When we look at the small sat express it has been in preparation for already 3 years. Some of the IoT satellites on board are build in less time. Major delays were caused by failed launchers messing up the queue of anticipated launchers after that. The main launch risk for small sat operators is not that the launcher they are on will explode (there is insurance for that) but for the launcher just before them to explode, causing indefinite delays and business plan push backs.

For the growing commercial small sat industry launch currently is a major bottle neck. Remember the current generation of operators on the small sat express is just beginning. When the launch of the first generation pathfinder small satellites already takes so much effort and patience, imagine what it takes be when they want to launch their constellations. Some speak of a launch gap.

Luckily there are many start up heros in the launch sector that aim to fill up this launch gap and we should whole heartedly support them all. With nearly 7000 new small satellites planned to be launched up to 2025 there is a significant commercial opportunity for dedicated small sat launchers. The development of a reliable rocket launching system however takes a number of years, and no relief on the launch situation for small satellites is expected until 2020-2021.

The proof of the pudding: What IoT markets will benefit from the newspace IoT networks?

After launch a new challenge is waiting for the new satellite IoT operators. With the IoT market characterized as "the market with the one million verticals" where will the small sat IoT operators fit in? We already see pilots and interest in small sat IoT from the maritime market, logistics and asset tracking, for monitoring industrial processes, provide grid management in the energy and utility sector, smart agriculture and wide area monitoring in the public infrastructure sector or the meteorological sector.

--------------------

Hub Urlings was one of the pioneers of Satellite M2M as Product Manager Inmarsat-C at the famous KPN Station 12. The reliability and success of this “small data” satellite service, its global coverage and reliability made that the service was used for a myriad of applications: from sending messages, to truck fleet management, to pipeline monitoring and bringing back data from all types of sensors. At that time satellite was the only type of network that was able to offer global IoT coverage. Now, 25 years later that has not changed and he is again involved in the development of a new generation of Sat-IoT services working as Innovation Manager for the ESA program at Hiber. He can be reached at: urlings@m2sat.com

Hub Urlings was one of the pioneers of Satellite M2M as Product Manager Inmarsat-C at the famous KPN Station 12. The reliability and success of this “small data” satellite service, its global coverage and reliability made that the service was used for a myriad of applications: from sending messages, to truck fleet management, to pipeline monitoring and bringing back data from all types of sensors. At that time satellite was the only type of network that was able to offer global IoT coverage. Now, 25 years later that has not changed and he is again involved in the development of a new generation of Sat-IoT services working as Innovation Manager for the ESA program at Hiber. He can be reached at: urlings@m2sat.com

https://www.linkedin.com/in/huburlings

SIDEBAR STORY

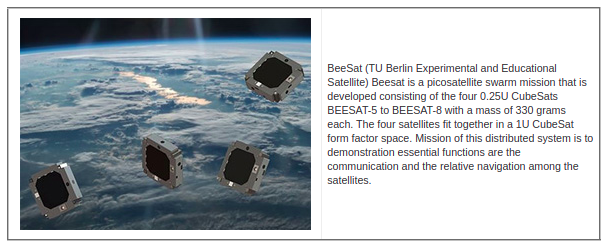

Other interesting missions on board the Small Sat Express

by Hub Urlings

Tech Demo

Who is going to make it?

Some argue that the global IoT market is large enough to support a number of small sat IoT operators.

A proper evaluation of which system will succeed is not only depending on the technical capabilities of launching a satellite and getting the end-2-end network up and running. There is also financial, regulatory and commercial issues to consider. Is there enough financing available for the system to build out the complete constellation and to deal with the high launch costs and associated risks?

Is the frequency band the system is working on sustainable in future, will there not be interference in the band affecting service quality? And how will these start up operators manage to sell their equipment and services ? In particular as we talk of potentially tens of millions of devices? Building satellite is one thing, building up a global distribution network is another.

-----------------------------

Hub Urlings was one of the pioneers of Satellite M2M as Product Manager Inmarsat-C at the famous KPN Station 12. The success of this “small data” satellite service, its global coverage and reliability made that the service was used for a myriad of applications: from sending messages, to truck fleet management, to pipeline monitoring and bringing back data from all types of sensors. At that time satellite was the only type of network that was able to offer global coverage for what we would now call IOT services. Now, 25 years later he is again involved in the development of a new generation of Sat-IOT services. He can be reached at: urlings@m2sat.com

Hub Urlings was one of the pioneers of Satellite M2M as Product Manager Inmarsat-C at the famous KPN Station 12. The success of this “small data” satellite service, its global coverage and reliability made that the service was used for a myriad of applications: from sending messages, to truck fleet management, to pipeline monitoring and bringing back data from all types of sensors. At that time satellite was the only type of network that was able to offer global coverage for what we would now call IOT services. Now, 25 years later he is again involved in the development of a new generation of Sat-IOT services. He can be reached at: urlings@m2sat.com