Since 2016, the FCC had approved satellite constellations for new Non-geostationary Orbit (NGSO) Systems and the latest ones given green light were Spacex, Telesat, Keppler, and Leosat in November 2018 authorizing nearly 8,000 small telecom satellites to serve U.S. entities from Low Earth Orbit allowing global coverage.

The FCC approval for SpaceX (USA) and Telesat (Canada) to expand their constellations allow more satellites in the V-band spectrum. Kepler Communications (Canada) received approvals for 140 Ku-band satellites and LeoSat (Netherlands) for 78 Ka-band satellites. Among the four approvals, SpaceX got the largest with 7,518 satellites in a Very Low Earth Orbit or VLEO constellation that will operate below 350 kilometers.

OneWeb and a least 11 other entities are in various stages of consideration at the FCC for their operation. An FCC approval triggers a regulatory deadline whereby the companies must place at least half their constellations in orbit within six years, and the full systems in nine. At the end of nine years, the FCC freezes approval at the number of satellites in use.

Here’s a quick status of some of the main satellite proposals that applied at FCC. However, this report is not exhaustive, as other ventures contemplate satellite constellations for a variety of applications starting from Intenet of Things (IOT) to broadband for end users and enterprises are evaluating other solutions.

OneWeb. OneWeb has shifted the debut launch of its satellite mega constellation for 2019. OneWeb is building the first 900 satellites of its constellation through a joint venture with Airbus called OneWeb Satellites. Backed by SoftBank, Intelsat, Coca-Cola, and other investors, OneWeb is creating a constellation of small telecom satellites with the goal of making the internet accessible to everyone on earth by 2027.

OneWeb. OneWeb has shifted the debut launch of its satellite mega constellation for 2019. OneWeb is building the first 900 satellites of its constellation through a joint venture with Airbus called OneWeb Satellites. Backed by SoftBank, Intelsat, Coca-Cola, and other investors, OneWeb is creating a constellation of small telecom satellites with the goal of making the internet accessible to everyone on earth by 2027.

In March 2018, OneWeb asked FCC to expand its authorization from 720 to 1,980 Ku-band satellites. The company still expects to begin service in 2019, starting with the first few hundred spacecraft. “As long as we begin our production launches this year, we are still on schedule,” remarked Greg Wyler, OneWeb CEO, in one recent press conference.

Since OneWeb’s first launch will only have 10 satellites onboard, the rocket will travel straight to their 1,200-kilometer Low Earth Orbit instead of the 500-kilometer drop off planned for subsequent flights, Wyler said. The near-direct insert cuts a few months of orbit raising time that would have relied on each satellite’s internal propulsion.

Wyler estimated that there might be a two-month gap between the first launch and the rest of the launch campaign, which consists of a Soyuz launch every 21 days. After the first launch, each Soyuz will carry 36 satellites, with some occasionally carrying 34, he explained.

OneWeb also has a contract with Virgin Orbit for 39 Launcher One missions and a memorandum of understanding with Blue Origin for five New Glenn launches to supplement its primary Arianespace campaign. Neither of those vehicles are launching yet, however.

Wyler added OneWeb’s first generation satellites have “actually beat our plans” on mass, weighing in at around 145 kilograms each, instead of the projected 150 kilograms. “We are at about 14.5 kilograms per Gbps. Each satellite is about the same performance as the satellites I designed for O3b, yet we are putting nine times as many on a rocket,” he beamed.

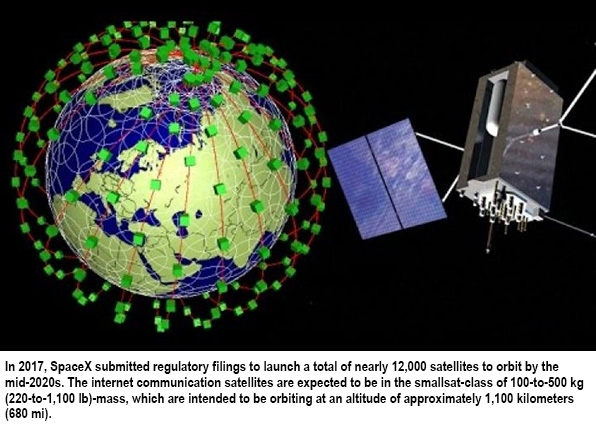

SpaceX. SpaceX launched two prototype satellites last February and plans to use Ku- and Ka-band to begin evaluating how its service would fare and what the company would need to do to scale its operations. SpaceX is building its satellites in-house. So far, it has received FCC approval for more than 11,000 satellites in total.

Elon Musk, CEO of SpaceX, is raising $500 million to fund a satellite-based internet service. SpaceX is looking to launch a massive network of satellites into orbit to provide internet service for devices on the ground, which would offer companies and consumers an alternative to cellular. And while SpaceX hasn’t divulged which industries it would target with this service, it could potentially fill a need in the IoT that would provide the company with a sizable revenue stream.

SpaceX is looking to get its Starlink internet service off the ground with the new-found capital. The company’s planned satellite-based communication network would require a web of thousands of satellites to be able to blanket the planet in wireless coverage.

SpaceX is among those targeting the unconnected, with plans to bring high-speed, reliable and affordable broadband internet service to consumers in the U.S. and the world, including areas underserved or currently unserved by existing networks. The SpaceX system will initially consist of satellites using Ka- and Ku-Band spectrum to provide a wide range of broadband and communications services for residential, commercial, institutional, governmental, and professional users worldwide. SpaceX has separately filed for authority to operate in the V-Band, where it has proposed an additional constellation of 7,500 satellites operating even closer to Earth.

For the consumer, SpaceX says its end-user terminals, which will amount to a relatively small flat panel the size of a laptop, will use phased array technologies to allow for highly directive, steered antenna beams that track the system’s LEO satellites. In space, satellites will communicate with each other using optical intersatellite links, which the company says will effectively create a mesh network flying overhead that will enable seamless network management and continuity of service.

The Starlink satellite-based internet service could be a huge boon for the IoT if SpaceX chooses to include low-power services in its network. A number of companies have announced plans to test and potentially deploy commercial satellite networks geared specifically toward IoT use cases, including Iridium, Astrocast, and Ligado. These companies are looking to the spacefaring networks to serve IoT devices because they are a viable alternative to cellular-based communications and typically operate on different wavelengths, due to the distances that signals have to travel. The Federal Communications Commission last year gave SpaceX permission to deploy 11,943 low-Earth orbit satellites for the planned Starlink system. A new application from SpaceX Services, a sister company, asks the FCC for “a blanket license authorizing operation of up to 1,000,000 Earth stations that end-user customers will utilize to communicate with SpaceX’s NGSO [non-geostationary orbit] constellation.”

The Boeing Co. filed a proposal two years ago to FCC but in June 2018, an executive of Boeing admitted that the project is not moving forward at this time.

Boeing original project proposes to operate up to 2,956 satellites in LEO to provide internet access to government and commercial customers in the United States and globally. Boeing planned to deploy the first portion of the system -- 1,396 satellites -- operating at an altitude of 1,200 km within six years following license grant, and to subsequently increase the constellation to a total of 2,956 satellites. Boeing mentioned that the kind of V-band NGSO system that it proposes could go a long way toward meeting the Commission’s desire to foster greater availability of affordable broadband, especially in rural or remote areas, where terrestrial providers cannot or won’t build out.

O3b-SES. O3b already provides services to cruise ships and governments around the world, but it said that it wants market access to the V-band for up to 24 additional satellites that would operate in a circular equatorial orbit as a constellation called O3bN.

Earlier this year, O3b CEO Steve Collar told the media that he’s optimistic that the solution that the company has for its follow-on architecture will be extremely competitive with anything else that is either in the market now or planned for the future. But for O3b, it’s not about launching hundreds of satellites; it’s more about developing the capability and efficiency of each satellite, he declared.

Kepler Communications. Canada-based Kepler is planning enabling intelligent shipping, smart agriculture, connected transportation, and remote telematics by deploying a satellite M2M backhaul service. At the core of each satellite is a novel Software Defined Radio, electronically steerable antenna array, and networking protocol that has the potential to become the standard for satellite communications with dynamic links and variable channel sizes.

Kepler Communications. Canada-based Kepler is planning enabling intelligent shipping, smart agriculture, connected transportation, and remote telematics by deploying a satellite M2M backhaul service. At the core of each satellite is a novel Software Defined Radio, electronically steerable antenna array, and networking protocol that has the potential to become the standard for satellite communications with dynamic links and variable channel sizes.

The Kepler system will consist of up to 140 satellites, inclusive of in-orbit spares, with the capability to increase the number of satellites in operation to meet user demand. Kepler pledges that each spacecraft’s cost will be low enough that they can be upgraded every three years with the latest advances in communication technology.

Kepler has launched two satellites that are already serving early customers with pilot trials for Global Data Service, a wideband store-and-forward service that allows moving bulk quantities of data over LEO constellation. This is the only wideband connectivity service available in remote and polar regions delivering up to 400 GBs a month worth of data to customers around the world.Kepler plans to launch the next satellite on the second half of 2019, which will be tasked with a different mission: to trial IoT connectivity solution (everywhere IoT) to early customers.

In 2020, Kepler will be launching GEN 1 constellation of up to 15 satellites. This GEN 1 will deliver Global Data Service to customers globally, and will incorporate the learnings from Sat 1 and 2, delivering wideband satellite connectivity.

GEN 2, of up to 50 satellites, is planned for 2021/22 and will be capable of both wideband and narrowband connectivity, delivering Global Data Service and everywhere IOT offerings globally.

During 2022/23, Kepler expect the full constellation to be deployed, adding to the total of 140 satellites that will provide global real-time coverage and real-time access to other satellites via data relay system with the use of ISL.

TELESAT. Canada-based Telesat currently provides satellite-delivered communications solutions worldwide to broadcast, telecom, corporate and government customers. The company’s fleet consists of 15 satellites, plus the Canadian payload on ViaSat-1 with two new satellites under construction.

Telesat is developing a state-of-the-art LEO constellation that will leverage the company’s global spectrum rights in Ka band and proprietary LEO architecture to transform global communications. It will offer an unsurpassed combination of capacity, speed, security, resiliency, and low cost with latency that is equal to, or better than, the most advanced terrestrial networks. Able to serve the entire globe, Telesat LEO will become a core component in satisfying many of the world’s most challenging communications requirements. It will accelerate 5G expansion, bridge the digital divide with fiber-like high speed services into rural and remote communities, and set new levels of performance for commercial and government connectivity on land and in key maritime and aeronautical broadband markets, which are among the fastest growing in today’s satcom industry.

The proposed Telesat system, as listed by FCC, consists of a constellation of 117 satellites in 11 orbital planes. In 6 of the 11 planes (12 satellites per plane), which are inclined 99.5 degrees, satellites will be in a circular orbit at an approximate altitude of 1,000 kilometers. In the other 5 planes (9 satellites per plane), which are inclined 37.4 degrees, satellites will be in a circular orbit at an approximate altitude of 1,248 kilometers. Operation of the satellites is authorized by Canada and will be conducted in the 37.5-40.0 GHz (space-to-Earth), 40.0-42.0 GHz (space-to-Earth), 47.2-50.2 GHz (Earth-to-space), and 50.4-51.4 GHz (Earth-to-space) frequency bands. This is according to the company’s FCC 18-163 filings on Nov 19, 2018.

ViaSat. ViaSat already offers broadband services, including to rural America, but it wants to augment its network with a constellation of 24 satellites at an altitude of 8,200 kilometers, according to the FCC.

ViaSat is still working on a Medium Earth Orbit satellite constellation idea revealed almost two years ago, but has not finalized what that system would look like. This is according to Mark Dankberg, CEO of Viasat, during a press conference in August 2018.

ViaSat is “putting a bunch of work” into optimizing a 24-satellite system disclosed in a 2016 application to FCC that would provide connectivity using Ka-band and the lesser used V-band spectrum.

The company’s main focus has been spinning up telecommunications services on ViaSat-2, which launched last spring, and building a trio of large geostationary satellites to cover the globe, with each sporting a terabit or more of total capacity. A Viasat medium-Earth-orbit system, being closer to the Earth, would augment services from Viasat’s geostationary fleet.

A hybrid system of GEO and MEO — something SES of Luxembourg is the only operator doing today — would provide “interesting opportunities to reinforce coverage in high-demand places and to get polar service,” Dankberg said. “We think it’s probably going to be a little more expensive on a per unit basis than what can be done with really good GEOs, but still could be a worthwhile addition to our fleet, and that’s the direction we are going,” he added.

Dankberg gave no timeline for fielding the MEO system. The FCC has yet to approve Viasat’s application, which would trigger regulatory deadlines to bring at least half the system into service in six years, and the full constellation in nine.

Viasat is talking about the ability to offer 25, 50 or even 100 Mbps speeds to homes, rivaling terrestrial broadband offerings, while simultaneously serving thousands of passengers on cruise ships and in airplanes. If and when the system becomes operational, it will be able to move capacity to where the demand is, for example, where cruise ships need it. It would allow people flying from Los Angeles to Istanbul, for example, to stream movies and video at 35,000 feet over the Atlantic Ocean, regardless of how many people and devices are connected.

Space Norway. Norway-based Space Norway wants to be able to operate at least two satellites in what would be part of its Arctic Satellite Broadband Mission (ASBM) to access the U.S. market. As it implies, the company’s main focus is to deliver high-speed broadband internet connectivity to end users in the Arctic region, which includes Alaska.

The company said its ASBM will be capable of providing broadband internet access to users in the Arctic region who have poor or no connection to GEO satellite systems or terrestrial networks.

Space Norway AS has been working to establish satellite-based broadband communications capacity in the High North since 2015. Space Norway’s project is based on a system of two satellites providing coverage 24 hours a day in the area north of 65 degrees N latitude. The expected lifespan of the satellites is 15 years. If all goes according to plan, the satellites will be launched in 2022.

FCC released in November 2017 a grant to the Space Norway Petition to pursue its goal of providing broadband Internet access to currently unserved and underserved communities in the Arctic region of the United States.

LeoSat. LeoSat initially planned to launch two prototype satellites in 2019, but having completed a meaningful amount of tech-validation on the ground with Thales Alenia Space and investor Sky Perfect JSAT of Japan, came to the conclusion it wasn’t necessary, allowing for significant savings.

Mark Rigolle, CEO of LeoSat Enterprises, explains that LeoSat is attempting to build the world’s first business backbone in space. As a dynamic young company, LeoSat believes that fast, reliable, and ubiquitous data connectivity will fuel growth for businesses worldwide. The company’s solution is to take data networking into space, and in doing so, will set a new bar for ultra-secure, high-speed connectivity.

In 2018, LeoSat achieved a number of significant milestones, including -- securing investment from Hispasat, the Spanish national satellite operator, gaining approval from the FCC to operate the constellation in the U.S., and getting commitments from customers and resellers totaling over US$1 billion.

Hispasat, the Spanish national satellite operator, last year entered into an agreement to invest in LeoSat. Hispasat is one of the only satellite operator to have achieved continuous growth over the past years, thanks to a strong focus on innovation and smart long-term investments. With this investment, Hispasat has found a perfect complement for its geostationary fleet with the ability to expand its scope significantly towards new verticals that will define the data market over the coming years. The investment underlines Hispasat’s firm belief in the unique attributes of LeoSat’s new LEO network architecture to ensure further growth in the future.

Combining advanced on-board routers with inter-satellite laser links, LeoSat is creating an optical backbone in space, providing fiber-like low-latency and gigabit per second data delivery, which is ultra-secure and extremely resilient, thanks to its gateway independent meshed-network data-connectivity from transmitter to receiver. This solution will provide valuable new business opportunities in the growing data and mobility markets in sectors such as telecommunications, multinational enterprise, maritime and government services by ensuring previously unavailable levels of network performance combined with worldwide reach.

LeoSat was recently awarded the authority by FCC to provide NGSO services in the U.S. The FCC market access grant allows LeoSat to address currently unmet demand for high-bandwidth, low-latency, high-security data transmissions from large commercial and government customers in the United States.

Earlier in 2018, LeoSat entered into an agreement with Phasor, the developer of enterprise-grade electronically-steered antenna (ESA) systems, to develop a powerful Ka-band, NGSO-ready version of its breakthrough low-profile ESA, scalable to virtually any use-case requirement. This collaboration will provide high-speed, low-latency, ultra-secure, Ka connectivity infrastructure to corporate, government and commercial markets, offering speeds about 1.5 times faster than terrestrial fiber.

Phasor’s very low profile, electronically steerable antenna enables the reliable, robust delivery of high-bandwidth services. The antenna is solid-state, with no moving parts, allowing satellite signals to be tracked electronically. The ESA can be flat or conformal in design and can be fitted seamlessly to moving vehicles, enabling a number of applications for maritime and mobility markets.

LeoSat said pre-launch agreements spanning a wide range of fast-growing data and mobility sectors including enterprise, telecoms, government and finance, have now taken the commitments the company has received from customers and resellers over the threshold of US$1 billion.

LeoSat is thus helping open-up new markets and deliver business growth for partner companies such as DCS Telecom, Globecomm, and Signalhorn, who are looking to provide innovative connectivity solutions.

LeoSat will focus on the following markets: Enterprise-to-Enterprise; Energy; Telecoms and Government. The company has high expectations from the enterprise and government markets, the companies that face the real challenges in connecting sites and locations in a high security and low-latency fashion. Filling an immediate need for organizations that have budgeted the money for that makes the proposition an attractive target for LeoSat. Mobility is certainly facing the same issues, but now more in the context of “simply get me connected.” The company believes it can be successful by focusing on the right markets where requirements go beyond merely getting connected such as Online Gaming, Low-latency cloud applications, etc.

LeoSat will focus on the following markets: Enterprise-to-Enterprise; Energy; Telecoms and Government. The company has high expectations from the enterprise and government markets, the companies that face the real challenges in connecting sites and locations in a high security and low-latency fashion. Filling an immediate need for organizations that have budgeted the money for that makes the proposition an attractive target for LeoSat. Mobility is certainly facing the same issues, but now more in the context of “simply get me connected.” The company believes it can be successful by focusing on the right markets where requirements go beyond merely getting connected such as Online Gaming, Low-latency cloud applications, etc.

PointView Tech LLC. A filing with the FCC of a multi-million-dollar experimental satellite from Facebook was confirmed last July 2018. The satellite, named Athena, will deliver data 10 times faster than SpaceX’s Starlink Internet satellites.

In early 2019, PointView’s Athena will also head out to LEO, on an Arianespace Vega rocket. Athena is about the same size and weight (150 kg) as SpaceX and OneWeb’s satellites, but Athena will use high-frequency millimeter-wave radio signals that promise much faster data rates. The company estimates its E-band system will deliver up to 10 gigabits per second. “PointView is aiming to understand whether a system using E-band spectrum can be used for the provision of fixed and mobile broadband access in unserved and underserved areas,” it wrote in the FCC application.

PointView specifies three ground stations in its application that will send data to Athena in orbit and receive it in turn. One is a so-called satellite ‘teleport’ near Ventura, Calif., that is shared by a number of satellite companies. The second is Mount Wilson Observatory in the hills above Los Angeles, another popular location for communications hardware.

There are technical barriers to using E-band radio from orbit, however. High-frequency millimeter waves fade quickly and are easily absorbed by rain or other particles in the air. Part of Athena’s two-year mission will be to test just how big of a problem that is. “PointView plans to publish many of its experimental findings, including atmospheric attenuation model validation data,” says its application.

PointView expects to get download speeds of around 10 Gbps at its ground stations, with uplink speeds topping 30 Gbps. But because Athena is in LEO, it will only fly above the three ground stations a couple of times each day, and for less than eight minutes at a time.

The project, dubbed Athena, would eventually launch a fleet of small satellites into low-Earth orbit, somewhere between 100 and 1,250 miles above sea level, and beam Internet access down to rural areas. Athena would join competing projects from SpaceX and OneWeb, both of which are racing to put thousands of their own Internet satellites into orbit first.

The many LEO satellite constellation coming on-board in the next few years has also stimulated the ground equipment market with many companies providing innovative solutions for LEOs. One such company is LP Technologies which released LPT-LEO 1.0, an innovative spectrum monitoring software for LEO satellties. LPT-LEO has been in development for nearly 2 years, during that time the company has worked closely with many leaders in the satellite industry to to find a solution to monitor fast moving LEO satellites, and address the interference challenges the new generation of LEO satellites bring.

LPT-LEO is the only monitoring system to-date designed specifically for the LEO market. Its revolutionary approach to large data monitoring allows LPT-LEO to monitor large constellations of LEO satellites and record tens of thousands of passes per month. LEO touts the ability to automatically schedule spectrum analyzer changes to match LEO passes allowing for continually monitoring coverage and setting hand-offs between terrestrial sites. LPT-LEO is a network wide solution allowing for countless users to connect simultaneously, and the ability to connect every compatible analyzer into the system without any impacts on performance.

With FCC authorizing the majority of the players to implement NGSO satellite constellations in orbit during the next 5-10 years, new technologies and business competition will continue to rise, but the new generation of satellite players in the market will only succeed if their technology and economics will fit perfectly in the ever-changing market.

---------------------------------------------

Bernardo Schniederman is the Principal of Telematics Business Consultants. He can be reached at: info@tbc-telematics.com.

Bernardo Schniederman is the Principal of Telematics Business Consultants. He can be reached at: info@tbc-telematics.com.