It will come as no surprise to anyone in this industry who is paying attention to what has been happening over the last few years, to hear me say that the industry is in a state of flux. This is hardly news, but the pace appears to be accelerating and things that have been talked about for the last several years, are either reality or now very close to be becoming so.

On the content side, we are beginning to see new alliances and strategic moves as the balance of power starts to shift. Over the Top (OTT) services have steadily been increasing their penetration and share of viewing time (although globally linear still retains the lion’s share of this). Historically, the traditional content providers have been happy to participate in this growth by licensing their content to Netflix, Hulu, Amazon and other OTT providers, but this is changing.

On the content side, we are beginning to see new alliances and strategic moves as the balance of power starts to shift. Over the Top (OTT) services have steadily been increasing their penetration and share of viewing time (although globally linear still retains the lion’s share of this). Historically, the traditional content providers have been happy to participate in this growth by licensing their content to Netflix, Hulu, Amazon and other OTT providers, but this is changing.

As mentioned in an article earlier this year, Disney is launching its own streaming service and starting to pull back content from other OTT players. In the UK, ITV and the BBC are also venturing down this path with the launch of BritBox. This is described as a joint venture between the two organizations, but initially ITV will own 90% of the venture, although the BBC’s share could increase to 25% in the future. Many, but not all of the programs shown on the BBC and ITV will move to BritBox, after been shown first (OTA) and then on the broadcasters’ own catch-up services: iPlayer and ITV Hub. In the future, content specifically made for BritBox will be included.

However, the budget for this is reported to be in the “tens of millions of pounds.” A drop in the ocean, compared to the US$15 billion Netflix is reported to be spending in 2019. BritBox launched in the US in 2017 and now has 650,000 subscribers. Again, small fry compared to Netflix’s 60.1 million US subscribers. BritBox will launch in the UK this autumn with a monthly price of £5.99 (US$7.27 at current exchange rates) for HD viewing on multiple screens. This is cheaper than Netflix’s HD subscription for two screens which is currently priced at £7.99 (US$9.70).

The value proposition however, is very different. Netflix is delivering a tranche of new and original programming as well as older movies and TV shows. BritBox with its relatively small programming budget will largely be showing old TV shows. Furthermore the “recently old” shows will previously have been available for free on catch-up services: the BBC’s iPlayer and the ITV Hub. Currently both these catch-up services have very limited viewing windows, but the BBC is petitioning Ofcom (the UK regulator) to be allowed to leave content on the iPlayer for up to a year. It is widely expected that this permission will be granted. So the question is, how many viewers will want to pay to watch old content, or content that until recently has been available for free?

However, whilst the BBC and ITV are launching a service to compete with Netflix and Amazon Prime, they are also collaborating with them for certain productions. For example the BBC partnered with Amazon to produce “Fleabag” and ITV partnered with Amazon to produce “The Widow.” Meanwhile, in a different strategic move, Netflix has hired Jackie Lee-Joe, formerly Chief Marketing Officer (CMO) for the BBC to be its CMO.

Streaming Services

The UK is not the only country in Europe, where broadcasters are launching their own streaming services to compete with the likes of Amazon Prime and Netflix. In Germany, ProSiebenSat.1 has launched a streaming service with Discovery, known as Joyn. Initially Joyn will be advertising funded and will include approximately 50 channels. At the end of this year, a premium Video-on-Demand (VoD) subscription service will be launched to compete with the entrenched OTT services. In France a similar joint venture between broadcasters to launch a streaming platform known as Salto, is facing opposition and at the time of writing its launch is far from certain.

Looking to the future, it seems unlikely that there will be such a thing as a pure linear broadcaster. One way or another hybrid delivery will become the norm as broadcasters look to OTT to further monetize their content, and attract viewers that are moving away from linear viewing. This change is not only occurring in delivery to the consumer, it is also taking place at the enterprise level. Companies that we traditionally associate with satellite distribution are already there, working with content producers to create and distribute their content in multiple formats.

Globecast for example, recently formed GCVN (Globecast Virtual Networking). Using GCVN media event producers and content creators in the B2B space will be able to deliver streaming, file transfers, Wi-Fi, 4K, 8K and 360-degree live content using native IP-based satellite transmission from remote locations via a guaranteed high-bandwidth solution.

Battle for C-Band Spectrum

Another issue confronting the content producers and satellite operators alike, is the proposed change in available spectrum. The C-Band alliance is focused on relinquishing 200MHz of C-Band spectrum in the US. This spectrum is primarily used for content delivery networks. The potential loss of this spectrum is causing concern, not only in the US but around the world, as other operators fear that harmonization will win the day and that that same spectrum will be allocated to 5G in other regions as well. Fears center around the cost of repointing antennas, knowing where all the affected antennas are located, and whether with the increasing bandwidth requirements of video, there will be enough spectrum available for future content delivery.

Crystal, a technology company that has been following this issue, has taken the preemptive step of being acquired by LTN, a video transport company whose primary business is delivering content over the internet. According to Roger Franklin, former President and CEO of Crystal, and now General Manager of Crystal, a division of LTN Global: “LTN have a “secret sauce” that enables it to avoid all the bottlenecks in the internet. This means that it can consistently deliver content extremely reliably and with extremely low-latency, something no other company can do.” Roger said that he had been studying the impact that the loss of spectrum would have, and recognized that many video distributors are going to need an alternative to satellite distribution.

Fiber, Ku and Ka-Band and even the LEOs are also possible solutions, but they all come with additional challenges. The expense and unreliability of fiber; although far better than it used to be, rain-fade can still be an issue for Ka and Ku-Band, and of course new antennas would be needed; and the new LEO constellations have yet to prove their viability. Therefore, reliable, low-latency internet delivery offers the best alternative. Combine this with Crystal’s technology to insert regional and local advertisements into a feed, and broadcasters now have an alternative to delivering multiple feeds to local affiliates. They can now deliver one feed, to the LTN network, which will be regionalized so that each local affiliate will receive its own tailored feed.

Ultra HD

On the technology side, the move from standard definition to high definition (SD to HD) continues, as does the more limited move to Ultra-High Definition (UHD) also referred to as 4K. Both of these require more bandwidth than the previous standard. This is already causing distribution issues. The increase in streaming services has been accompanied by a corresponding decrease in purchases of physical media such as Blu-ray disks.

This means that that most HD and 4K content is delivered OTA, via satellite, cable or over the internet. In most parts of the world, the latter two are not easily able to provide the requisite bandwidth for large numbers of simultaneous viewers watching HD or 4K content. Compression can go a long way to solve this issue, but as the bandwidth required increases, compression standards need to improve in parallel. High efficiency video coding (HEVC) is fundamental to the adoption of 4K, but for 8K which is already waiting in the wings, (NHK already has a commercial 8K service), and virtual reality, a fundamental improvement is needed.

The Joint Video Experts Team and MPEG are working on a new standard known as Versatile Video Coding (VVC). The target is to improve the compression efficiency of HEVC by 50%. In early trials it has achieved a 35% improvement over HEVC when used for 4K. However, as well as the technical hurdles there are also commercial ones to be overcome. There are fears that the licensing costs will severely hinder its deployment.

Until VVC reaches its target potential and becomes widely available, bandwidth will continue to be an issue for high resolution content. As we all know, there are no bandwidth constraints when satellites are broadcasting content to multiple viewers. The issue is, how to make this attribute relevant in the age of streaming, where the traditional sight of a family sitting together in the living room watching television, is being replaced by each family member watching “their” content on their screen.

Until VVC reaches its target potential and becomes widely available, bandwidth will continue to be an issue for high resolution content. As we all know, there are no bandwidth constraints when satellites are broadcasting content to multiple viewers. The issue is, how to make this attribute relevant in the age of streaming, where the traditional sight of a family sitting together in the living room watching television, is being replaced by each family member watching “their” content on their screen.

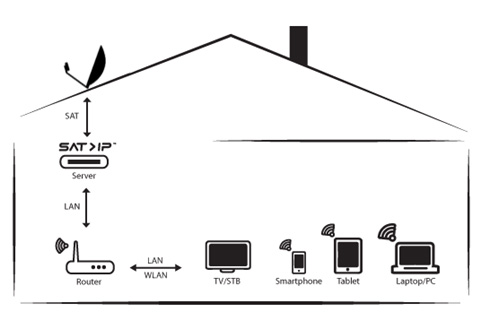

SAT>IP, first developed by SES and which became a European standard in 2013, is one way of addressing this. SAT>IP as would be expected from the name, was originally conceived for satellite, but has since been further developed to take cable and terrestrial signals as well, so it now supports all DVB broadcast standards: DVB-T/T2, DVB-S/S2/S2X and DVB-C/C2. In 2017 the SAT>IP alliance entered into an a liason agreement with the DVB Project, and DVB is now the organization working on future technical developments of SAT>IP. Last year it set up a working group (DVB CM-HB) that is defining the commercial requirements towards a next generation in-home distribution standard.

SAT>IP essentially takes the video content, as it enters the home and distributes it to multiple devices.

As Thomas Wrede, VP Technology and Standards at SES and President of the SAT-IP alliance says: “A high-quality service is possible irrespective of what internet bandwidth is available, which is hugely beneficial for delivering a great TV experience wherever you are in your home. This is particularly important for streaming live sports events where delays and buffering can lead to significant backlash from viewers.”

According to Speedtest.net, of the 177 countries it surveys, 47 of them have average fixed broadband speeds of over 50Mbps, so many would argue that SAT>IP is only relevant in developing countries and rural markets. However, in many countries, while internet speeds may easily test out at 100Mbps during the day; at peak viewing times, with multiple users in a household, terrestrial signals can drop way below this to the point that buffering is making a reappearance. With the move to 4K content and maybe 8K in the future, it is easy to envisage how SAT>IP could have a role to play in urban as well as rural areas.

--------------------------------------

Elisabeth Tweedie has over 20 years experience at the cutting edge of new commmunications entertainment technologies. She is the founder and President of Definitive Direction (www.definitivedirection.com), a consultancy that focuses on researching and evaluating the long-term potential for new ventures, initiating their development, and identifying and developing appropriate alliances. During her 10 years at Hughes Electronics, she worked on every acquisition and new business that the company considered during her time there. She can be reached at etweedie@definitivedirection.com

Elisabeth Tweedie has over 20 years experience at the cutting edge of new commmunications entertainment technologies. She is the founder and President of Definitive Direction (www.definitivedirection.com), a consultancy that focuses on researching and evaluating the long-term potential for new ventures, initiating their development, and identifying and developing appropriate alliances. During her 10 years at Hughes Electronics, she worked on every acquisition and new business that the company considered during her time there. She can be reached at etweedie@definitivedirection.com