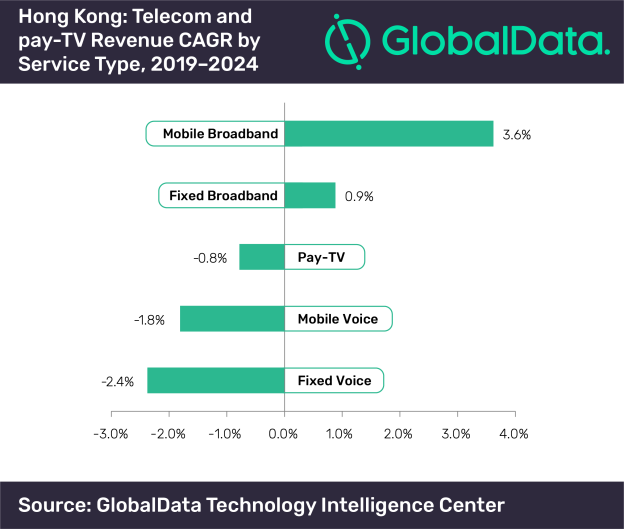

The total telecom and pay-TV service revenues in Hong Kong will grow at a compound annual growth rate (CAGR) of 0.8% from an estimated US$5.5bn in 2019 to US$5.7bn by the end of 2024. Mobile broadband will be the leading contributor to the country’s total telecom service revenue during 2019-2024, according to GlobalData, a leading data and analytics company.

GlobalData’s Hong Kong Country Intelligence Report reveals that mobile voice revenue will decline at a CAGR of 1.8% over the forecast period as consumers increasingly substitute mobile voice services with over-the-top (OTT) based communication services.

However, increase in revenues from mobile and fixed broadband services will counterbalance the decline in the revenues from mobile voice, messaging, fixed voice and pay-TV.

Revenues from mobile data segment will increase at a CAGR of 5.4% to reach US$2.4bn by 2024. The growth will be mainly driven by spike in mobile broadband consumption, which will register nearly triple fold increase by 2024, and increasing adoption of 4G/5G services in the country.

Deepa Dhingra, Telecom Analyst at GlobalData, says “As regulator plans to conclude 5G spectrum auction in 2019 and operators already prepare for 5G roll-out, GlobalData expects commercial launch of 5G service in 2020. Furthermore, though 4G is currently the leading mobile technology in Hong Kong, 5G will overtake 4G to account for the majority share of total mobile subscriptions by the end of 2024.”

The fixed broadband revenue will expand at a CAGR of 0.9% during 2019-2024. The government’s effort to extend broadband coverage to underserved areas and investments from incumbent operator like CMHK will be the key drivers for fixed broadband revenue growth over the forecast period.

In the pay-TV market, GlobalData expects a decline in revenues at a 0.8% CAGR due to increasing adoption of the OTT applications as a substitute for pay-TV services among customers.

Dhingra concludes: “Operators are currently focusing on driving pay-TV subscription base by offering cost-effective multiplay packages, wide range of TV plans at a discounted rate along with new contents to attract the customers.”