Pay TV revenues for the 20 countries in the Middle East and North Africa region fell by 12% between 2016 and 2019 to just under US$ 3 billion according to new resarch from Digital TV Research. Given the hangover from the beIN ban and generally falling ARPUs, revenues in 2025 (US$ 2.81 billion) will still be lower than in 2019.

For the 13 Arabic-speaking countries, pay TV revenues fell by 15% from US$ 1,241 million in 2016 to US$ 1,053 million in 2019. However, the total will recover to reach US$ 1,269 million by 2025. Pay TV subscriptions fell by 5% between 2016 and 2019 to 3.58 million, but will progress to 4.71 million by 2025.

Simon Murray, Principal Analyst at Digital TV Research, said: “The ongoing ban on beIN in most Arab-speaking countries is adversely affecting the whole sector. Even when the ban is lifted, we believe that an unofficial ban will remain. As beIN suffers, it is reducing its expenditure on top events – thus making it less attractive to potential subscribers.”

Simon Murray, Principal Analyst at Digital TV Research, said: “The ongoing ban on beIN in most Arab-speaking countries is adversely affecting the whole sector. Even when the ban is lifted, we believe that an unofficial ban will remain. As beIN suffers, it is reducing its expenditure on top events – thus making it less attractive to potential subscribers.”

Pay TV turmoil is not confined to the Arab world. OTT platforms provide considerable competition to the traditional pay TV sector in the region’s largest markets: Israel and Turkey.

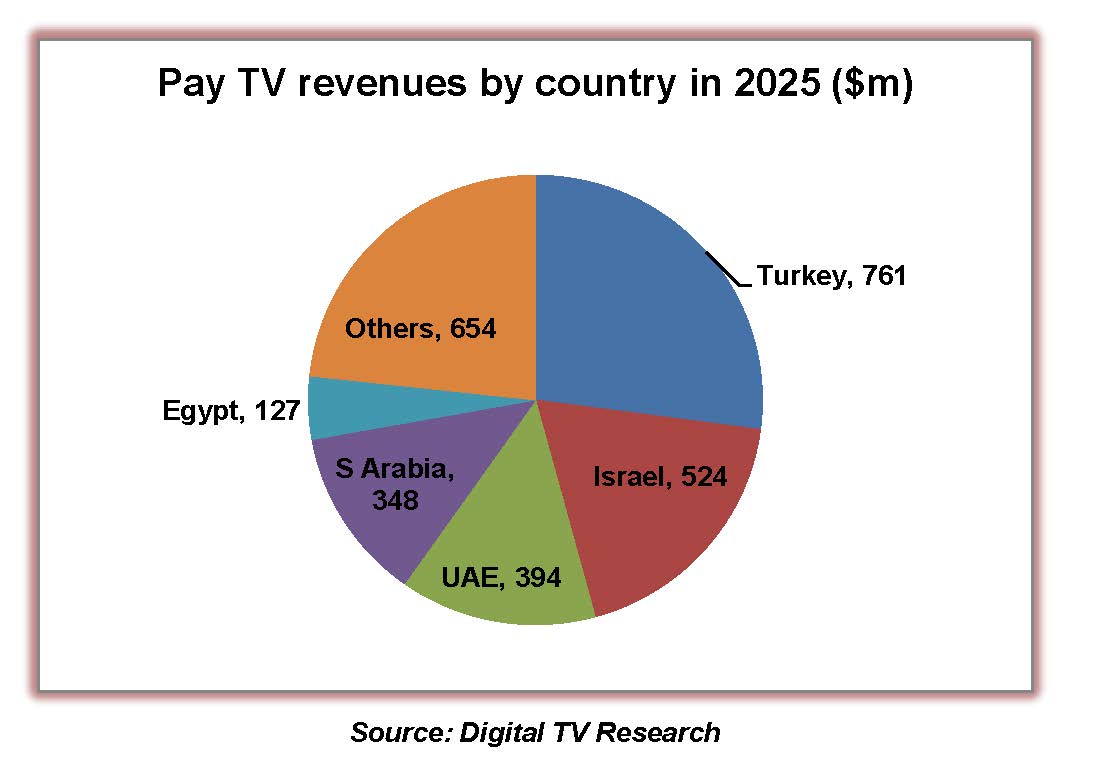

Israel has the dubious honor of experiencing some of the worst cord-cutting outside the US. Israel will lose 24% of its pay TV subs between 2015 to 2025. Digital TV Research forecasts that Israel’s pay TV revenues will halve from more than $1 billion in 2015 to $524 million in 2025. These figures are for traditional pay TV.

The Turkish pay TV market has been shaken by greater competition. Turkish pay TV revenues will reach $761 million in 2025; 16% lower than the peak year of 2016. However, the number of pay TV subscribers will grow from 7.17 million in 2019 to 7.87 million in 2025.