GlobalData’s South Korea Telecom Operators Country Intelligence Report predicts that mobile broadband services will increase at the fastest CAGR of 3.1% during 2019-2024, led by fast growing machine-to-machine (M2M) connections, projected rise in adoption of 5G services and subsequent increase in mobile data average revenue per user (ARPU).

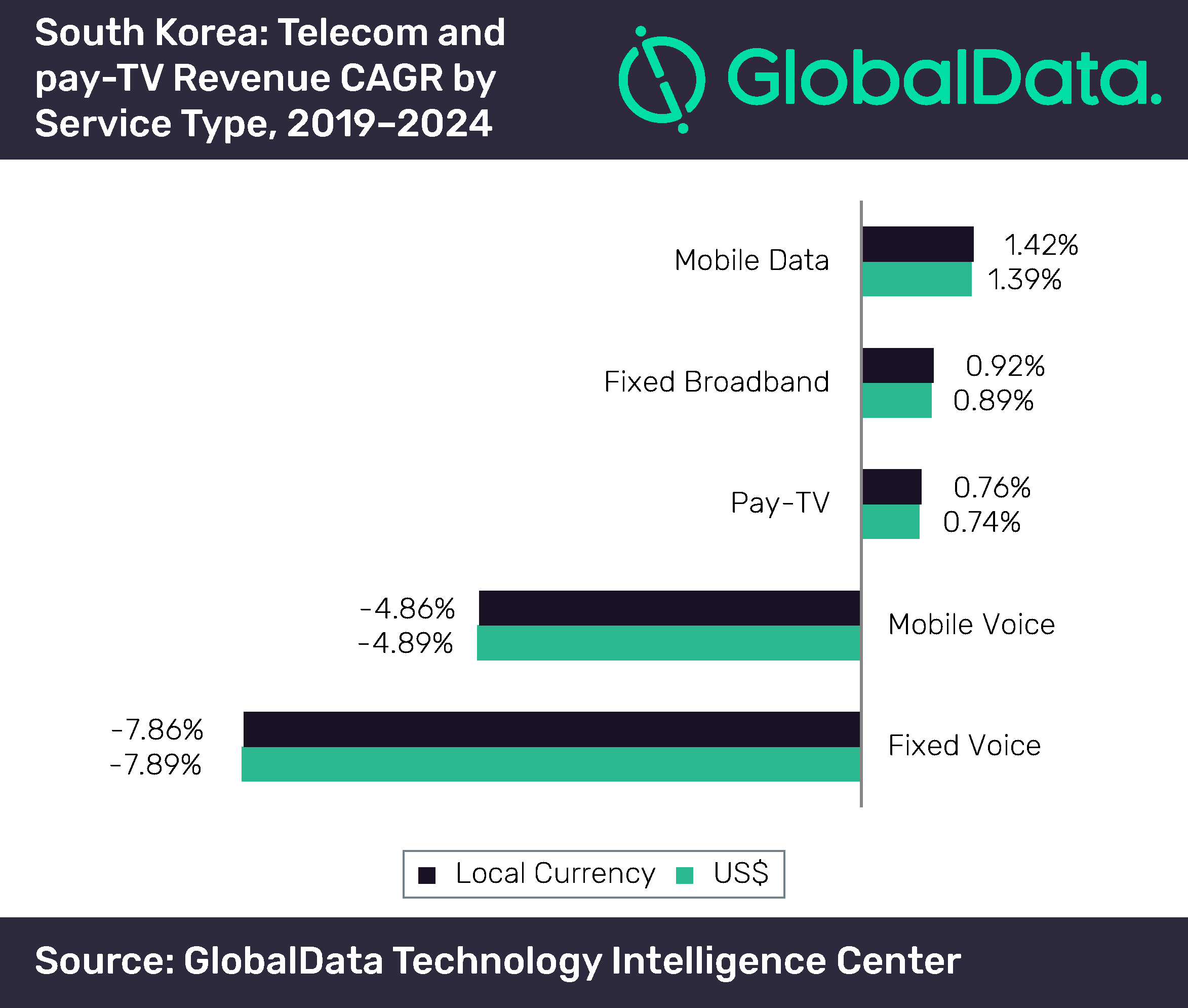

The total telecom and pay-TV services revenue in South Korea is expected to decline at a compound annual growth rate (CAGR) of 0.3% in between 2019 and 2024. Growth in mobile data, fixed broadband and pay-TV segments’ revenues will however fail to offset steady decline in revenues from mobile voice, messaging and fixed voice segments, according to GlobalData, a leading data and analytics company.

Mobile data, which accounted for an estimated 36.9% share of the total telecom service revenue in 2019, is forecast to grow to 43.6% in 2024.

Deepa Dhingra, Telecom Analyst at GlobalData, says: “Even though 4G will be the leading mobile technology in South Korea through the forecast period, its share of total mobile subscriptions will decline from 79.2% in 2019 to 59.6% in 2024. With all the three major operators, SK Telecom, KT and LGU+ having launched their 5G services in April 2019 and expanding network coverage, 5G’s share in total subscriptions is set to reach 40.1% by year-end 2024.”

Deepa Dhingra, Telecom Analyst at GlobalData, says: “Even though 4G will be the leading mobile technology in South Korea through the forecast period, its share of total mobile subscriptions will decline from 79.2% in 2019 to 59.6% in 2024. With all the three major operators, SK Telecom, KT and LGU+ having launched their 5G services in April 2019 and expanding network coverage, 5G’s share in total subscriptions is set to reach 40.1% by year-end 2024.”

Fixed broadband revenue will increase at a CAGR of 0.9% over 2019-2024, supported by continued rise in adoption of fiber-to-the-home (FTTx) services and government’s efforts to increase fiber networks penetration in the country.

Pay-TV revenues will increase at a CAGR of 0.7% over 2019-2024 to reach US$7.8bn by 2024, supported by the steady growth in Internet protocol television (IPTV) subscriptions.

Dhingra concludes: “Operators are heavily investing in the expansion of their 5G networks and services to compete in the mobile broadband market. For instance, KT has pledged an investment of KRW16.3 trillion in 5G infrastructure and ICT convergence by 2021 while SK Telecom is aggressively deploying 5G network in all populated public areas such as highways, trains, major cities and parks.”