Historically the Mobile Satellite Services (MSS) providers Inmarsat, Iridium and Globalstar were the only satellite operators that were providing services for the maritime market. During the last ten years the market changed and now all the major satellite operators both MSS and Fixed Satellite Services (FSS) providers are now offering maritime solutions with a range of frequencies from L-Band ( Inmarsat, Globalstar, Irdium) and C-, Ku-, Ka- and X-Bands ( All major satellite operators e.g. Intelsat, SES, Eutelsat, Telesat).

The critical factors for the maritime market is antenna efficiency and size as well as capacity of bandwidth available for a portfolio of applications that start with Internet of Things (IOT) to full internet broadband services for cruise ships and Oil & Gas market and offshore Platforms among other segments.

According to Euroconsult’s latest report about Maritime Satellite Communications the maritime connectivity market continues to be vibrant, as shipowners’ transition to the next level of broadband connectivity. The merchant, passenger and leisure segments have all been supporting growth in revenues and capacity usage, while a rebound-on oil pricing would accelerate the offshore segment. In addition to capacity, an increasing focus is on the supply of value-added services and on the outsourcing of daily operations by shipping companies.

According to Euroconsult’s latest report about Maritime Satellite Communications the maritime connectivity market continues to be vibrant, as shipowners’ transition to the next level of broadband connectivity. The merchant, passenger and leisure segments have all been supporting growth in revenues and capacity usage, while a rebound-on oil pricing would accelerate the offshore segment. In addition to capacity, an increasing focus is on the supply of value-added services and on the outsourcing of daily operations by shipping companies.

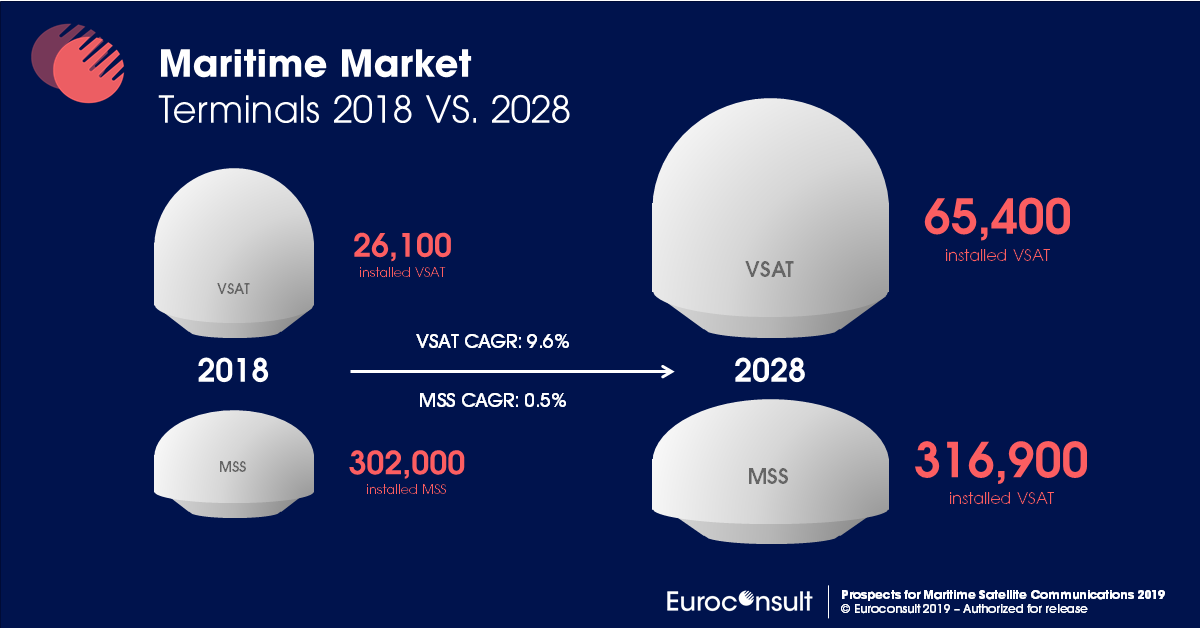

The maritime satellite VSAT communications market experienced extensive growth in 2018, with the number of terminals increasing by almost 18% YOY and reaching 26,000 at year-end 2018. VSAT services revenue exceeded US$ 1 billion, resulting in growth of almost 11% compared to the previous year. Increasing demand from passengers, as well as regulatory pressure on communications and crew welfare are major factors pushing maritime operators to install new generation satellite systems on their vessels.

In addition, decreasing prices for capacity and terminals encourage more customers to adopt VSAT services, while existing client’s transit to higher data packages. HTS capacity is rising fast and is expected to grow even faster in the next five years, as new operators enter the market. Hardware, such as receiving antennas and modems, is also evolving rapidly; smaller, lighter, and more efficient antenna systems are gaining traction as the industry constantly evolves.

“The VSAT market is anticipated to grow quickly; the number of terminals should increase to more than 65,000 in 2028,” said Xavier Lansel, Senior Consultant at Euroconsult. “As a consequence, VSAT solutions will generate more than 90% of the maritime satellite communications revenue in 2028. VSAT revenue is anticipated to increase to $2.7 billion by the end of the decade.”

NSR‘s Maritime Satcom Markets, 7th Edition report forecasts VSAT-enabled Maritime vessels to grow from over 20,000 vessels in 2018 to over 75,000 by 2028. Generating almost $42 Billion in cumulative revenues between 2018 – 2028, the Maritime satcom connectivity market has never looked more promising.

Brad Grady, Principal Analyst and report author“ mentioned the right combination of price, end-user requirements, and connectivity demand is having a significant impact on the market. With new investments across the throughput spectrum, there is one clear message – a significant part of the maritime market has become unlocked for broadband satellite connectivity. Falling capacity prices in addition to lower equipment costs have opened the next-tier of Maritime end-users, accelerating adoption rates, and unlocking more vessels. FSS and MSS will play pivotal roles in generating retail revenues, but HTS from GEO and Non-GEO is the growth story.”

The maritime satellite communications market is at a crossroad; more capacity is available in all frequencies and orbits thanks to Iridium’s recently launched Certus plans, VSAT terminals are getting lighter and cheaper, and end-users continue to find value in some flavor of higher throughput connectivity. Unlike Aeronautical Markets that struggle with complex business plans, the Maritime sector is very much in the ‘connect-it’ mode.

Maritime vessels are adopting broadband satellite services at an ever-increasing rate. From 2017 to 2018 over 7,700 vessels adopted some flavor of VSAT or MSS Broadband connectivity – nearly double the rate from 2016 to 2017. By 2028, NSR’s latest projections place the market at over 140,000 vessels with broadband connectivity, more than half of which will be VSAT.

-------------------------------------------

Bernardo Schneiderman is a correspondet of Satellite Markets and Research and the Principal of Telematics Business Consultants. He can be reached at: info@tbc-telematics.com