Bristol, UK, May 18, 2020

The global Subscription Video on Demand (SVoD) market is projected to be positively impacted by the COVID-19 lockdowns, as consumers turn to SVoD services to fill increased viewing hours and restrictions on movie theater attendance. Disney’s arrival on the global streaming stage could not have come at a more opportune time, and it is projected to soon pass Amazon’s Prime Video viewership, and close the gap on first-place Netflix towards the end of 2025.

The collective streaming providers are the nail in the coffin for traditional pay TV approaches, and it is hard to see how viewers with two or more SVoD services can ever return to the conventional pay TV model. The three streaming providers have had the biggest opportunity to rip market share from the pay TV market handed to them on a plate, and their projected success here means that they will fundamentally alter the viewing habits of hundreds of millions of households.

Amazon should be able to convert millions of Prime subscribers into habitual Prime Video viewers, although needs to ensure its apps are available on enough TVs and set tops, and ensure its user-experience is up to scratch. Similarly, Disney will have to ensure that Disney+ has enough content to keep its subscribers coming back. It will have to follow Netflix’s example, in fleshing out the libraries, and Amazon has made similar moves to improve its own regional catalogs.

Soon, Disney’s Hulu and ESPN operations will pale in comparison to its flagship service, but as it stands, Disney+ looks like the SVoD service that has the shortest shelf-life of the three. This slight is made up for by its price, however, and it is a problem that can be readily fixed – if Disney can get its content at the right price. Still, churn is going to be turbulent.

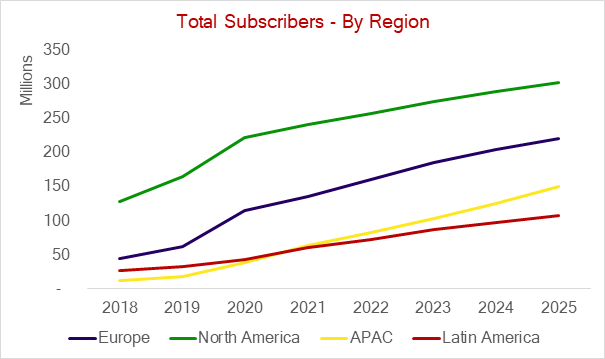

Combined, this is a market that reaches 775.8 million global subscribers, worth $72.3 billion in 2025. That growth comes at the expense of traditional pay TV services, and the uplift expected from the COVID-19 lockdowns will have long-lasting affects. Once kids are locked into an SVoD library, and Disney’s does look particularly enticing, parents are going to be quite reluctant to cancel that service, and when the prices are this low, the SVoD services become very sticky offerings. When measured against our historic projections, we believe that the lockdowns will result in an 8.7% increase in subscriptions, and a 7.9% increase in revenue, in 2020.

This is the latest forecast in the Rethink TV Archive, which now includes:

- How to survive the Set Top Box endgame

- Virtualization to capture 500 million fixed broadband customers by 2025

- Addressable advertising boom across all regions and platforms

- Globalization lifts TV sports rights past $85 billion future

- Esports on verge of hypergrowth to $5bn plus gambling

-