Enterprise networks, increasingly deployed by private operators, will provide small cells with the sweet spot they have been seeking for so long, and drive the market to 26 million units by 2026. The cells deployed will be increasingly diverse in form, ranging from compact versions of macro base stations to almost invisible systems embedded in electronic equipment. But the huge majority – 68% of all small cells that will be deployed between 2019 and 2026 – will be for enterprise and industrial use cases.

These conclusions have been reached by the latest forecast from Rethink Technology’s RAN Research service, entitled Private networks and shared spectrum: making the 5G enterprise a reality - Small Cells and Private Networks 2019-2026. A key growth driver will be the rise of private networks to support industrial and engineering use cases, increasingly enabled by emerging shared spectrum in mid-band and millimeter wave bands.

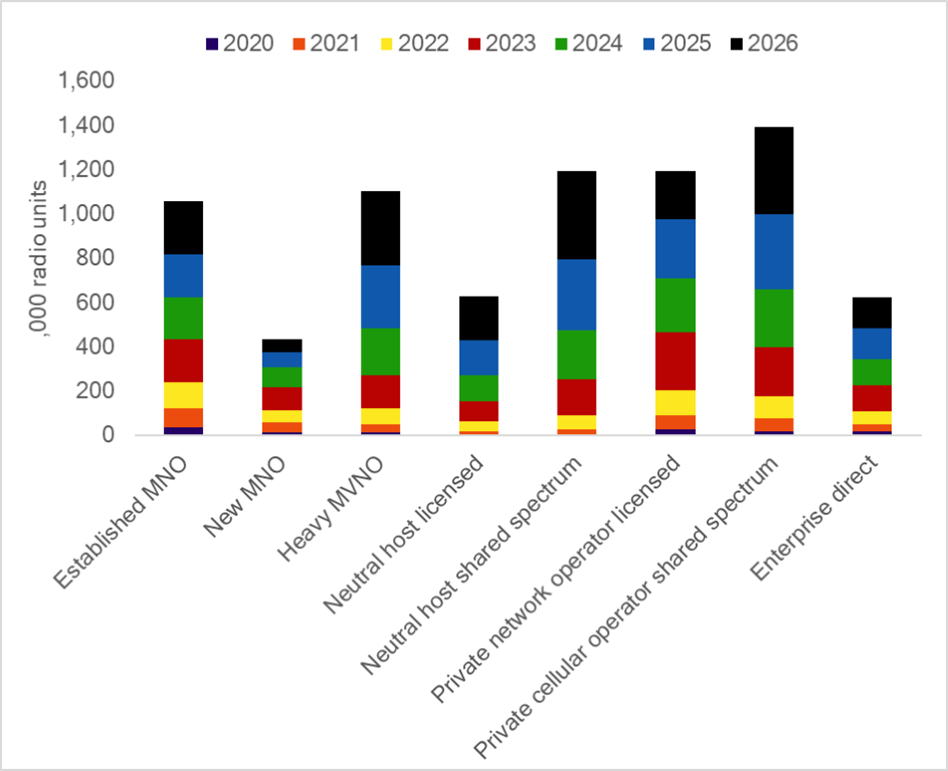

While established MNOs will still command the largest installed base of enterprise small cells by 2026, private operators and neutral hosts will be deploying the largest numbers of new cells from 2023 in enterprise settings, and their impact will be highest in mmWave and shared spectrum, which will be key enablers of alternative deployers.

Retail, government, transport, healthcare, and hospitality will lead the way in early adoption of small cell networks, while accounting for the highest cumulative deployments between 2019 and 2026.

|

|

The RAN Research forecast obtained opinions on small cell deployments and barriers from 66 traditional MNOs, 28 alternative private, enterprise or neutral host operators, and also 72 enterprises across North America, Europe, China, India, and South East Asia. This revealed some continuing frustration – the survey revealed that fundamental capabilities of indoor coverage and data or voice QoS are extremely important to enterprises, ranked on average at over 7 on a scale of 1 to 10, and yet perception of how well these capabilities had been delivered was only around 5.

Most enterprises and industries confirmed their aspirations to apply cellular connectivity for greater efficiency, but too few can yet access networks that are sufficiently reliable, let alone optimized for emerging capabilities promised under 5G, such as low latency. Fewer than half of enterprises reported that mobile quality of service was adequate, and only about 20% would yet trust cellular networks for critical communications.

Yet the report offers hope that four trends, if well supported by regulators, operators, and the broader ecosystem, will enable the required quality and reliability under 4G and later 5G. These trends will support an essential diversity of provider, technology and application. These enablers are:

- greater service diversity and specialization

- shared spectrum to lower barriers to entry

- self-contained RAN and core technologies with open architectures, again to lower costs and barriers to new providers

- and co-investment across the ecosystem with costs and rewards split between enterprises, operators, and other partners.

These, together with more creative regulatory policies regarding industrial spectrum, will help to achieve the reduced TCO and wider monetization opportunities, which are essential to drive operators of all kinds to invest heavily in the indoor use cases