An NSR report released last month estimates the Machine to Machine (M2M) and Internet of Things (IoT) via satellite market to reach US $12.4 Billion from 2019-2029 with small satellites driving growth. Alan Crisp, NSR Senior Analyst and report lead author stated lower price points will unleash unaddressed use cases. Higher volumes will likewise lead to higher ARPUs, changing the overall demand dynamics of numerous verticals. “That is not to say that MSS and VSAT offerings will lose their competitive edge or role in the marketplace. On the contrary, these longstanding platforms will continue to play an enduring role in the IoT growth story,” said Crisp.

NSR identified key growth verticals to watch include Agriculture and Construction will see the strongest increases. The more traditional vertical segments, notably Transportation & Cargo, along with Energy and Maritime, provide a solid revenue base. Not everything is rosy, however. Apart from the challenges posed by COVID-19, funding for small satellite programs, maturing regional or country markets, regulatory challenges, and other macroeconomic factors can all inhibit market growth. One thing remains certain, IoT is an integral part of enterprise networks and consumer needs, requiring satellite’s ubiquity, instant infrastructure, and network simplicity advantages as part of its core.

We tracked more than 20 new companies planning to launch small satellite constellation focus in IoT but the two key characteristics among all the players are low cost data collection terminals and low-cost bandwidth. Satellite Executive Briefing invited the current players and some future players to provide insights on this important market. We receive the following feedback for our virtual roundtable questions from the following executives: Chris Gray,Vice President, Emerging Technologies, Globalstar ; Dan Losada, Vice President, International Division, Hughes: Tara Maclachlan, VP IoT at Inmarsat; Tim Last, Vice President and General Manager of IoT at Iridium; Nathan Robinson, Director, Sales & Marketing, Kepler: and Fabien Jordan, Founder & CEO of Astrocast.

Excerpts of the roundtable discussion follows:

Satellite Executive Briefing (SEB): Considering the new wave of Satellite Constellation focusing in IOT how do the upcoming LEO, MEO or GEO constellations figure in your current and future plans?

Globalstar: Globalstar launched its constellation of second-generation LEO satellites in orbit in 2014. For these upcoming constellations, the technology they are using means larger antennas on the ground, certainly for the two big LEO ones which will use Ku/Ka frequencies. Those new constellations are also looking more at the traditional maritime and high bandwidth Internet connectivity markets. For IoT you need something smaller and less power hungry and Globalstar certainly fits into that category. CubeSats are another interesting area as some of those incorporate our chipsets to take advantage of our network. Regardless of which constellations are being launched, the media is making more people aware of satellite technology which is a positive for the whole market.

Hughes: As IoT expert Edewede Oriwoh says, the IoT is “not a concept...it is the true technology-enabled network of all networks.” Like any network, the connected network of things must have the reach, resiliency and capacity to be ubiquitous, dependable and adaptable. That’s where satellite plays an important role – with GEO, MEO and LEO constellations each delivering specific advantages.

For instance, GEO delivers the capacity density – even in urban areas—needed for services such as in-flight connectivity and cost-effectively transmitting large amounts of latency insensitive communications, such as aggregated IoT data. LEO has the advantage of lower latency, important for applications like smart home technology or autonomous vehicles. And both LEO and MEO expand satellite coverage areas not served by GEO beams. Our Hughes JUPITER™ Aero system can successfully switch between GEO and MEO satellite beams to enable continuous connectivity on a flight even, for example, over oceans or polar regions. This kind of intelligent, multi-transport connectivity will define our connected future.

Hughes is investing in multi-transport innovation, GEO and LEO satellite constellations. Our new GEO Ultra-High-Density JUPITER 3 satellite will deliver unprecedented capacity across a wide range of service sectors, including consumer, enterprise, aeronautical, government and cellular backhaul. Hughes also has agreed in principle to invest $50 million in the consortium of the U.K. Government and Bharti Enterprises purchasing LEO operator OneWeb from bankruptcy.

Inmarsat: Inmarsat owns and operates 13 satellites in geostationary (GEO) orbit 35,786km (22,236 miles) above Earth. Our L-band services, which are delivered via the Inmarsat-4 series of satellites, form the bedrock of our IoT offering. Working closely with our global partner ecosystem, our L-band services help industries from agriculture, energy and mining to transport and utilities harness the benefits of IoT and do things more efficiently, more safely and more sustainably, regardless of where they operate.

Low Earth Orbit (LEO) and Medium Earth Orbit (MEO) satellites have gained in prominence over the last decade. This is hardly surprising noting that the cost of building and launching satellites is coming down across the space sector and new technology has provided ways to deliver new capabilities using smaller satellites. However, understanding how they compare with GEO satellites is crucial to determining your approach to IoT and whether choosing LEO is really the right decision.

For example, as GEO satellites are constantly in the field of view and their orbit is higher, only three satellites are needed to provide near global coverage, whereas multiple LEO and MEO satellites are required in order to create a constellation to provide the coverage across the planet.

This can lead to issues where one satellite passes the connection to another, particularly with mobile assets.

Increasingly LEO service providers are focusing on one specific use case and may only have one or a few satellites in orbit. This could mean that a data point is taken once or twice in 24 hours as the satellite moves around earth. Our satellites’ distance and orbit mean they stay in position, helping companies monitor and control their assets in near real time and providing the ubiquitous connectivity needed to enable IoT.

Iridium: Iridium has been a leader in LEO-based satellite IoT since the launch of our first IoT service, Short Burst Data® (SBD®), in the early 2000s. While some may think new constellations are competitive threats, in most cases we view them as opportunities for potential partnerships and collaboration. Our network is the only truly global, mobile satellite constellation, offering a very resilient, high-quality, and real-time service that leverages dedicated L-band spectrum around the world. These characteristics, combined with the ability to provide two-way communications service through small-form-factor devices and transceivers that can add satellite connectivity to existing solutions, make us ideally suited for satellite IoT services. The combination of these unique capabilities does not exist among newcomers, and therefore, any new services provided by new LEO, GEO or MEO entrants, will rely on less robust signals in either unlicensed bands or in Ka-and Ku-band. Due to the inherent advantages of our network for satellite IoT, we have seen heightened interest for new partnerships and projects within the market. One example is the potential we see to augment or partner with some of the new one-way, high-latency, low-cost smallsat companies where the service price point is not right for the Iridium network. We’ve made announcements about our interest in these types of partnerships in the past as well.

Kepler: As a LEO satellite operator, Kepler is of course focused on this type of constellation. Though similar to our approach to the wideband (Ku in the case of Kepler) market, we see and appreciate that there are some applications well served by GEO, and some applications well served by LEO. Kepler will focus on areas where our global coverage and economic advantages bring value to IoT applications.

Astrocast: We are part of this new wave with the new Small Satellite constellation.

SEB: What is the status of your product portfolio in IOT via Satellite or Hybrid?

Globalstar: Globalstar has a very strong portfolio and one that can meet some unique markets. For those that need to build something fully customized, we have our two chipset options, the STX3 and STINGR. Both use our Simplex one-way small data packet network. The main difference being that the STINGR has an integrated antenna. We just recently launched our ST100 which is an all in one ready to go IoT board, which

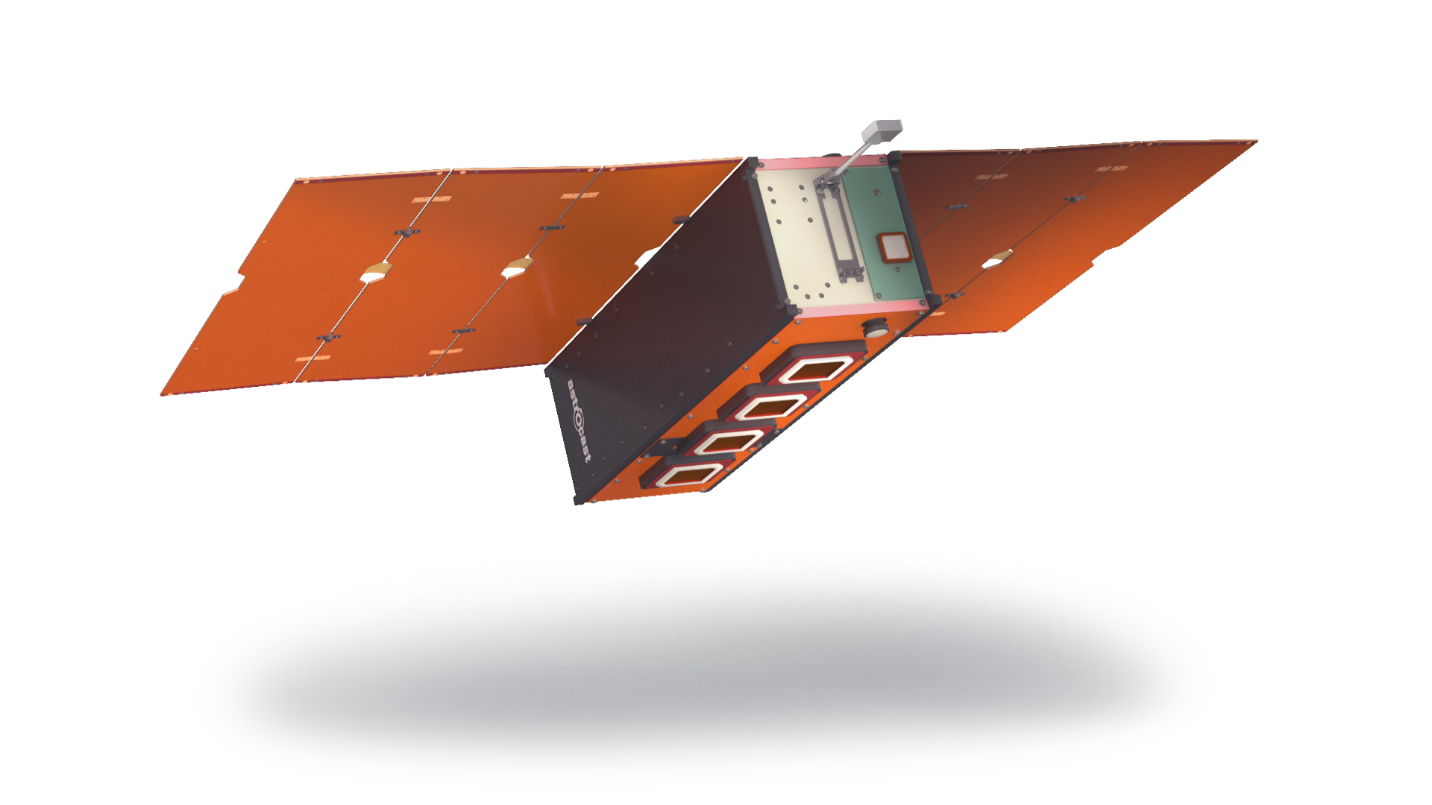

|

| Astrocast microsatellite |

includes the Satellite modem, antennas, GPS, accelerometer, Nordic processor, Bluetooth and our firmware that can be customized. With the ST100, you just need to add a battery, solar panel and plastics and you have a finished product. We also have our complete product sets, namely the SmartOne C and SmartOne Solar, designed for tracking assets, sending sensor information, etc. The SmartOne Solar is fully ATEX certified and has up to a 10-year life. We also have our consumer SPOT side that is really part of IoT. We have our SPOT Trace for tracking assets, our recently launch SPOT GEN 4, a one-way personal tracker and SOS device and our SPOT X two-way messaging device that also does tracking and SOS.

Hughes: As both a technology AND services provider, Hughes plays a variety of roles today in the ecosystem and will do so into the future. For example:

Hughes developed the gateways to enable OneWeb service, and continues to lead the industry in ground system innovation.

Our JUPITER System is already 5G NSA ready. And we will continue to innovate multi-transport technology that will enable the hybrid networks of the future.

The Hughes HT2000L terminal is an industry first that allows both satellite and LTE connections in a single device with automatic failover switching between the two paths.

Inmarsat: Inmarsat has a large portfolio of IoT capability which is built around our L-band network; ranging from direct to satellite M2M offerings, edge connectivity additions and spectrum leasing.

Our direct to satellite M2M offerings are enabled by our L-band constellation and include our Isatdata Pro (IDP) service which is a two-way, short-burst data service for tracking and monitoring fixed or mobile assets globally. It is ideal for simple monitoring and controlling applications such as logistics tracking, monitoring pipelines and tracking machinery in agriculture and mining. Our other direct to satellite service BGAN M2M is a reliable, global, two-way IP data service designed for long-term machine-to-machine management of fixed and mobile assets. BGAN M2M supports higher bandwidth applications giving our customers full visibility and management of their dispersed assets across an entire operational area, which is ideal for applications like monitoring electrical grid infrastructure and oil and gas operations.

In addition to these services we also combine edge connectivity such as LoRaWAN and backhaul it over satellite which provides our customers with additional flexibility for monitoring their data producers. Our recent work with MinFarm Tech provides a highly cost-effective, standalone LoRaWAN network over messaging, rather than over IP. This unique solution enables data from IoT sensors operating on LoRaWAN networks to be optimised for transmission over Inmarsat’s IDP service and has significant benefits for the customer.

Finally, we also work with customers who have specific demands to build their own IoT networks/use cases using Inmarsat spectrum, which means they can design the service they offer their customers, completely to their liking.

Iridium: With the completion of our next generation satellite network, we entered a new era for our satellite IoT portfolio. We continue to support our existing SBD based services, while also creating new IoT offerings with our customers leveraging the new capabilities of our new network. For example, Iridium Certus®, our next-generation satellite broadband service, provides solutions ranging from new message-based and cloud-connected services, to fully IP- capable, real-time communications. Additionally, for the first time, we are delivering a range of finished IoT products to market, including the cellular add-on Iridium Edge device, self-contained solar powered Iridium Edge Solar and fully programmable satellite-only Iridium Edge Pro. Hybrid devices are enabled through our add-on Iridium Edge products, and there is potential to launch hybrid and dual-mode devices if there is a strong enough return on investment and market demand.

Kepler: Kepler’s IoT offering is just now being rolled out, enabled by the launch of our third satellite, TARS, in early September and quickly followed by our first two GEN1 satellites at the end of that month. These three satellites have both wideband and narrowband capabilities, meaning that they add capacity to our existing data backhaul offering Global Data Service, and will enable initial field trials of our EverywhereIoT service. The first device is our IoT developers kit, which will be followed by other devices in 2021.

Astrocast: Our products include the Astronode S is a bidirectional solder-down module for customers who want a simple serial interface connection to Astrocast Network. Its small size allows for its use in embedded applications. Our Astronode DevKit which has the Astronode S architecture at its core, enables you to quickly and securely connect your assets to the Astrocast Nanosatellite Network.

SEB: What key Verticals will you be focusing on IOT via satellite now and in the medium and long term (3-5-10) years?

Globalstar: Oil and Gas markets have always been a main area for us along with Government opportunities. With a record number of US landfall storms this season we certainly see an increase in people being prepared with devices as well as FEMA and other first responders. Forestry has also really started to take off with lone workers and communications needed in those remote areas that are not covered by terrestrial networks. Agriculture is another market we are seeing growth in and that will be an area that will certainly expand over the next few years quite dramatically. This includes animal tracking which is turning in to a much broader area with our partners. We are seeing a lot more interest in sensor technology and we are working on some exciting developments there both with partners and how to update some of our current products via firmware changes. Connected cars of course is always talked about and at Globalstar we look at all types of vehicles that can be connected in some form or another.

We will in the future be adding in a half-duplex IoT board providing a low power small antenna two-way communication module. What is exciting from our VARs is an openness to a new ecosystem where they will not only create a finished product but will offer that to other resellers and partners as a hardware only option allowing the other party to resell airtime. This type of cooperation within our community will allow more rapid development and deployment of solutions. As an example, with our ST100 we have seen that from the time a VAR receives the board to having a fully working proof of concept to the end customer for testing is about 6 weeks.

Hughes: As both a technology and services provider, Hughes services enterprise, aero, maritime, consumer, and government verticals. We will continue to innovate multi-transport technology that will enable the hybrid networks of the future.

Inmarsat: Historically, Inmarsat has supported IoT or M2M in the utilities and oil and gas sectors and these sectors are still key for us. In the last few years, we have expanded our focus to break into the agriculture, mining and transport markets. Even today, much of the world where agriculture and mining take place, or where goods and utilities are distributed, lacks reliable connectivity. This is where Inmarsat’s satellite connectivity is playing a vital role in enabling the benefits of IoT in these industries.

For example, we have been supporting electrical infrastructure IoT based applications for some time and one example of this is the solution we are providing to CEMIG in Brazil to monitor the status of their grid and to respond to outages with remote fix capability.

Our I-4 satellites will continue to provide coverage and support to numerous industries, such as mining, well into the 2020s. However, looking into the future we are continuing to invest in our L-band network and are transforming the way a variety of industries can make use of IoT. In particular, our sixth generation (I-6) fleet of satellites represents a step-change in the way we deliver our [L-band] services. From the world’s most advanced global safety services and low-cost mobile services, to new applications for the 5G era, its capabilities will further strengthen our world-leading L-band offer and how we support many different verticals.

Iridium: As a leader in satellite and industrial IoT, we maintain a robust and varied customer base and partner network. These key markets include heavy equipment and construction Original Equipment Manufacturers (OEMs), agriculture, fleet management, asset tracking, personal tracking, oil & gas, utilities, maritime and aviation verticals. Some of the less penetrated and emerging markets include smart agriculture, Unmanned Aerial Vehicles (UAVs) and drones and autonomous vehicle industries. We have integration partners exploring the addition of Iridium data and location services into solutions for these new and growing markets, and we believe there is a long-term and robust future for satellite IoT.

Kepler: As described in the previous question, LEO has the advantage of providing global coverage from the outset. The tradeoff is latency due to the revisit time of the satellites, but this steadily decreases with each additional satellite brought into the constellation. This guides the markets we can add value to at the outset -- sensor monitoring, certain types of asset tracking, etc. Asset tracking applications are horizontal in nature and spread across various industries. We’ve seen significant interest in monitoring applications in the public sector (research, weather monitoring, etc) as well as SmartAg. As the constellation grows there will be a natural expansion beyond these applications as the capabilities of the service grow.

Astrocast: Th key markets for Astrocast include Maritime, Environmental, Oil, Gas & Mining, Connected Vehicles, Agriculture & Livestock, Asset Monitoring. Our product is a low-cost miniaturized solder-down communication module that can be easily integrated in any terminal with a small and low-profile L-band patch antenna to connect any IoT device.

SEB: Do you have any specific examples of vertical markets that you are now using IOT via satellite or hybrid?

Globalstar: As I previously mentioned, we have many devices in the Oil and Gas market using the SmartOne Solar. Having a safe device to use in these volatile remote locations with a long battery life is very appealing. A more, slightly unusual market we have got involved in is tracking cattle. Our ST100 board was specifically designed to use as an ear tag on cattle sending tracking data, having a battery and solar panel that can last 5 years, which is about the life span of beef cattle.

use in these volatile remote locations with a long battery life is very appealing. A more, slightly unusual market we have got involved in is tracking cattle. Our ST100 board was specifically designed to use as an ear tag on cattle sending tracking data, having a battery and solar panel that can last 5 years, which is about the life span of beef cattle.

We have several partners developing products both as an ear tag and as a tamper resistant collar for areas that are prone to theft. The testing out there has gone very well, and we will start to see full production this year of some of those products. This solves real world issues for farmers that can spend a million dollars a year on fuel looking for animals which gets cut in half at least by knowing where they are. Some remote herds can reduce by 20% due to cattle wandering off into potentially dangerous locations. Thanks to Geofence alerts, farmers can intervene quickly, meaning a reduction in losses and increased revenues - a double win for them with minimal investment. This has also brought in the ability to track elephants, rhinos, birds, baboons, lions and more due to the price point of both the hardware and the airtime. As an example, with lion tracking we showed that compared to other solutions using the same budget, they would be able to track 10 times more animals for a much longer period of time. That is both exciting and fulfilling to see how this technology can help with the tracking, preservation and combating the poaching of these endangered animals. Another path that is very interesting, and something that we are making easy to do, is for 3rd parties to integrate their existing sensors and use our solutions to transmit data with minimal effort. Knowing some of those solutions that are being developed and tested will again improve efficiencies in business, reduce costs and improve customer satisfaction, everything that IoT promises to do.

Hughes: Many IoT applications today use mobile satellite services (MSS) or “narrowband” connectivity for reliable, wide-range, low-power transport and cellular networks. In the U.S., Hughes customers use MSS for applications such as smart meter monitoring of energy consumption. Hughes created the GEO Mobile Radio interface (GMR-1) standard for IoT, making it possible for MSS services to tap into GEO satellite connectivity. This transport flexibility diversifies the network for IoT applications that require more bandwidth.

And VSATs have played a key role in supporting M2M applications for the oil and gas industry. At the “upstream” segment of the Oil and Gas sector, VSATs are used to support monitor and control for well heads. In the “mid-stream” segment, VSATs are used extensively for pipeline monitoring and control – often in complement to other connectivity methods so as to provide extremely high availability.

Hughes recently announced our new artificial intelligence (AI) for IT operations (AIOps) solution for enterprise Wide Area Networks (WANs).

Already in use across more than 32,000 managed sites, the technology automatically predicts and preempts—or “self-heals”—undesirable network behavior, preventing service-disrupting symptoms in 70% of cases. Hughes is the first managed services provider to deliver a self-healing WAN edge capability to enterprise customers. This innovation targets WAN edge systems, such as routers, SD-WAN devices and firewalls—regardless of transport type—because a failure in those systems at the edge can be catastrophic for a site and cost hours of network downtime.

Inmarsat: As mentioned, we are working to help businesses from a variety of industries harness the benefits of IoT and do things more efficiently, more safely and more sustainably, regardless of where they operate.

A recent example of this is the work we have done with Rumo Rail, the largest railway operator in Brazil. Due to the remoteness of Rumo’s network, in certain locations drivers, railway engineers and control centres previously had no way to communicate with each other, putting the safety and efficiency of its operations at risk. However, with the support of our partner, Globalsat Group, we have been able to provide Rumo with a bespoke satellite-enabled rail telemetry and communication solution to address these challenges. In harnessing Inmarsat’s Broadband Global Area Network (BGAN) service, the solution means that they can now access uninterrupted, high-quality connectivity to facilitate the transfer of telematics, voice and video data. This allows the accurate real-time tracking of each train and communication between drivers, maintenance staff and regional control centres, no matter where trains are located on the network.

Another example is our recent work with Farmbot Monitoring Solutions (Farmbot), a partner that has developed a simple, user-friendly remote water monitoring solution that provides real-time visibility of agricultural water supplies. Farmbot is based in Australia where water management is a huge challenge, although due to the remoteness of many places, so is connectivity. By developing their solution around our IDP service Farmbot are helping their customers overcome these issues. The fact that IDP offers two-way messaging makes it particularly ideal as it allows Farmbot’s customers to both remotely monitor water tanks, dams and reservoirs and also activate pumps and other machinery in real time.

-------------------------------------------

Bernardo Schneiderman is a correspondet of Satellite Markets and Research and the Principal of Telematics Business Consultants. He can be reached at: info@tbc-telematics.com