In its latest research titled “China Space Industry Report,” Euroconsult provides in depth analysis of how commercialization is driving both growth and technology advances in the Chinese space sector, with oversubscribed IPOs and a wave of private investment. China Satcom is now the world’s highest valued pure satellite operator with a market cap of US$11 billion as of May 2020, while China Satcom parent company China Aerospace Science and Technology Corporation (CASC) reported record revenues of $37 billion in 2018.

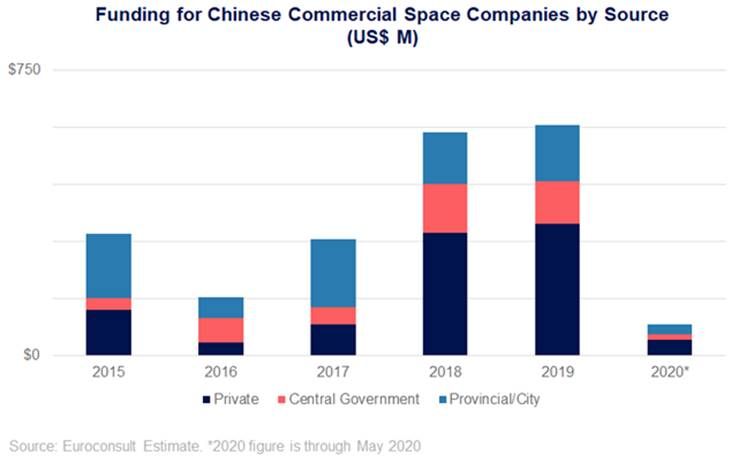

With a deep-dive into the structure of the Chinese space industry, the report details the relationships between myriad space organizations and China’s complex delineation between commercial and government entities. The Chinese government began to liberalize private investment into the space sector in 2014, and since then more than US$900 million in private funding has been invested. With nearly equal investment from government sources, commercial companies have raised a total of at least US$1.85 billion since 2014.

Notably, Euroconsult finds that following a short-term lull in activity corresponding to the COVID-19 pandemic, the Chinese space industry is rebounding strongly, having resumed launches, re-opened manufacturing facilities, and continued to move forward with much-needed reforms. The pandemic has coincided with a drop in funding, with 2020 thus far seeing around RMB 900M of funding raised by Chinese space companies, however this is partly due to 2019 being a historically large year in terms of funding.

Notably, Euroconsult finds that following a short-term lull in activity corresponding to the COVID-19 pandemic, the Chinese space industry is rebounding strongly, having resumed launches, re-opened manufacturing facilities, and continued to move forward with much-needed reforms. The pandemic has coincided with a drop in funding, with 2020 thus far seeing around RMB 900M of funding raised by Chinese space companies, however this is partly due to 2019 being a historically large year in terms of funding.

“Our overview and analysis of the Chinese space ecosystem provides context and understanding for one of the most opaque markets in the world,” said Blaine Curcio, Euroconsult Senior Affiliate Consultant based in Hong Kong. “The growth of the private sector since 2014 has been astonishing, and there is little to suggest a deceleration in this growth. That being said, the low starting point for the private sector, combined with the sheer size of state-owned incumbents, means that the private sector remains extremely fast-growing but relatively small.”

In addition to information on Chinese investment in the space sector, the research provides detailed analysis of five market segments including Earth observation, ground systems, launch services, satellite communications, and satellite manufacturing. It sizes the markets and discusses both government and private companies in each sector, including their business activities and international plans. It also delves into vertical sub-segments such as the national TT&C network, backhaul and trunking demand, and Chinese plans for low-earth orbit (LEO) broadband constellations similar to western concepts such as Starlink.

The report includes an Excel database which organizes hundreds of data points, including funding, supply, demand, and revenue numbers for each of the five market segments. It also provides an up to date analysis of the LEO constellations being developed in China today as well as information on China’s NGSO filings with the ITU for Q/V-band, X-band, and S-band spectrum rights.

Key Findings

Euroconsult’s analysis shows that from 2014 to 2019 there were 319 launches of Chinese manufactured satellites. Of these, 178 were launched in 2018 and 2019, reflecting the recent expansion of China’s manufacturing and launch capabilities.

In the launch sector there have been 46 rounds of private investment in Chinese launch companies since 2014, with total funding raised from both private and government sources of roughly US$1 billion. This investment is targeted at commercial launch companies that are developing more than 20 rockets, many using liquid propellants. Of the launch vehicles being developed, at least seven are expected to have a first launch in 2020 or 2021.

“It’s important to understand the government policy decisions that are driving industry trends in China,” said Steve Bochinger, Chief Operating Officer, Euroconsult. “When the National Development and Reform Commission added satellite internet as one of its “new infrastructures” to be developed, it triggered a flurry of private investment. While the majority of the Chinese space industry is domestic-focused, there is also an increasing emphasis on internationalization, with this expected to accelerate as China rolls out more global space infrastructure.”

China has built out significant space infrastructure over the past 5-10 years, including the BeiDou satellite navigation constellation, the Gaofen Earth observation constellation, and coming LEO broadband constellations. It has a clear strategy for internationalizing this infrastructure to provide turnkey service in regions including Eurasia, Africa, and Latin America.

About the research

“China Space Industry Report” provides an in-depth view of the strategic dynamics impacting the Chinese space industry as well as an overview and analysis of the Chinese space ecosystem. It includes detailed analysis of five sectors with details on each vertical sub-segment. Among the new additions to this year’s research is market sizing across verticals, fundraising for commercial space companies, and inclusion of the increasingly important ground segment and TT&C (telemetry, tracking and command). The research is an essential tool for large aerospace and defense companies, satellite operators and service providers, launch companies, space agencies, and investors who need to understand the competitive landscape and opportunities in the Chinese market. It is available now and can be ordered from the Euroconsult shop.