In their latest edition of the FSS Capacity Pricing Trends report, Euroconsult, the leading global consulting firm for satellite-enabled markets, reported that fixed-satellite service (FSS) capacity pricing is decreasing at a rapid rate due to services supported by next-generation geostationary (GEO) and non-geostationary orbit (NGSO) HTS systems such as Starlink undercutting the market. At the highest industry level, FSS capacity pricing continued to erode in 2022, as the global volume of leased and used capacity increased at a rate that far outpaced the growth in satellite operator revenues.

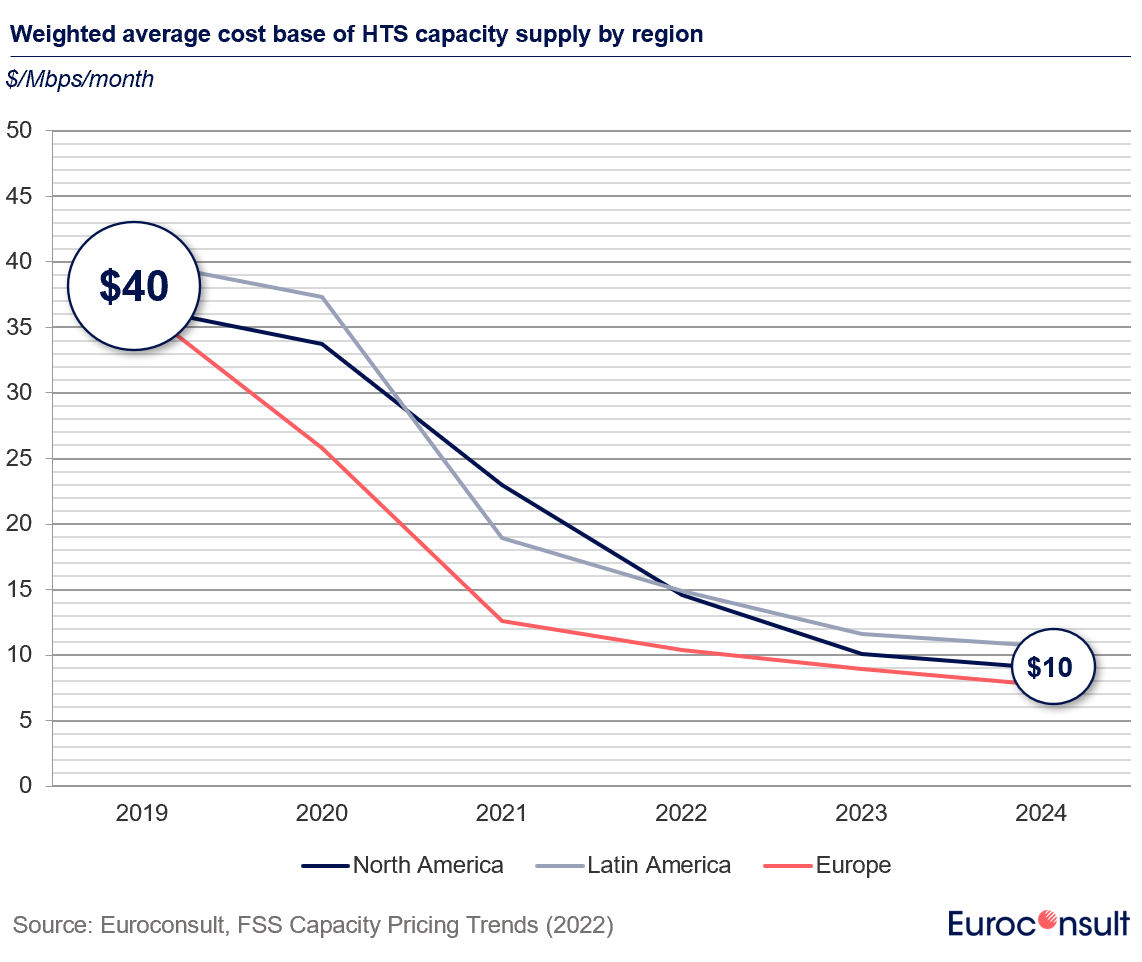

Over the past five years, global averages for capacity pricing in video and data markets have fallen by approximately -20% (-4% CAGR) and -67% (-20% CAGR) respectively. For data markets, Euroconsult’s newly introduced forecasts anticipate this general trend continuing over the next two years with annual declines of -8% to -15% projected across most regions. For most data and broadband markets, this sharp downward trend has brought significant disruptions to the industry, largely due to the abundance and ever-falling cost base of new HTS capacity which supporting aggressive pricing levels.

The influence of both GEO-HTS and NGSO-HTS capacity is expanding both regionally and vertically in terms of market reach. However, while the coverage of NGSO broadband constellations is inherently near-global, regional HTS capacity pricing dislocations are likely to become further pronounced over the next several years, notably in regions such as Russia and South Asia where national regulatory and import substitution policies are likely to limit near-term impacts of new, lower-cost HTS capacity supply.

The dynamics laid out in the report highlight drastic changes for the industry, which had previously thrived for decades on revenue-maximisation strategies underpinned by relatively limited competition and a well-maintained equilibrium between supply and demand that often contributed to situations of capacity scarcity. The scale, compelling value and capability offered by Starlink and other next-generation GEO-HTS systems and NGSO-HTS constellations may mark the onset of a structural shift away from the traditional model of wholesale leasing of dedicated (uncontended) bandwidth by service providers towards the resale of best-effort (contended) managed broadband offerings supplemented by value-added service add-ons.

Compared to traditional satellite broadband services, the low latency, high-data rates, and high priority data allowances supported by next generation NGSO-HTS capacity, alongside its compelling pricing and high value for money, have been the biggest cause for waves in the market. To illustrate, based on a global analysis of over 1,000 consumer and business satellite broadband service plans, Starlink’s equivalent price per GB of priority data was found to be 10 to 50 times lower than the vast majority of competing legacy offerings on the market today, and at a similar or lower total monthly cost.

For granular forecasts of reference pricing levels across major regions, applications, and frequencies for 2023 and 2024, as well as an in-depth insight of the previous year, the FSS Capacity Pricing Trends report leverages an extensive database of over 2,000 capacity pricing contracts and quotes, with new features such as detailed analyses on the evolution of the capacity supply cost base over time, as well as specific analyses of NGSO constellations.

The FSS Capacity Pricing Trends report provides an assessment of the current dynamics for the pricing of satellite capacity in the capacity of sustained technology innovation and the additional satellite capacity associated with new generation satellites. The report includes coverage of nine regional markets, together with a specific review of the mobility and government vertical markets. The publication presents an analysis of how pricing parameters have evolved over the past 12 to 18 months and documents the average and specific pricing data points. The report also reviews the evolving cost of building and launching FSS, HTS, and NGSO satellites, and provides granular forecasts of pricing levels across the various frequency bands, applications and regions for the upcoming years.

The Euroconsult Group is the leading global strategy consulting and market intelligence firm specialized in the space sector and satellite enabled verticals. Privately owned and fully independent, we have forty years of experience providing first-class strategic consulting, developing comprehensive market intelligence programs, organizing executive-level annual summits and training programs for the satellite industry. We accompany private companies and government entities in strategic decision making, providing end-to-end consulting services, from project strategy definition to implementation, bringing data-led perspectives on the most critical issues. We help our clients understand their business environment and provide them with the tools they need to make informed decisions and develop their business. The Euroconsult Group is trusted by 1,200 clients in over 60 countries and is headquartered in France, with offices in the U.S., Canada, Japan, Singapore, and Australia. www.euroconsult-ec.com

Media enquiries

Montreal

Emeline Bardoux

ebardoux@euroconsult-na.com