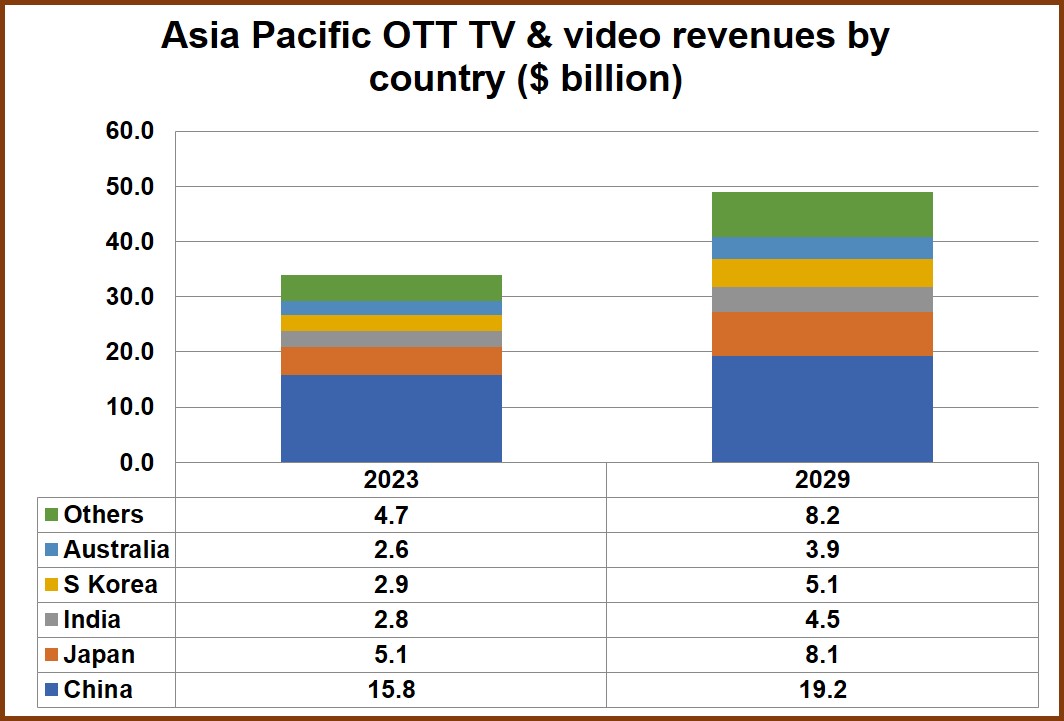

Asia Pacific OTT TV episodes and movie revenues will reach $49 billion in 2029; up from the $34 billion recorded in 2023. This comes despite China, the world’s second largest market, maturing rapidly and India experiencing SVOD shake-up.

China will account for 39% of the region’s total revenues by 2029, down from 47% in 2023 as other countries grow faster. China is reaching SVOD maturity, with a poor AVOD sector at present. India’s SVOD was disrupted by Indian Premier League cricket converting to AVOD in 2023.

Asia Pacific’s SVOD revenues overtook AVOD revenues in 2019. AVOD will recover, but revenues will remain lower than SVOD. SVOD and AVOD revenues will climb by $4 billion and $9 billion respectively between 2023 and 2029.

The big six US-based platforms will account for only 18% of the region’s OTT revenues by 2029 – the lowest proportion for any region.

Simon Murray, Principal Analyst at Digital TV Research, said: “Disney now appears less keen on expanding Hotstar to the region’s developing markets as it is classified as “non-core”. Warner Bros Discovery is yet to announce international plans for Max. Paramount’s Asian rollout will be very limited.” For more information on the Asia Pacific OTT TV and Video Forecasts report,