As global economic landscapes continue to navigate challenges posed by inflation, geopolitical tensions, and the residual effects of pandemic-related disruptions, the Earth Observation (EO) market is undergoing a transformative phase, reflecting both setbacks and opportunities for industry players worldwide.

Commercial operators are restructuring, reducing costs, and optimizing resources with a focus on execution. In the current year, Maxar, BlackSky, Planet, Satellogic and now Airbus have adapted their organizations to reflect slower market dynamics and an increasingly competitive landscape.

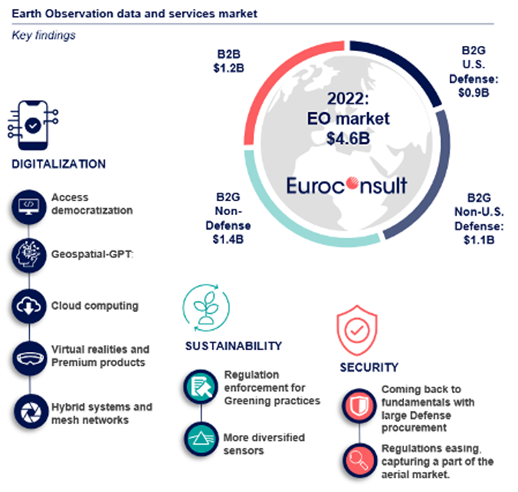

The alignment of Security, Sustainability, and Digitization becomes a pivotal support system driving market dynamics. Defense sector investments, notably exemplified by the Electro-Optical Commercial Layer (EOCL) increased budgets via the U.S. National Reconnaissance Office (NRO), spearhead market momentum. This impetus is further reinforced by European recovery plans and public policies fostering EO ecosystems, such as Japan Aerospace Exploration Agency’s (JAXA) mechanisms for investing in private enterprises.

According to Alexis Conte, Earth Observation Managing Consultant, and Chief Editor: “underlying drivers remain supportive, there is a realignment from Private equity investment falling year-on-year for the first time in the last 10 years, toward rising public investment.” The latter supports the idea of recognizing the pressing concerns of Security, Global Warming, natural disasters, and the global shift toward sustainability, investments in EO technologies increasingly prioritize eco-friendly practices.

However, amidst short-term challenges, the long-term outlook for the EO market remains optimistic, bolstered by technological advancements across the value chain. These innovations catalyze the evolution of higher-value premium products, enhancing operational decision-making and facilitating timely monitoring across diverse applications.

The data market landscape currently stands at US$ 1.78 billion (2022), growing at a 5-year CAGR of 6%. Forecasts project an upward trajectory, anticipating a valuation surpassing US$ 2.7 billion by 2032, growing at a 4% CAGR throughout the decade, primarily fueled by submetric resolution usage.

In parallel, the service market, currently valued at US$ 2.86 billion (2022), demonstrates a 5-year CAGR of 9%. Predictions envision an escalation to US$ 4.9 billion by 2032, growing at a 6% CAGR. The commercial Value-Added Services (VAS) sector, by its nature, remains fragmented, with the top two players contributing approximately 26% of revenues (28% in 2021).

The Business-to-Government (B2G) sector remains foundational, with Defense continuing to be the most significant, valued at US$ 2 billion in 2022. Despite moderate growth rates, the Defense market is expected to witness a substantial net addition of $910 million between 2022 and 2032, primarily attributed to the U.S. defense sector’s projected 4% CAGR.

North America retains its position as the primary market, constituting nearly 45% of revenue while Europe, accounting for 22% of the market share, witnesses a shift in demand from data to information services based on cost-efficient supply. Meanwhile, Asian markets, led by China, Japan and South Korea, are poised for robust growth, driven by domestic usage and burgeoning export potential.

The Earth Observation market’s evolution continues to be shaped by a delicate interplay between economic realities, geopolitical dynamics, technological breakthroughs, and shifting consumer demands. Amidst these fluctuations, industry leaders are positioned to leverage emerging opportunities and drive the EO sector toward sustained growth and innovation.

This comprehensive resource is vital for attaining a thorough understanding of the prevailing Earth Observation market and is now available with a free extract.

Euroconsult’s latest edition, the 16th installment of the Earth Observation: Data & Services Market report, is now available for purchase through their Digital Platform. This comprehensive resource is vital for attaining a thorough understanding of the prevailing Earth Observation market and is now available with a free extract.

Subscribers to the Premium Edition gain access to a more comprehensive database. Encompassing a detailed breakdown of the market from 2017 to 2032, offering multi-level, multi-entry insights categorized by sectors, regions, resolution ranges, sensor categories and user types. Also including, an exclusive database detailing private equity funds raised by Earth Observation companies, covering the period from 2012 to 2032. This database provides specifics about fundraising stages and the value proposition of the companies, offering a deeper understanding of the financial landscape within the Earth Observation sector.

Included in the Premium Edition or as a standalone product, Euroconsult delivers the Earth Observation Satellite Systems Database as a comprehensive global assessment of the EO space systems market. Covering both historical and future landscape of EO satellites, the report focuses on manufacturing, launches and their evolution over the past and coming decades. This database encompasses commercial, civil government, and unclassified defense satellites, providing insights into satellites launched and those scheduled until 2032, and is available with a free extract.

About Euroconsult

The Euroconsult Group is one of the leading global strategy consulting and market intelligence firm specialized in the space sector and satellite enabled verticals. Privately owned and fully independent, we have forty years of experience providing first-class strategic consulting, developing comprehensive market intelligence programs, organizing executive-level annual summits and training programs for the satellite industry. We accompany private companies and government entities in strategic decision making, providing end-to-end consulting services, from project strategy definition to implementation, bringing data-led perspectives on the most critical issues. We help our clients understand their business environment and provide them with the tools they need to make informed decisions and develop their business. The Euroconsult Group is trusted by 1,200 clients in over 60 countries and is headquartered in France, with offices in the U.S., Canada, Japan, Singapore, and Australia. www.euroconsult-ec.com