Providing connectivity to the oil and gas industry remains a significant market for satellite operators and service providers around the world, and nowhere more so than in the Middle East where a significant portion of the world’s oil and gas deposits are located. However, satellite is not confined to providing service to offshore locations; terrestrial pipelines, refineries and storage facilities, particularly those in remote locations, may also be served by satellite.

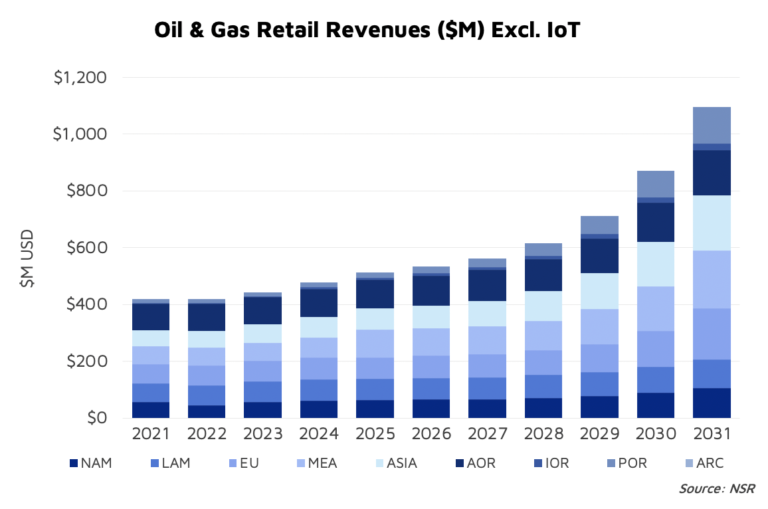

According to the latest Energy SATCOM Markets report from NSR, an Analysys Mason company, satcom revenues from the energy industry, (excluding revenue from the internet-of-things (IoT) connectivity) is poised to grow to over US$1.1 billion per annum by 2031 up from just over US$400 million this year. Cumulatively, the highest portion of those revenues will come from the Middle East and Africa, which alone will generate US$1.1 billion in satcom revenue in the ten years to 2031. This is hardly surprising, given that the Middle East holds 40% of the world’s oil reserves and has consistently supplied around 35% of the world’s oil for the last 20 years.1

The gas sector in particular is forecast to experience significant growth. According to a report from Wood Mackenzie, gas production in the Middle East is expected to reach 86 billion cubic feet per day (bcfd) by 2030, up from 72 bcfd in 2020. To put this increase in perspective, the increase of 14bcfd is equivalent to the entire gas consumption of the European power sector. Qatar alone, is forecast to be exporting 126 million metric tonnes per annum (mmtpa) of liquid natural gas (LNG) by 2030, up from 80 mmtpa in 2020.

IoT and M2M

As well as growing, the sector is also undergoing a major transformation. There are two reasons for this, firstly it is in response to the global drive to produce energy more sustainably and reduce the carbon footprint of hydrocarbon industries. Secondly, the transformation is a response to companies’ natural desire to operate more efficiently and reduce costs. As a result, companies working in this sector are seeking innovative solutions to optimize operations at the same time as minimizing their carbon footprint.

The Internet of Things (IoT) and machine-to-machine (M2M) communications are integral to this transition. A recently released report from Berg Insights indicated that the installed base of wireless IoT devices featuring cellular, Low-power wide area (LPWA) or satellite for the oil and gas industries is forecast to grow at a compound annual growth rate (CAGR) of 19.3% to reach 18.8 million connected devices by 2028, up from an installed base of 7.8 million devices at the end of 2023. An indication of just how quickly this growth is accelerating is clearly shown by the fact that as recently as 2018, Berg Insights were forecasting an installed base of less that 2 million devices by 2023.

Additional drivers for the increased usage of IoT include the introduction of more stringent health and safety standards which require greater monitoring of equipment and processes, and the increasing sophistication of preventive maintenance (PM, also known as predictive maintenance) with the introduction of new devices and equipment. 2

IoT is contributing to improved efficiencies at all stages of the production cycle. Under pressure to cut costs, improve safety and reduce carbon emissions, the oil and gas industry has embraced the IoT as a major tool to meet those goals. But IoT alone is not sufficient, machine learning (ML) and artificial intelligence (AI) need to be integrated in order to handle the sheer volume of data being generated and to achieve full benefit.

As more sophisticated tools and equipment become available these are being deployed in all segments of the industry from exploration to refining and storage. Whereas once a sensor simply brought attention to a problem, now once an issue has been identified, remotely controlled or autonomous machinery may fix the problem. For example, a device will flag that a pipeline in a remote area has sprung a leak. Previously, this would have meant flying engineers and equipment out to repair the pipe. Now, machines strategically located at intervals on the pipeline, are moved into position to do the repair. These may be operated remotely, or autonomously.

The oil and gas business is essentially divided into three segments: upstream, midstream and downstream. Upstream refers to exploration and extraction, midstream relates to transportation and storage and downstream encompasses refining and distribution. IoT has a role to play in all three segments.

Upstream for example, IoT is deployed for remote asset monitoring, providing data on the condition and performance of equipment. Insights from this are used for predictive maintenance, so reducing downtime and failures. IoT can also be used for remote operation of equipment, improving safety and reducing the number of personnel needed onsite. Environmental monitoring is another essential tool, in an industry which is under scrutiny to minimize its environmental impact.

In the midstream segment, IoT has a role to play in enhancing efficiency and safety. One example as already mentioned, is pipeline monitoring for leak detection and repair, and tracking of real-time flow and pressure. Another is attaching sensors to storage facilities at tank farms as an aid to prevent shortages or over stocking. Preventative maintenance is just as important in this segment as it is in the upstream segment, as is remote control and monitoring of equipment.

|

Downstream IoT can be used for refinery optimization, by monitoring equipment to reduce downtime and improve overall efficiency of operations. Monitoring of environmental conditions, detecting gas leaks and ensuring regulatory compliance is another example of how the IoT is streamlining the oil and gas industry.

Another very important, but specialized use of IoT data from the oil and gas industry, is the creation of digital twins. These are virtual representations of assets. Data collected from an oil rig for example, is aggregated and AI then creates a digital twin of the rig. This can be used by engineers to run simulations of different scenarios that could potentially occur and cause problems. Working on the twin, different solutions can be tried. Having this knowledge enables operators to either alter processes to avoid major issues, or have the tools at their disposal to rectify a problem should it occur. An invaluable tool for preventative maintenance.

Integral to IoT is the ability to send all this data to the cloud, whether public or private for storage, processing and shared remote access. None of this would be possible without robust, reliable communication links.

Bandwidth Demands

This is an industry with heavy but fluctuating bandwidth demands. In the exploration stage a tremendous amount of data is generated relating to geological formations and rock composition, all of which needs to be sent back directly to headquarters or to the cloud for analysis. Once drilling commences, data relating to ongoing operations, flow and valve, pressure and temperature monitoring for example becomes critical and needs to be monitored as do things like leak detection. All of this data is collected and sent back onshore for analysis and response, whether that response be manual, remote operation of equipment and machinery or totally autonomous.

|

While communication to and from “things” is now an essential requirement of the industry, equally important is communication with people. An offshore oil platform will be staffed by hundreds of people, all of whom will stay there for many weeks at a time. Their needs are similar to those of the crews of long-distance shipping lines, namely the same connectivity that they would get at home, so they can stream and download movies, play online games and use Facetime or Zoom to keep in touch with family and friends. In addition, video communications are used for training and most critically for emergency telemedicine in the event of injury or sickness.

In short, stable communications, able to cope with fluctuating bandwidth demands are crucial to the oil and gas industry. Communications could be via fiber or microwave, but in many cases, particularly for offshore and remote sites, it is satellite that provides the needed connectivity. One of the key requirements is for flexible services. Not only do the bandwidth demands change depending on where the company is in the production cycle, they also change in response to data received. For example, low bandwidth will be needed to monitor sensors, but if an exception is identified, it may be necessary to switch to video or instigate remote control of devices. Also, of course, activity from any given oilfield will change with fluctuating output, which may be driven by global economic pressures.

Connectivity Solutions

One satellite company located in the epicenter of oil and gas production in the Middle East is Es’hailSat, so it is hardly surprising that it is a key partner for many of the national and international energy and service companies located in the region.

Its 50,000 square meter teleport located on the outskirts of Doha in Qatar is at the heart of the services provided to energy companies, as well as to clients in other sectors including telecoms and broadcast. This state-of-the-art teleport, provides world-class facilities and hosting services with a Tier 3 infrastructure. The advanced equipment located in the teleport includes an iDirect hub which means that Es’hailSat is able to offer the flexibility needed as well being able to cater for multiple waveforms. There are also multiple diverse fiber connections into the teleport providing redundant connectivity to the global internet backbone. The extensive antenna farm also has plenty of room for expansion for companies wishing to collocate their own antennas. Es’hailSat also offers a wide range of options for companies wishing to use the facility as a node in their network. A company can rent a space as small as one rack unit or as large as a private self-contained suite.

Energy customers are among the most demanding, with their needs for constant 24/7 availability, flexible bandwidth, on-site installation, high security, mobility services, on-site support and, in the event of a problem arising, disaster recovery. Es’hailSat has been providing its customers with end-to-end services for many years, so really understands the requirements of this sector, and with its highly trained workforce is able to address all these needs. Increasingly, energy companies are also looking for managed VSAT service, which of course Es’hailSat provides.

As one of the leading providers of communication services to the energy market, Es’hailSat also partners with other players, including Inmarsat, iDirect, Kymeta, Viasat, Ooredoo and Gulf Drilling International (GDI). Viasat Energy (which was created in 2021 when Viasat acquired Rignet) has recently expanded its multi-transponder services agreement with Es’hailSat and will also be using Es’hailSat’s teleport for VSAT services across the Middle East and North Africa (MENA) region. This multi-faceted partnership is an important one for Es’hailSat as it takes advantage of the many services the company is able to offer, including fixed satellite services (FSS), mobility and ground infrastructure. Moving forwards, Es’hailSat is engaging with Viasat at many levels in order to leverage the combined strength of both organizations.

Other prominent clients include: Qatar Energy, North Oil Company and Total Energies. These are served through Es’hailSat’s partnership with Ooredoo, a multi-national telecoms company headquartered in Doha. Ooredoo also partners with many other major players to facilitate its comprehensive service offerings.

Es’hailSat owns and operates two geostationary (GEO) satellites, Es’hail-1 and Es’hail-2, launched in 2013 and 2018 respectively. Both satellites provide Ku and Ka-band services, and Es’hail- 2 is equipped with the capability to provide anti-jamming services. However, constantly in-tune to developments in the satellite industry, Es’hailSat is open to partner with non-GEO operators (NGSO). Right now, the company is evaluating multiple NGSO operators carefully, as well as other GEO operators, in order to explore all viable options to extend and enhance its capabilities as a satellite operator. Es’hailSat is already a major regional player in the MENA, but looking ahead the operator plans to be a major global player.

As mentioned above IoT is playing an increasingly important role for the energy sector. In the majority of cases artificial intelligence (AI) and machine learning (ML) are also incorporated into the service, in order to make the most use of all the information available from IoT sensors and devices. Es’hailSat will not be left out of this transition. It is already working on incorporating these advanced technologies, as well as cloud services, optical laser communications and flat panel antennas into its portfolio, tailoring its offerings to meet the needs of the different sectors, energy, government and maritime. Going forwards 5G non-terrestrial-networks (5G NTN) will also find its place in Es’hailSat’s portfolio, to provide a more efficient way of providing high-speed data and voice connectivity.

|

| Es’hailSat’s 50,000 square meter teleport located on the outskirts of Doha in Qatar is at the heart of the services provided to energy companies. (image courtesy of Es’hailSat) |

One of the keys to Es’hailSat’s success is its young team of engineers who are certified and trained in installation, support and maintenance in the most challenging offshore environments. But. more than that, as a young organization, the ethos of the company is founded on flexibility and innovation; constantly finding new ways to improve its products and services and adapt its offerings to meet individual customer needs.

Environmental, Social and Governance (ESG) is also an important undertaking for Es’hailSat. Reducing dependence on hydrocarbons, is part of the Qatar National Vision 2030, and therefore is also part of the objectives to be addressed in Es’hailSat’s overall ESG strategy. The company is actively engaging with educational institutions at all levels in order to share the knowledge that it has acquired to help develop the next generation of engineering, science and technology professionals. In addition Es’hailSat is operating the world’s first GEO payload supporting amateur radio on Es’hail-2 and is working with the Qatar Amateur Radio Society and the amateur radio community at large, as amateur radio communications can be a vital resource during times of unrest or natural disasters when all other communication methods are impacted.

No matter what role a company plays in the energy value chain, Es’hailSat has the communications technology and services that you need today, and will need in the future.

Notes:

[1]David Oni, “Is Non-GEO Primed for Growth in Middle East Energy Markets?” https://www.nsr.com/is-non-geo-primed-for-growth-in-middle-east-energy-markets/

[2]Energy Connects, “Why the Gas Sector is on the Rise in the Middle East” https://www.energyconnects.com/opinion/thought-leadership/2023/july/why-the-gas-sector-is-on-the-rise-in-the-middle-east/

[3]Berg Insights, “Industrial IoT Applications in the Oil and Gas Industry”, https://www.berginsight.com/iiot-applications-in-the-oil-and-gas-industry

Elisabeth Tweedie is Associate Editor of the Satellite Executive Briefing. She has over 20 years experience at the cutting edge of new commmunications entertainment technologies. She is the founder and President of Definitive Direction (www.definitivedirection.com), a consultancy that focuses on researching and evaluating the long-term potential for new ventures, initiating their development, and identifying and developing appropriate alliances. She can be reached at: etweedie@definitivedirection.com

Elisabeth Tweedie is Associate Editor of the Satellite Executive Briefing. She has over 20 years experience at the cutting edge of new commmunications entertainment technologies. She is the founder and President of Definitive Direction (www.definitivedirection.com), a consultancy that focuses on researching and evaluating the long-term potential for new ventures, initiating their development, and identifying and developing appropriate alliances. She can be reached at: etweedie@definitivedirection.com